Netflix Inc (NASDAQ:NFLX) recently announced a 10-for-1 stock split, with trading on a split-adjusted basis set to begin next week. Most investors understand a stock split doesn’t change a company’s fundamental value, since the share price adjusts proportionally, but it will make the stock (and its options) more accessible to retail traders.

This is especially true for NFLX, which is trading above $1,000 per share. Will the lower price drive the stock higher? This week, I’m examining the historical data to see how stocks have performed following splits. I’ll take a closer look at high-priced, large-cap stocks like NFLX to see if they tend to behave any differently.

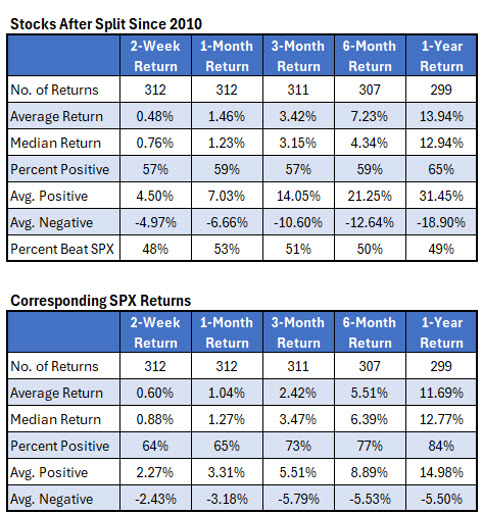

Monitoring General Stock Splits

Using a list of current optionable stocks going back to 2010, I have data on about 310 stock splits. The table below summarizes how stocks performed following those splits. The second table is for comparison and shows the returns of buying the S&P 500 Index (SPX) instead of those stocks.

Stocks slightly underperformed in the very short term after a split. The two-week return for a stock after its split averaged 0.48%, which was less than the average return of buying the SPX (0.60%). The average for longer-term returns is barely above the corresponding SPX returns, but only half the stocks beat the index, and that slightly higher average return comes with a lot more volatility (based on the average positive and average negative returns).

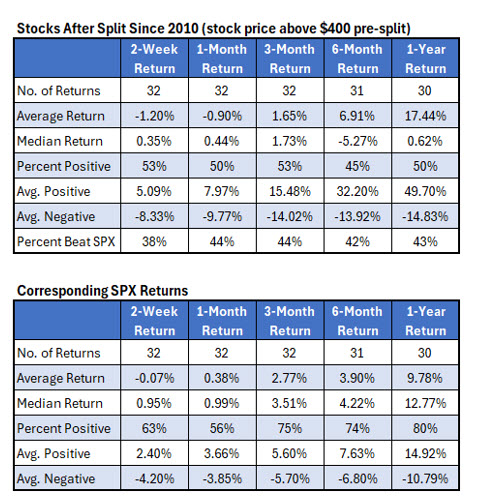

$400 Pre-Split High-Priced Stocks

Netflix stock is getting significantly more affordable. I wondered whether a dramatic price drop might make shares a lot more enticing for investors and lead to better post-split returns. To test this, I looked at returns for stocks that were priced above $400 before the split. The table below shows the results.

There were 32 stocks in my list in which the stock was priced above $400 before it split. I was a little surprised to find these stocks underperformed in the short term, especially in the first two weeks. After the split, these stocks declined 1.2% on average over the first two weeks, with just 38% of them beating the SPX. The underperformance lasts for about a month, but then the longer-term returns (six months and one year) beat the broader market on average.

Buying these high-priced stocks just after a split would has yielded an average return of 17.4% over the next year, compared to 9.8% for the SPX. These stocks average high returns despite only 50% of them being positive, and just 43% beating the broad market over the next year. That average was skewed by some outlier returns, though. For example, Strategy (MSTR) split in August 2024 and nearly tripled over the next 12 months.

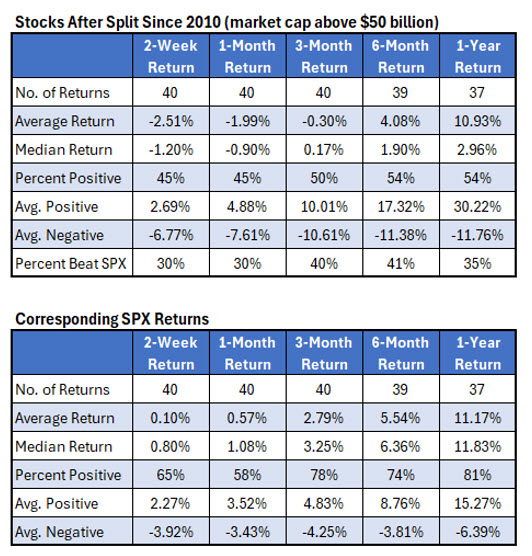

Looking at High Market Cap Stocks

The market cap for Netflix is around $480 billion, making it a mega-cap stock. Stock splits of large companies like this get more press coverage, making retail investors more aware of the split. Again, I wondered how it might change behavior after the split. The table below summarizes post-split returns of stocks with a market cap of at least $50 billion.

There were 40 stocks splits that met this parameter. The data below shows underperformance, especially in the short term. Over the first three months after a split, the $50 billion+ stocks averaged a slight loss of 0.3%, with half of the returns positive, and just 40% of them beating the SPX.

Over the next year, the stocks averaged close to 11%, which is in line with the broader market. However, with these stocks, only 54% of the returns were positive, whereas the SPX would have been positive 81% of the time. With the increased notoriety of larger cap stocks, it’s possible they tend to get bids up until right after the announcement, making these companies overvalued on the split date, which then results in underperformance going forward.

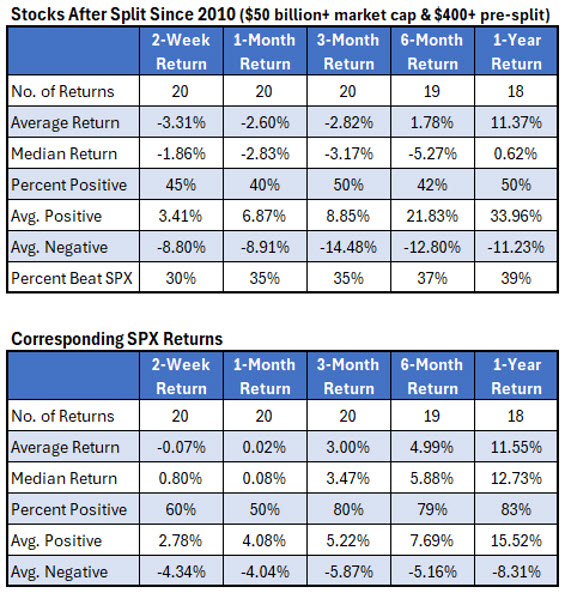

Applying Both Filters

Finally, I used both filters simultaneously to see historical results for large-cap stocks (above $50 billion) that were priced above $400 before the split. This will be the NFLX’s situation next week when it splits. If history is our guide, this increases chances of post-split underperformance.

I have 20 stocks on my list that meet both parameters, and they averaged a loss of 2.82% over the next three months, with just 35% of them beating the SPX. Buying the SPX instead of the stock would have returned 3% on average over three months. Over the next six months, these stocks averaged a return of just 1.78%, with less than half (42%) positive, and just 37% of them beating the SPX.

You’re about to hear pundits talk about how Netflix stock is about to become more accessible to retail traders. But data shows us for large-cap, high-priced stocks, splits tend to lead to weak performance in the months that follow.