1inch Network (1INCH) is a leading DeFi ecosystem that provides optimized, secure, and cost-efficient crypto trading solutions across multiple blockchains. Over the past few weeks, the price of 1INCH has increased to $0.38 (+80%) from its previous low of $0.21. This significant increase reflects growing investor interest and positive market sentiment towards 1inch Network’s role as a decentralized exchange aggregator, which optimizes token swaps across multiple liquidity sources. How will the 1inch platform develop in the future? This article explores 1inch Network price prediction and the key factors driving its future growth.

| Current 1INCH Price | 1INCH Prediction 2025 | 1INCH Price Prediction 2030 |

| $0.28 | $0.75 | $8 |

1inch Network (1INCH) Overview

1inch Network is a DEX aggregator designed to optimize trading by routing token swaps across multiple decentralized exchanges, including major platforms like Uniswap, SushiSwap, and others. By leveraging advanced smart contract algorithms, 1inch Network searches through liquidity pools on over 100 different protocols across ecosystems such as Ethereum, Binance Smart Chain, and Polygon, to secure the best possible trade prices for users. This approach not only minimizes slippage and reduces transaction costs but also enhances security by executing trades through its smart contracts, which ensure funds are protected even when interacting with various liquidity sources.

Beyond simple token swaps, 1inch Network offers a comprehensive DeFi ecosystem that includes features like limit orders, liquidity provision opportunities through its 1inch Liquidity Protocol (an automated market maker or AMM), and a native governance token, 1INCH, that empowers holders to participate in decisions shaping the protocol’s future. The platform’s user-centric design balances accessibility for newcomers with powerful tools for experienced traders, contributing to its broad adoption.

1INCH Price Statistics

| Current Price | $0.28 |

| Market Cap | $391,766,067 |

| Volume (24h) | $52,691,491 |

| Market Rank | #144 |

| Circulating Supply | 1,395,633,158 1INCH |

| Total Supply | 1,500,000,000 1INCH |

| 1 Month High / Low | $0.3845 / $0.2108 |

| All-Time High | $7.87 May 08, 2021 |

1inch was founded in 2019 by Sergej Kunz and Anton Bukov and debuted as a DEX aggregator at the ETHNewYork hackathon, solving the problem of fragmented liquidity by scanning multiple DEXs to offer users the best swap rates. The 1INCH token was released in December 2020 by the 1inch Foundation.

1inch Network Features

1inch offers several features within the crypto space:

Decentralized governance: 1inch Network operates as a DAO governed by its community of 1INCH token holders. Token holders can stake their tokens to earn Unicorn Power, which they use to vote on proposals concerning network improvements, treasury allocations, and protocol parameters.

Liquidity aggregation and optimization: 1inch aggregates liquidity from over 100 DEXs across multiple blockchains, including Ethereum, Binance Smart Chain, and Polygon.

Advanced order types and AMM: Beyond simple swaps, 1inch provides advanced features like limit orders and an AMM protocol called the 1inch Liquidity Protocol, which improves capital efficiency and protects users from front-running attacks.

Staking incentives and governance participation: Users can stake their 1INCH tokens for periods between one month and two years, earning Unicorn Power to participate in governance or delegate their voting power. Staking also grants rewards and boosts community engagement.

Gas token: 1inch Network introduces the Chi gas token, which users can utilize to reduce gas fees during periods of high network congestion, facilitating cheaper and more efficient transactions.

1INCH Price Chart

Price Chart for the Last Year, CoinGecko, August 8, 2025

1INCH Price History Highlights

2020: 1inch Network’s native token, 1INCH, was launched in 2020.

2021: On May 8, 2021, it skyrocketed to an all-time high of $7.87. Later in the year, it hit a peak of $5.155.

2022: 1INCH soared to a high of $1.8 in February and $1.77 in April of 2022. At the end of 2022, the token only reached a peak of $0.86.

2023: For most of 2023, it stayed below $0.7.

