The HBAR price trades near $0.118, up about 2% today but still down around 18% this month. The broader structure is fragile, and the chart still hints at a downtrend continuation, courtesy of a breakdown pattern.

Even with that risk, buyers are pushing back. Dip buying and early on-chain shifts now decide whether HBAR avoids a deep correction.

Breakdown Risk Meets Dip Buying Support

HBAR’s daily chart still shows a bearish pole-and-flag pattern. If the price loses $0.108, the breakdown can open the door to a 31% slide based on the pole projection.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Hedera Price Risk: TradingView

Dip buyers are trying to disrupt that. The Money Flow Index (MFI), which measures inflows and outflows through price and volume, has diverged bullishly from price.

Between December 9 and December 29, the Hedera (HBAR) price trended lower while the MFI turned higher. That shows buyers stepping in on dips rather than allowing breakdown continuation.

Key Bullish Divergence: TradingView

Divergence does not guarantee recovery, but it signals demand returning at key levels. That could be one reason HBAR found support at the lower trendline of the bear flag and attempted a bounce.

Derivatives Positioning Shows Early Doubt and Quiet Support

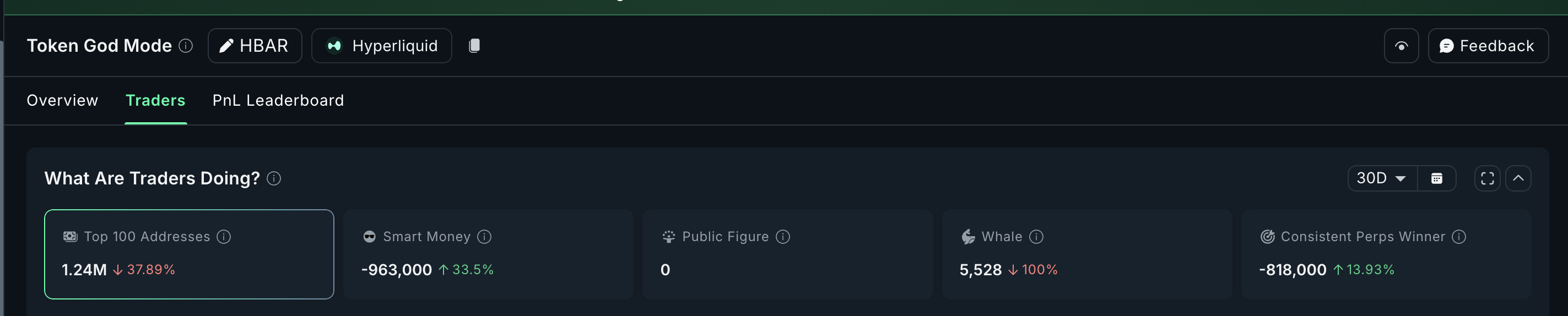

Derivatives positioning also explains why the structure has not collapsed yet. At first glance, the overall 30-day perp positioning looks short-biased.

Smart money is still net short over the last 30 days, but the size of short exposure has begun to shrink. Consistent perp winners are also net short, but they are opening fresh longs, almost 14% over 30 days. These groups often rotate early before direction changes.

The top 100 addresses and whales are still net long, even though their exposure has reduced.

HBAR Perps: Nansen

This creates an uneven picture. Most traders expect downside, but the reduction in short build-up and existing long positioning suggests some believe the breakdown can be avoided.

HBAR Price Levels Decide Whether Breakdown Holds

HBAR sits close to critical levels.

$0.108 is the neckline. Losing it confirms the bear flag. Below that, $0.102 is the last support before the 31% continuation target path strengthens.

Buyers need to retake $0.120 first. Above $0.126, momentum shifts enough to damage the flag structure. A move above $0.139 cancels the pattern and restores a neutral-to-bullish bias. For now, the HBAR price is balanced between both outcomes, with the bearish pressure still taking center stage.

HBAR Price Analysis: TradingView

HBAR needs roughly a 6.9% move to reclaim $0.126 and break the short-term downtrend. If that happens while MFI holds its divergence and derivative shorts keep contracting, the feared breakdown could fail to materialize.