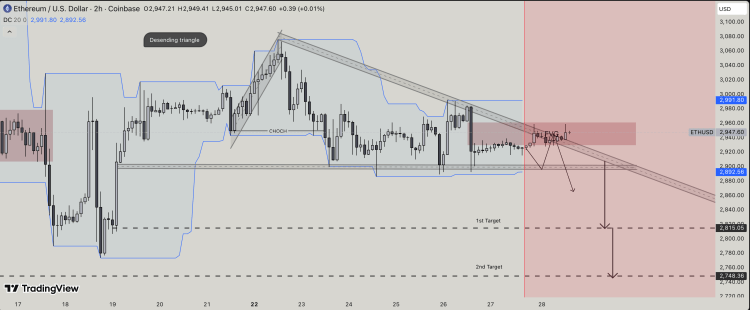

Ethereum has been having a hard time over the last few months after hitting a brand new all-time high back in August 2025. The last quarter of the year has been especially brutal, with the cryptocurrency’s price down more than 29% in Q4 2025. Despite this abysmal performance, things have failed to turn around, with technical indicators continuing to point to further decline for the altcoin. The latest of these is the appearance of a descending triangle structure, that carried the promise of further downside.

Ethereum Price Is Still Not Bullish

As crypto analyst Alpha Trade Scope points out in a TradingView post, the Ethereum price chart is still showing major signs of weakness. For example, the digital asset saw its price crash below a descending trendline, and this has marked the continuation of the downtrend that began three months ago.

The current price trend has led to the formation of a descending triangle structure, which emerged after the cryptocurrency completed an impulse move. Not only this, the trend of recording lower highs has been evidence of the increased selling pressure on the cryptocurrency. Doing this below the aforementioned descending trendline just lends credence to the fact that the downtrend is not over.

There has also been a major shift in the market structure of the Ethereum price. For one, there was a Change of Character (CHoCH), which shows that the Ethereum price is no longer bullish, but is rather more bearish at this point.

Resistance has also mounted at the $3,000 level over time, and the price has been trading well below this resistance for a while now. Also, the Ethereum price is caught in a tight range, trading within the Fair Value Gap (FVG) mapped out between $2,930 and $2,960. This shows the rising resistance at this level, that could serve as a rejection in the case of a recovery attempt.

How Low Can The ETH Price Go?

If the current bearish trend holds and the Ethereum price does get rejected, then the first target for the downside lies at $2,815. This first target serves as the first support for the cryptocurrency and the destination for an initial liquidity sweep as investors sell into the decline. However, it is not the final target.

In the case of a further break, then $2,800 is expected to give way, leading to the second major target at $2,748. This target is more of a major demand zone and is more likely to trigger a bounce due to the mounting buying pressure at this point. “The chart presents a classic bearish continuation setup, favoring downside expansion if support breaks with confirmation,” the analyst said.