2024: In March of 2024, 1inch crypto surged to a high of $0.65.

2025: In July of 2025, $1INCH shot to $0.38. At the moment, 1inch Network coin trades between $0.25 and $0.3.

1inch Network Price Prediction: 2025, 2026, 2030-2040

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.24 | $1.29 | $0.75 | +170% |

| 2026 | $0.4 | $2.15 | $1.3 | +365% |

| 2030 | $1.3 | $14.4 | $8 | +2,750% |

| 2040 | $54 | $181 | $120 | +42,750% |

1inch Network Price Prediction 2025

DigitalCoinPrice crypto experts think that in 2025 1INCH coin’s price can hit $0.59 (+120%) at its peak, while at its minimum it can cost no less than $0.24 (-10%).

PricePrediction analysts forecast 1INCH coin to cost $0.2911 (+8%) at its minimum, while at its peak 1INCH will rise to $0.3258 (+21%).

Experts at Telegaon are certain that in 2026 1inch Network crypto will cost a minimum of $0.32 (+20%), or it can hit $1.29 (+380%).

1INCH Price Prediction 2026

Analysts at DigitalCoinPrice project a bullish trajectory for the 1INCH token in 2026, estimating a peak price of $0.69 (+150%). Their conservative model suggests a floor of $0.57 (+110%), reflecting moderate volatility within a defined range.

PricePrediction’s analysis presents a more restrained forecast, anticipating a minimum trading value of $0.4173 (+55%) and a potential high of $0.5027 (+85%). This suggests a narrower band of price movement compared to other projections.

In contrast, Telegaon’s research team offers a significantly more aggressive outlook, predicting a minimum price of $1.35 (+400%) and a potential peak of $2.15 (+700%). This forecast implies substantial upside potential, likely tied to broader market adoption or ecosystem developments.

1INCH Coin Price Prediction 2030

Analysts at DigitalCoinPrice project a bullish trajectory for 1INCH by 2030, estimating a peak price of $1.46 (+440%). Their conservative model suggests a floor of $1.27 (+370%), reflecting moderate volatility within a defined range.

PricePrediction’s analysis presents a more aggressive forecast, anticipating a minimum trading value of $1.93 (+620%) and a potential high of $2.37 (+770%).

Telegaon predictions estimate that in 2030 1inch Network can hit $14.43 (+5,250%) at its peak. At its lowest point, it will cost no more than $11.64 (+4,200%) per coin.

1INCH Crypto Price Prediction 2040

According to PricePrediction’s analysis, the 1INCH token is projected to reach historic highs by 2040, with a minimum price target of $154.2 (+57,500%) and a peak potential of $181.35 (+67,600%). These forecasts reflect an optimistic long-term trajectory for the token, driven by anticipated advancements in DeFi adoption and 1inch Network’s ecosystem growth.

According to Telegaon, in 2040 1INCH coin’s price will cost no less than $54.12 (+20,000%) or it can go to $66.81 (+24,000%). This forecast implies exponential growth, likely tied to speculative market cycles or unprecedented adoption of 1inch’s aggregation technology.

1inch Network Price Prediction: What Do Experts Say?

1inch is a leading DEX aggregator, optimizing trades across multiple DEXs to offer users the best swap rates. As DeFi adoption grows, demand for efficient trading tools like 1INCH increases, which could drive up the token’s value. The platform has already processed $707B+ in total trading volume, showcasing its utility. Moreover, experts point out that 1inch has expanded beyond simple swaps, introducing products like 1inch Wallet (for Web3 asset management), 1inch Fusion (gasless swaps with MEV protection), and 1inch DAO (decentralized governance).

Many analysts believe that 1INCH’s price potential hinges on DeFi adoption, ecosystem growth, and market trends. While short-term fluctuations are likely, its strong fundamentals and utility position it for long-term gains if the broader crypto market remains bullish. For instance, CoinLore forecasts for $1INCH a maximum of $32 per coin in 2030.

