KEY TAKEAWAYS

FIRO breaks four-year wedge, forming a long-term bullish structure.

Upcoming hard fork and ZK pedigree strengthen market sentiment.

Volume, SAR, and CMF show momentum toward higher resistance levels.

Firo (FIRO) has already delivered a staggering 747% pump over the last 90 days. However, as it stands, the cryptocurrency could be poised to extend this rally.

Why? You may ask. One glaring reason is the bullish sentiment surrounding privacy-themed cryptos, which FIRO falls under.

As of this writing, the FIRO coin price wobbles around $4.42. In this analysis, CCN breaks down why the market value could be higher before the end of 2025.

Firo Nears 4-Year High

On the weekly chart, FIRO had remained trapped in a persistent downtrend that began in November 2021 and lasted until last month.

This extended decline produced a falling wedge pattern. However, the FIRO coin price has now broken above the wedge’s upper trendline, signaling that bearish momentum has finally weakened.

This breakout has pushed the cryptocurrency to its highest price level since January 2022.

The technical structure reinforces this shift. As seen below, FIRO’s price has formed a golden cross on the weekly timeframe for the first time in several years.

The bullish crossover occurred when the 20-week Exponential Moving Average (EMA) (blue) moved above the 50-week EMA (yellow).

With momentum building and the breakout confirmed, FIRO now appears ready to advance toward the next major resistance zone at $7.80.

Hard Fork Drives Volume Higher

Beyond the recent buying pressure, FIRO’s reputation as an early pioneer of zero-knowledge proofs within the cryptocurrency space has also strengthened bullish sentiment.

Additionally, FIRO’s upcoming hard fork, scheduled for Nov. 19, could serve as another major bullish catalyst.

The upgrade will introduce Spark Name transfers, reduce GPU VRAM requirements, allowing 8GB GPUs to participate in mining, and deliver several other performance and usability improvements.

Such development could encourage new network activity, possibly impacting the FIRO coin price positively.

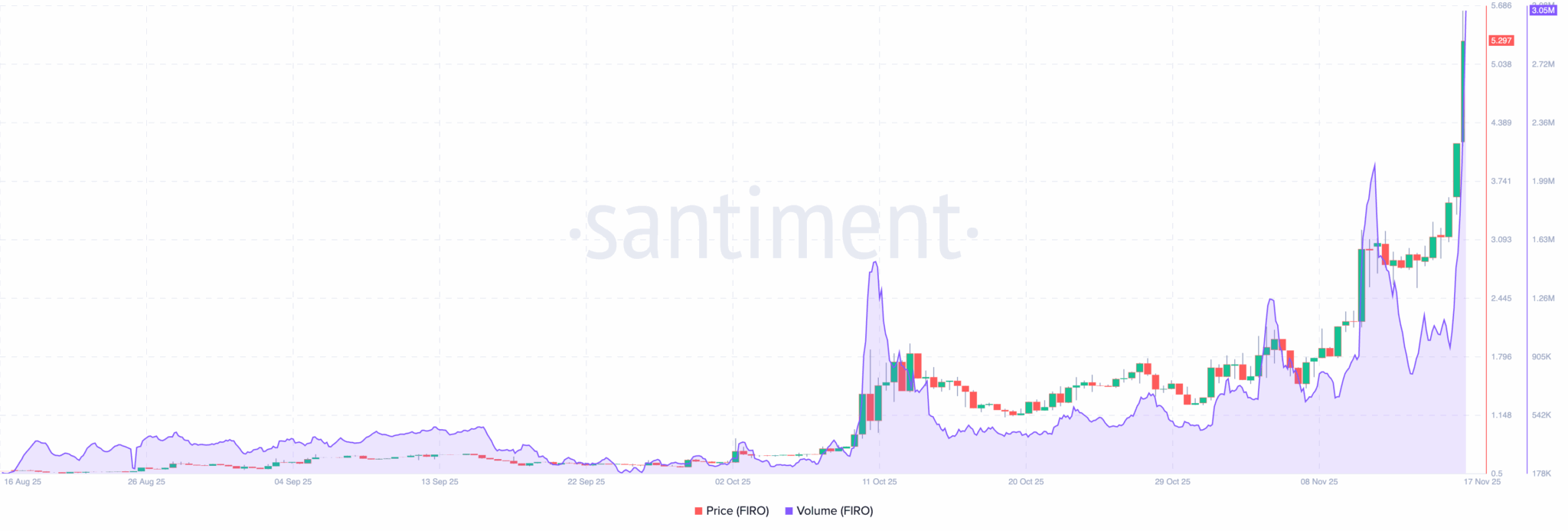

Furthermore, FIRO’s trading volume has increased in tandem with its price, according to Santiment data.

Rising volume typically signals genuine market participation rather than a speculative rally, suggesting that buyers are willing to commit increasing levels of capital.

This also reduces the likelihood of a false breakout and supports the probability of continued upside, especially when combined with FIRO’s newly formed golden cross and upcoming network upgrade.

Should this trend continue, FIRO’s price would likely evade a notable correction.

FIRO Price Prediction: Rally Isn’t Over

Examining the daily chart, the Parabolic Stop and Reverse (SAR) indicator displays its dots positioned below the FIRO price.

This indicates that the short-term trend has shifted firmly in favor of the bulls.

Also, this placement typically reflects rising momentum, suggesting that buyers continue to maintain control.

Additionally, the Chaikin Money Flow (CMF) has moved above the zero line, indicating that capital inflows are outpacing outflows.

When the CMF holds positive territory, it confirms strengthening buying pressure and validates the broader bullish structure seen across higher timeframes.

Should this trend persist, the FIRO coin price may breach the resistance at $5.75. Once this happens, the next target for the cryptocurrency could be around $9.13.

However, if the cryptocurrency becomes overbought and demand drops, this prediction may not materialize. Instead, FIRO might decline to $4.59.