What Is Kaia Chain?

Kaia Chain is an EVM-compatible Layer‑1 blockchain that merges Klaytn (by Kakao) and Finschia (by LINE) to form Asia’s Web3-enabled superapp infrastructure. Designed for speed, reliability, and real-world use, Kaia delivers 1-second block time, instant finality, and throughput up to 4,000 TPS, making it ideal for consumer and enterprise applications across Asia.

Kaia’s native Web3 integration with LINE and KakaoTalk reaches 250M+ users, powering an ecosystem with 12M+ users and over $13M in GMV via Kaia Wave mini dApps.

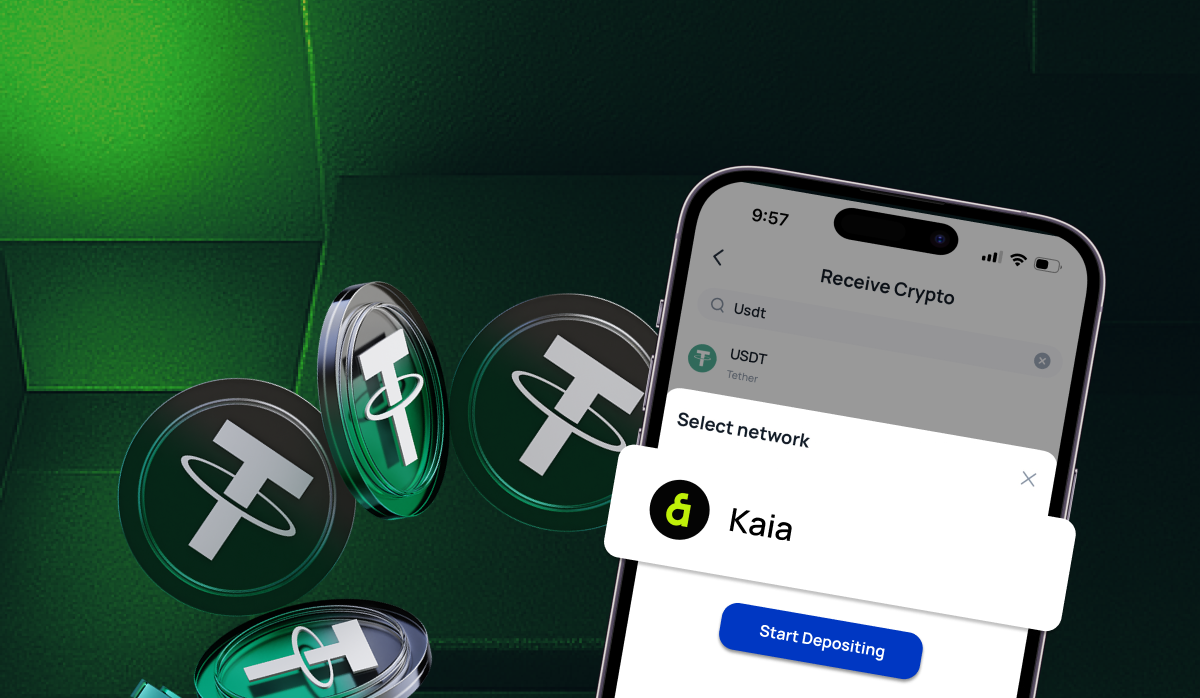

Why USDT on Kaia Matters

In May 2025, Kaia onboarded native USDT, launching its “Stablecoin Summer” initiative. This unlocks fast, low-cost crypto payments for LINE and Kakao users across Japan, Taiwan, Thailand, and Indonesia. The integration brings mainstream stablecoin utility to a mass-market audience.

Tokenomics & Economics

KAIA Token: Infinitely supplied; ~6.07B circulating supply.

Distribution: 50% to validators/community; remaining split between ecosystem and infrastructure funds.

Burn Mechanism: Three-layer token burn ensures supply control.

Ecosystem Use Cases

KAIA

Gas fees for transactions

Staking and validator participation

Governance and proposal voting

Incentives via programs like Kaia Wave

USDT on Kaia

In-app payments across Kaia mini dApps

DeFi use: savings, liquidity provision

Remittance and global wallet transfers

Soon: transaction gas payments using USDT

Ecosystem Snapshot: DApps & Tools

Kaia hosts an expanding ecosystem of Web3 tools:

This integration-ready ecosystem enables fast adoption of DeFi, gaming, and infrastructure projects on Kaia.

What to Expect in 2025 and Beyond

Kaia is scaling key infrastructure and ecosystem features throughout 2025:

Permissionless validation: Wider participation in network operations

Fair transaction ordering: Enhanced UX across dApps

USDT expansion: Adoption by more Mini dApps and Web3 projects

DeFi growth: New yield, savings, and liquidity protocols

Improved onboarding: Fiat on-ramps, gas fee abstraction, LINE/Kakao login

Regulated stablecoin pilots: KRW stablecoin and regional partnerships

These developments aim to cement Kaia as Asia’s premier blockchain for real-world utility.

Kaia Chain bridges Web2 and Web3 by merging powerful infrastructure with deep consumer reach. Native USDT and high usability via LINE and Kakao position it to scale DeFi, dApps, and digital payments across Asia. With robust governance, tokenomics, and partnerships, Kaia is proving to be a foundational Layer‑1 built for the next wave of Web3 adoption.