Chainlink is trading under sustained pressure as the price continues to struggle below the $13 level, failing to regain the bullish momentum that defined earlier phases of the market cycle. Repeated attempts to reclaim higher ground have been rejected, reinforcing a cautious outlook among traders. As broader market sentiment remains fragile, a growing number of analysts are warning that LINK could face additional downside before a meaningful recovery takes shape.

Despite the weak price action, on-chain data tells a more nuanced story. Analyst at CryptoQuant, known as CryptoOnchain, reports that recent market data reveals a compelling convergence between on-chain metrics and technical structure, pointing to growing accumulation activity at current levels. While price remains compressed, underlying behavior suggests that larger market participants may be positioning quietly rather than exiting.

This divergence between declining price and improving on-chain signals is often observed during transitional phases of the market, when selling pressure begins to fade, but confidence has not yet returned. According to CryptoOnchain, indicators tracking exchange flows and holder behavior show signs of significant buying interest emerging beneath the surface, even as LINK struggles to attract speculative demand.

Exchange Outflows and Long-Term Support Point to Accumulation

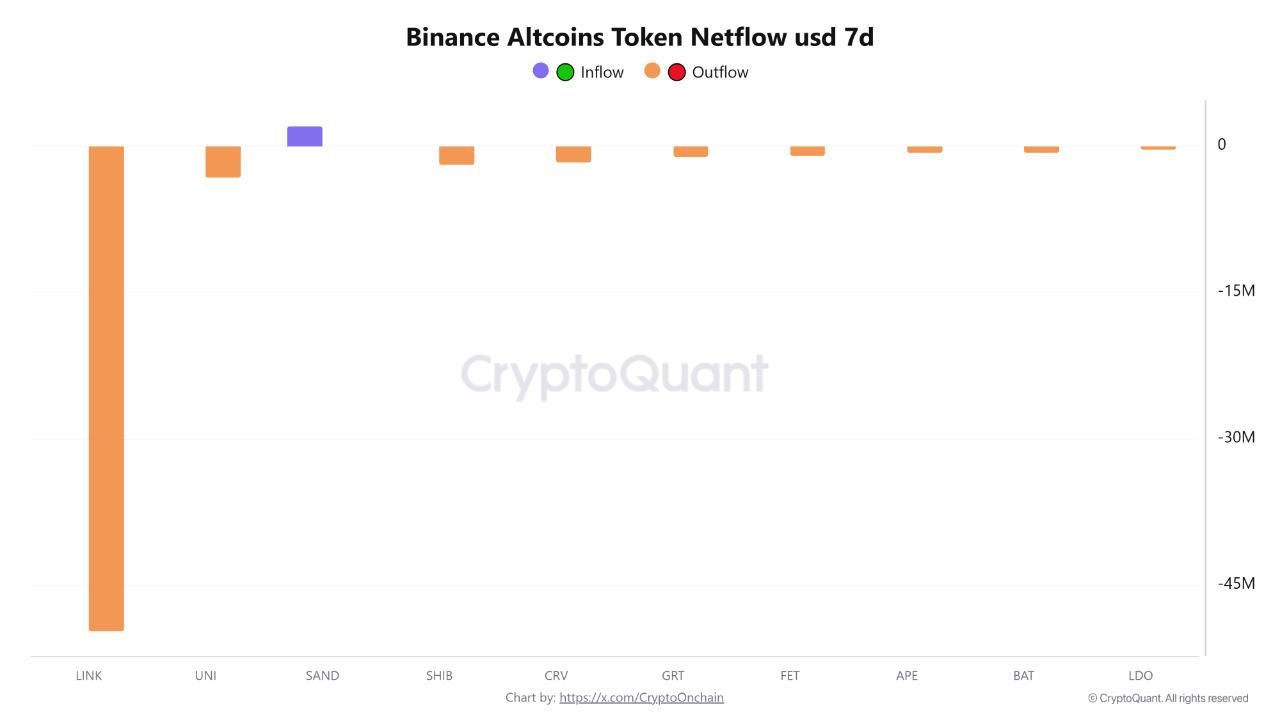

The analysis highlights a notable shift in Chainlink’s on-chain and technical dynamics, starting with exchange netflows. According to the Binance Altcoins Token Netflow 7-day chart, Chainlink has seen a substantial withdrawal from Binance over the past week, with total outflows approaching $50 million.

This magnitude stands out when compared with other large-cap altcoins such as Uniswap (UNI) or The Sandbox (SAND), which have not experienced similar capital movements over the same period.

In on-chain analysis, large and sustained exchange outflows are commonly interpreted as a reduction in immediate selling pressure. Rather than preparing to sell, holders appear to be moving LINK into self-custody or long-term storage, signaling a shift toward holding behavior. This type of activity is often associated with accumulation phases, particularly when it occurs during periods of weak price action.

At the same time, the technical structure reinforces the on-chain signal. The LINK/USDT daily chart shows price resting directly on a long-term bullish trendline that has acted as dynamic support since 2020. Historically, this level has consistently attracted demand and limited deeper drawdowns during corrective phases.

The convergence of heavy exchange outflows and a retest of major historical support sends a strong signal of smart money accumulation. It suggests that larger investors view current levels as a strategic entry zone. Defending this support remains critical, as holding it would preserve Chainlink’s long-term bullish structure and increase the probability of a future trend reversal.

LINK Testing Structural Demand

Chainlink (LINK) continues to trade under pressure, with price hovering around the $12.50 level on the 3-day chart after an extended corrective phase. The structure shows a clear loss of bullish momentum following repeated rejections from the $20–$25 region earlier in the cycle. Since that peak, LINK has established a sequence of lower highs, confirming a medium-term downtrend that remains intact.

From a technical perspective, LINK is currently trading below its short- and medium-term moving averages, which have rolled over and are now acting as dynamic resistance. The 50-period moving average sits well above the current price, reinforcing the idea that recent rebounds have been corrective rather than impulsive.

The longer-term moving average, however, is flattening near current levels, suggesting that selling pressure may be slowing as price approaches a historically important zone.

The $12–$13 range stands out as a key support area. This level has acted as a pivot multiple times over the past two years, repeatedly attracting demand during periods of broader market weakness. The fact that LINK is consolidating rather than breaking down aggressively suggests that sellers are losing momentum.

Volume behavior supports this view. While sell-offs earlier in the year were accompanied by sharp volume spikes, recent price action shows reduced participation, indicating distribution may be giving way to stabilization. For LINK to signal a meaningful trend reversal, bulls must reclaim the $15–$16 zone.

Featured image from ChatGPT, chart from TradingView.com