Dogecoin has emerged as one of the most discussed cryptocurrencies across social media platforms, according to recent data from blockchain analytics firm Santiment. In a post on X, Santiment reported that Dogecoin ranked alongside Bitcoin, Ethereum, and ZCash as one of the assets experiencing the sharpest rise in social media engagement over the past week.

By 2024–25, Dogecoin still leads all meme coins in social media engagement millions of interactions daily proving the community remains its engine.

Real world adoption followed the memes.

?(11/12)

— Coin Medium (@Thecoinmedium) December 23, 2025

The increase in online attention comes despite muted price performance across the memecoin sector. Santiment attributed Dogecoin’s visibility to a mix of Reddit discussions tied to DOGE sweepstakes, debate over the token’s relevance, and ongoing commentary on X related to market activity. While heightened social interest does not necessarily translate into immediate price momentum, it often reflects shifting sentiment that traders monitor closely.

On-Chain Metrics Suggest Reduced Selling Pressure

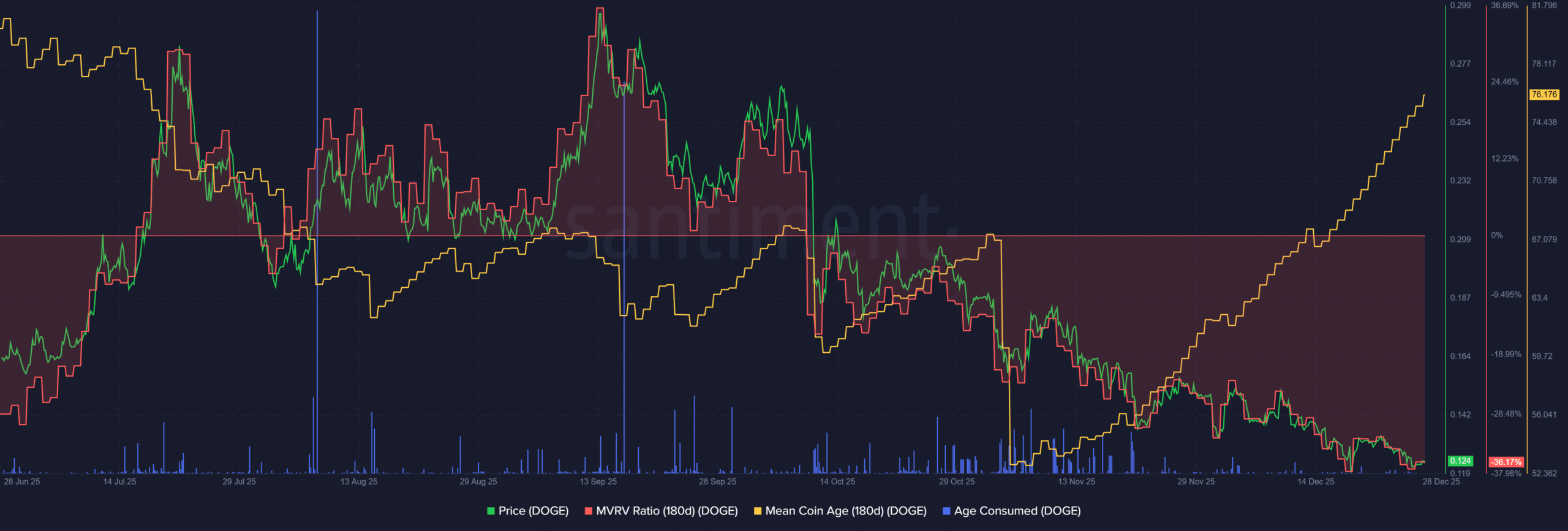

Beyond social metrics, on-chain indicators point to notable changes in Dogecoin holder behavior. Santiment data shows that DOGE’s Mean Coin Age has been rising steadily over the past two months. This metric tracks how long tokens are held on average and typically increases when coins remain inactive, a sign commonly associated with accumulation.

Image Courtesy: Santiment

At the same time, the Age Consumed metric, which spikes when long-dormant tokens move, has remained subdued since mid-November. Analysts generally interpret low age consumption as evidence that older holders are not distributing their tokens, suggesting that large-scale sell pressure has eased.

Another closely watched indicator, Market Value to Realized Value (MVRV), reached a six-month low in mid-December and has shown limited recovery since. According to Santiment, the data indicates that many Dogecoin holders are sitting on unrealized losses. On average, investors who acquired DOGE over the past six months are facing an unrealized loss of approximately 36%.

Price Consolidation Amid Broader Bearish Trend

From a technical standpoint, Dogecoin’s price action has shown signs of short-term stabilization. On the daily chart, DOGE has traded within a relatively narrow range between $0.122 and $0.133. While the broader trend remains bearish, the formation of a range over the past ten days suggests a period of consolidation rather than continued sharp declines.

Image Courtesy: DOGE/USDT on TradingView

Market observers note that a sustained move above the upper boundary of this range could alter the short-term structure. However, sentiment indicators such as Net Unrealized Profit/Loss (NUPL) suggest that the market remains in a cautious phase, with some participants still experiencing capitulation-like conditions.

Broader Context for Memecoins

Dogecoin’s current positioning reflects a broader pattern seen across memecoins during periods of market uncertainty. Social engagement can remain elevated even as prices stagnate, particularly for assets with strong online communities. Historically, accumulation phases marked by rising coin age and muted age consumption have preceded both recoveries and extended consolidation periods, depending on wider market conditions.

As the crypto market continues to navigate uneven sentiment, Dogecoin’s combination of high visibility and accumulating supply underscores the complex relationship between social activity, on-chain behavior, and price performance.

Maxi Doge: A Must-Buy Alternative

While Dogecoin remains the benchmark meme coin, newer projects like Maxi Doge ($MAXI) are attracting growing attention from traders seeking higher-upside opportunities. Built around a high-energy, leverage-driven trading culture, Maxi Doge combines meme appeal with an emerging social trading ecosystem for retail participants.

Interest in the project is already translating into strong capital inflows. At the time of writing, Maxi Doge has raised $4,379,331.05 out of a $4,707,240.73 target, suggesting accelerating demand as the presale approaches its next pricing milestone. With structured community incentives, competitive events, and aggressive marketing plans funded by presale proceeds, Maxi Doge is positioning itself as a higher-risk, higher-reward alternative for traders rotating from established meme assets like Dogecoin.

To buy early, visit the official Maxi Doge website and connect a wallet.