Toward the end of 2025, Binance solidified its peak position as the liquidity hub for stablecoins. The centralized exchange holds over 71% of stablecoin deposits, leaving other markets behind.

Binance remains the biggest holder of stablecoins among all other centralized exchanges. The market now carries over 71% of stablecoin liquidity, creating the biggest concentrated pool in crypto.

Exchange stablecoin reserves remain near an all-time high at the end of 2025, reaching around $69B. Binance still holds over $49B out of the total supply of 314B in various stablecoins. The most numerous inflows are for Ethereum and TRON-based coins.

Binance’s reserves are around five times higher compared to the liquidity on OKX. Overall, the top three exchanges hold 94% of stablecoin liquidity. The reserves may represent raw buying power for the spot market, but are also partially used for passive income as Binance opens yield programs for specific stablecoins.

The leading USDT and USDC tokens had Binance as their most active market. Over the course of 2025, Binance also decreased the supply of FDUSD, from around 2.5B tokens down to 500M. The balance at the end of the year remains near the historical peak, but may signal a shift for the next year.

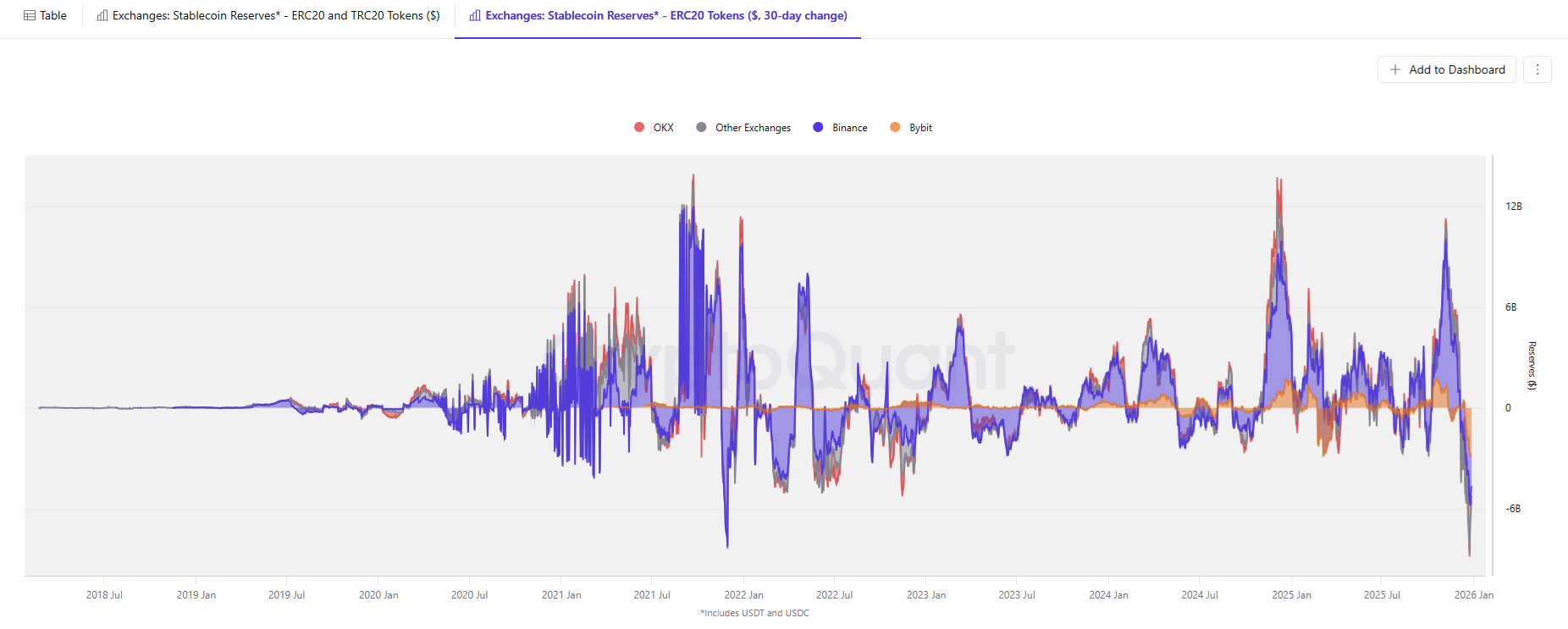

Stablecoins flowed out of exchanges in December

Stablecoin reserves on exchanges reached their yearly peak at the end of November, when Binance carried over $51B in stablecoin reserves. In total, $8B in stablecoins left exchanges in the final stretch of 2025.

Bybit saw the biggest outflows, with $2B leaving the exchange, while Binance had $2B in outflows.

Despite this, the markets have enough deposits to deploy in the case of a sentiment shift. Binance may become an indicator for buying pressure.

The accumulation of stablecoins is still not affecting the market, which is trading with thin holiday volumes and low sentiment metrics. Trading activity also slowed down, while whales slowly accumulated BTC on the spot market. The available buying power, however, is still not reigniting the hype or bringing BTC on the path to new all-time highs.

Liquidity flows to derivative markets

The overall trend for 2025 is for stablecoins to move from spot to derivative markets. Spot markets briefly revived after the October 10 deleveraging.

Despite this, stablecoins are mostly active on derivative trading pairs, with significant outflows from spot markets. Derivative exchanges hold $64B in stablecoins as of December 29, with a peak on November 14 at over $68B.

Spot reserves saw the most significant outflows, from $5.7B down to $1.3B on all exchanges, based on Cryptoquant data. Spot buying has also lost some of the retail market, while whales accumulate with exact deposits.

While some traders buy the dip, the liquidity on derivative markets is waiting for momentum to set up new positions. Traders remain cautious, as accumulations of both long and short positions get attacked and liquidated.

Stablecoin minting is also no longer directly correlated with BTC price recoveries as during previous bull markets. The record number of stablecoins serves other use cases in 2025, and the expanded supply does not guarantee buying. s get attacked and liquidated.

Stablecoin minting is also no longer directly correlated with BTC price recoveries as during previous bull markets. The record number of stablecoins serves other use cases in 2025, and the expanded supply does not guarantee buying. rantee buying.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free.