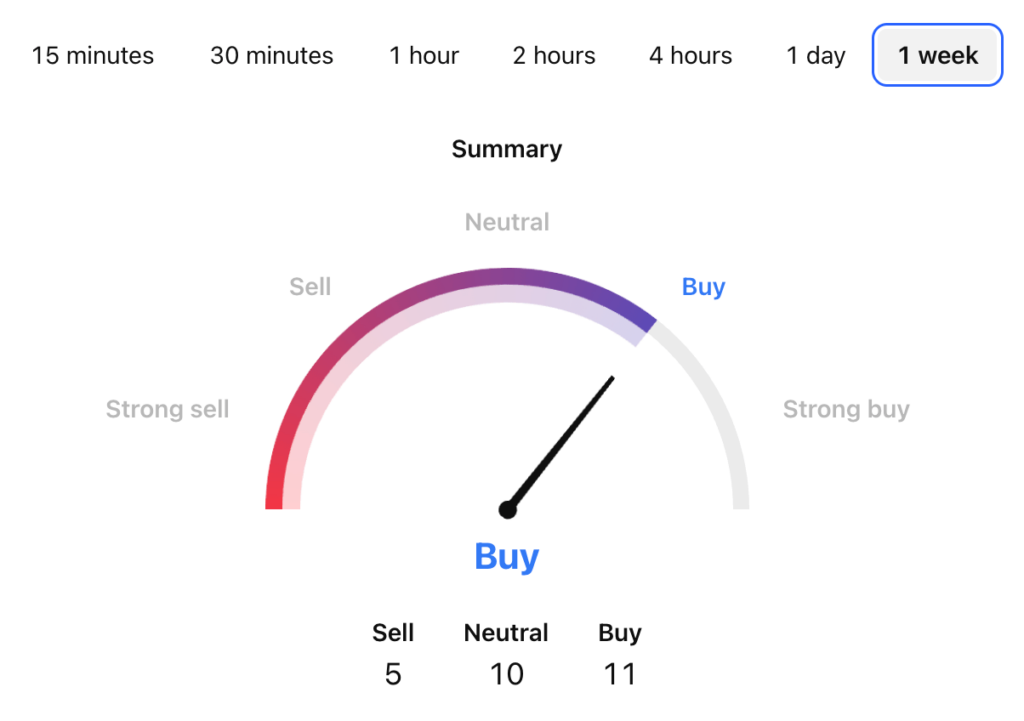

1INCH USDT Price Technical Analysis

Tradingview, August 8, 2025

Now that we’ve seen possible price predictions for 1inch Network, let’s find out a bit more about the factors that can influence its price.

What Does the 1INCH Price Depend On?

The price of 1INCH, the native token of the 1inch Network, depends on several key factors, including market demand, adoption of DeFi, and the overall performance of the crypto market. As a DEX aggregator, 1inch’s utility in optimizing trades across multiple decentralized exchanges drives demand for the token. Increased usage of the platform (such as higher trading volumes, staking participation, and governance activity) can positively influence its price. Additionally, broader crypto market trends, such as Bitcoin’s price movements and institutional interest in DeFi, play a significant role in shaping investor sentiment toward 1INCH.

Another critical factor is technological advancements and ecosystem growth. Innovations like 1inch Fusion (gasless swaps), cross-chain expansions, and partnerships enhance the platform’s utility, attracting more users and liquidity. Regulatory developments, competition from other DEX aggregators, and macroeconomic conditions also impact price stability.

Risks and Opportunities

The 1inch Network presents significant opportunities for users and investors, particularly through its innovative DeFi solutions and security measures. As a leading DEX aggregator, 1inch optimizes trades across multiple liquidity sources, offering users the best rates and minimizing slippage; these are all key advantages in a competitive DeFi landscape. The platform’s Fusion mode enables gasless swaps with MEV protection, while its governance token, 1INCH, allows holders to stake, vote on protocol upgrades, and earn rewards, creating passive income opportunities. Additionally, 1inch’s proactive compliance tools, like TRM Labs integration, screen high-risk addresses, fostering a safer ecosystem that could attract institutional interest as DeFi regulation evolves.

