KEY TAKEAWAYS

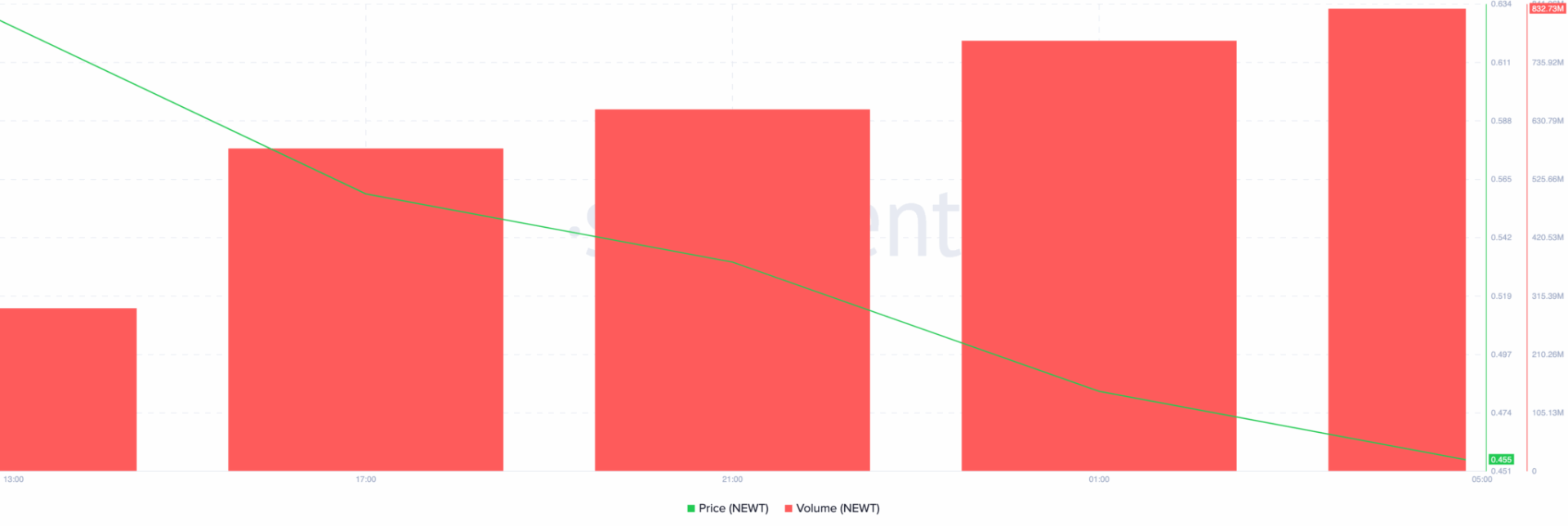

NEWT fell from $0.83 to $0.46 in 24 hours despite Binance and Coinbase support for the altcoin.

On-chain data shows trading volume surged to $823.73 million, indicating increased sell pressure.

As a newly launched token, NEWT is in price discovery and is struggling to establish fair value.

The launch of Newton Protocol’s NEWT token on Coinbase and a promotional airdrop campaign on Binance brought a double dose of bullish news. Yet, the market response was anything but optimistic.

In the past 24 hours, NEWT’s price has dropped by 15%, falling from a local high of $0.83 to $0.46 at press time. So, why did NEWT fall despite the strong catalysts?

In this analysis, CCN breaks down the factors behind the drop. We also reveal what could be next for the token’s price action.

Newton Protocol Plunges After Major Listings

Newton Protocol is a decentralized infrastructure layer for verifiable on-chain automation and secure agent authorization built on the Ethereum blockchain.

NEWT, an ERC-20 token, serves as the project’s utility token. On Tuesday, June 24, Binance listed NEWT and made it available for trading.

Before the recent price drop, Binance revealed plans for a promotional airdrop, allowing eligible users to receive a portion of the 215 million NEWT circulating supply.

Coinbase was also not left out. On the same day, it announced support for Newton Protocol and listed NEWT for trading. Despite these, NEWT’s price experienced a correction.

From an on-chain analysis standpoint, Newton Protocol’s trading volume surged as the token’s price declined. According to Santiment, volume soared to $823.73 million at writing, reflecting heightened activity across exchanges.

Typically, rising volume coupled with a rising price is a bullish signal, suggesting strong demand.

However, in this case, the volume spike is occurring alongside a falling price, indicating increased sell-side pressure. If this trend continues, it could exert further downward pressure on NEWT’s price.

NEWT Price Analysis: Too Early to Tell

Regarding NEWT’s short-term price outlook, it may be too early to draw definitive conclusions.

Given the token’s recent launch, NEWT is still in the price discovery phase, where buyers and sellers have yet to agree on a fair market value.

As such, the altcoin might experience high volatility and sharp price swings, making it difficult to determine the immediate direction. Short-term forecasts for NEWT’s price will likely remain speculative until a clear support and resistance structure forms.

However, on the 30-minute NEWT/USDT chart, the Relative Strength Index (RSI) is close to the oversold region, since the reading is close to 30.00. This indicates that sellers might be getting exhausted soon.

As such, NEWT’s price might soon experience a rebound. If this happens and trading volume increases, the cryptocurrency’s value could jump to $0.55 at the 0.618 Fibonacci level.

In a highly bullish case, it could climb to $0.69. However, if selling pressure intensifies, this prediction might not pass as NEWT could slide toward $0.36.