Bitcoin has entered one of its quietest phases in years, and market participants are starting to pay attention. Price action has slowed, daily ranges have narrowed, and volatility metrics are pressing toward historical lows.

While this kind of calm is often dismissed as stagnation, past cycles suggest it may be doing something very different beneath the surface.

Key Takeaways

Bitcoin volatility is back near historic compression levels.

Similar setups previously came before major price moves.

Options activity is suppressing volatility, not removing it.

Quiet markets often precede sharp breakouts.

Looking back over recent years, Bitcoin has repeatedly shown a rhythm that traders tend to overlook in real time: long periods of pressure-building followed by sharp, sudden releases. The current environment is beginning to resemble those earlier compression phases.

A recurring volatility pattern is emerging

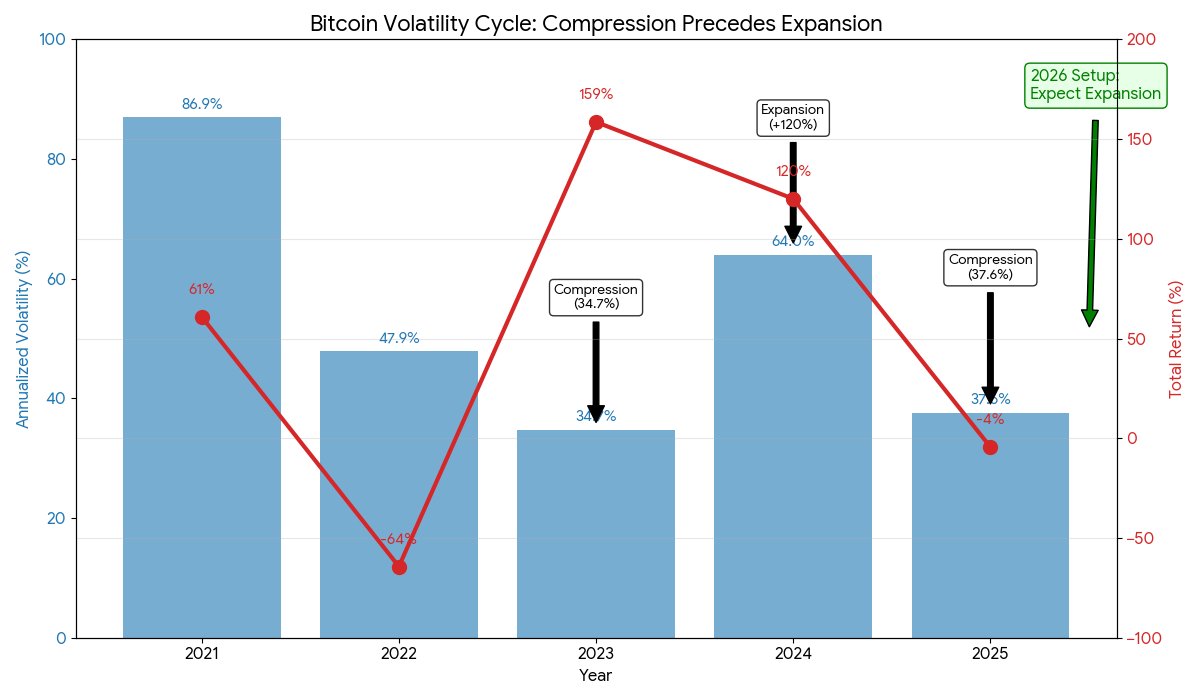

Annual volatility data paints a clear sequence. Periods of elevated volatility tend to align with cycle tops or major trend reversals, while prolonged contractions have historically preceded explosive moves.

In 2021, volatility surged alongside a euphoric market, culminating in a cycle peak. The following year saw a brutal reset, with returns collapsing and volatility falling sharply as leverage was flushed from the system. By 2023, Bitcoin entered a notably tight trading regime, with volatility compressing into the mid-30% range. That calm didn’t last long.

In 2024, price expansion returned aggressively, delivering triple-digit gains as volatility expanded once again. Now, in 2025, the market appears to be slipping back into another compression phase, with volatility retreating toward levels last seen before major breakouts.

The sequence does not guarantee direction, but the repetition itself is hard to ignore.

Why low volatility may not mean low risk

One of the most important details behind the current calm lies in the derivatives market. Rather than volatility disappearing, a large portion of it appears to have been deferred.

Options positioning suggests that significant gamma exposure did not unwind; instead, it was rolled forward. That process comes at a cost, effectively dampening short-term price movement while transferring risk into future expiries. In practical terms, the market has become quieter not because uncertainty vanished, but because it has been compressed into a narrower window.

This dynamic can leave spot prices deceptively stable while underlying tension continues to build.

Pressure doesn’t vanish – it concentrates

Historically, Bitcoin has not tended to break out during chaotic conditions. Instead, major expansions have followed periods when participation thins, ranges tighten, and conviction fades. These phases often feel uneventful at the time, but they have repeatedly served as staging grounds for the next directional move.

The current volatility readings are approaching levels that previously preceded large expansions. While past performance does not dictate future outcomes, the market structure is once again aligning with a familiar setup.

What this could mean going forward

If the pattern holds, the present calm may be less about exhaustion and more about preparation. Volatility compression has historically acted as a loading phase, not a conclusion. Whether the next expansion resolves higher or lower will depend on broader macro forces, liquidity conditions, and investor positioning, but the idea that “nothing is happening” may be the most misleading takeaway.

Quiet markets have rarely ended Bitcoin cycles. More often, they have quietly built the conditions for the next one to begin.