However, risks remain, including market volatility, regulatory uncertainty, and security threats. While 1inch employs advanced safeguards (such as smart contract audits, malicious token detection, and phishing takedowns) users may still encounter scams or exploits targeting DeFi platforms. The network’s reliance on third-party resolvers in Fusion mode introduces counterparty risks, and broader crypto market downturns could suppress 1INCH’s price despite its utility.

Is 1inch Network a Good Investment?

The 1inch Network is a leading DEX aggregator that scans multiple DEXs across blockchains like Ethereum, Binance Smart Chain, and Polygon to provide users with the best swap rates by splitting orders and optimizing routes using its proprietary Pathfinder algorithm.

What Does 1INCH Network Do?

The 1inch Network is a leading DEX aggregator that scans multiple DEXs across blockchains like Ethereum, Binance Smart Chain, and Polygon to provide users with the best swap rates by splitting orders and optimizing routes using its proprietary Pathfinder algorithm.

What Is 1INCH Famous For?

The 1inch Network is primarily famous for being a leading DEX aggregator that scans hundreds of liquidity sources across multiple blockchains to provide users with the best possible swap rates, minimizing slippage and gas fees through its advanced Pathfinder algorithm. Additionally, it gained recognition for pioneering gasless swaps via Fusion Mode, MEV protection, and a non-custodial wallet

How Safe Is 1INCH Crypto?

The 1INCH Network implements robust security measures to protect users, including non-custodial wallet integration (ensuring users retain full control of their assets), smart contract audits by top firms like ConsenSys Diligence and OpenZeppelin, and real-time threat detection for scams, malicious tokens, and phishing attempts. However, risks remain, such as third-party resolver vulnerabilities (highlighted by a $5M hack in 2025) and market volatility, though the team actively mitigates these through bug bounties and contract updates.

Does 1INCH Have a Future?

The 1INCH token appears to have a future, though its success depends on broader DeFi adoption, technological advancements, and market conditions. As the native token of 1inch Network, a leading DEX aggregator, it benefits from strong utility in governance, staking, and gas optimization; these are all key features in decentralized finance.

Will 1INCH Recover?

The recovery potential of 1INCH depends on several factors, including broader crypto market trends, adoption of DeFi, and 1inch Network’s ability to innovate. While short-term predictions show modest growth), long-term forecasts suggest stronger recovery, with some analysts projecting up to $5 by 2030 if DeFi adoption accelerates and the platform maintains its competitive edge.

Will 1INCH Reach $10?

The likelihood of 1INCH reaching $10 depends on several factors, including long-term DeFi adoption, market conditions, and 1inch Network’s ability to innovate. While some optimistic long-term forecasts suggest significant growth, reaching $10 would require a nearly 40x increase from current levels, which would demand extraordinary ecosystem expansion and bullish crypto market trends.

Should I Buy 1INCH?

This depends entirely on your risk tolerance. Analysts offer mixed forecasts, and while the token’s utility in DEX aggregation, governance, and staking supports its ecosystem, risks like market volatility, regulatory uncertainty, and competition (Uniswap, SushiSwap, etc.) remain. If you believe in DeFi’s growth and can handle crypto’s inherent volatility, 1INCH could be a speculative addition to your portfolio.

Conclusion

The 1inch Network has solidified its position as a leading DEX aggregator, offering users unparalleled efficiency in decentralized trading. With strategic token buybacks, expanded security measures, and cross-chain interoperability, 1inch is positioning itself for long-term growth in the evolving DeFi landscape. As the platform evolves, its ability to adapt and scale will determine whether it becomes a cornerstone of decentralized finance or faces stagnation in an increasingly competitive market.