XRP is struggling to regain bullish momentum as persistent selling pressure continues to dominate market conditions. Price action remains weak, and recent attempts at recovery have failed to attract meaningful demand. With bulls largely absent, sentiment across the XRP market has turned defensive, and an increasing number of analysts are warning that the token could face further downside in the coming weeks if current conditions persist.

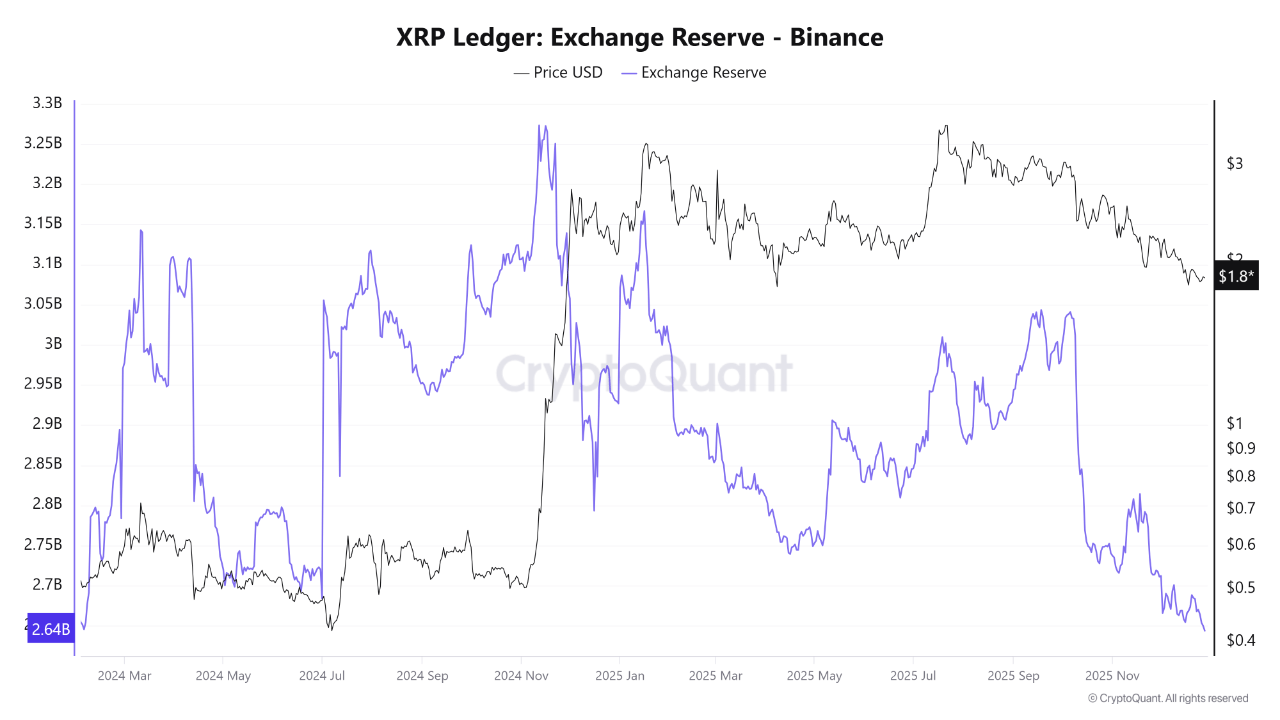

Despite the bearish tone reflected in price, on-chain data reveals an important structural shift. Data from Binance shows that XRP reserves on the exchange have declined to approximately 2.64 billion XRP, marking their lowest level since 2024.

This drop indicates that a significant amount of XRP has been withdrawn from the platform, reducing the supply readily available for immediate sale. In on-chain analysis, falling exchange reserves are typically interpreted as a sign that holders are moving assets into self-custody rather than positioning to sell aggressively.

The divergence between weakening price action and declining exchange reserves adds complexity to the outlook. While the market remains under clear pressure and momentum continues to fade, the absence of rising reserves suggests that the recent price decline has not been driven by large-scale exchange selling. Instead, the data points toward weak demand rather than an influx of sell orders.

Falling Exchange Reserves Suggest Selling Pressure Is Easing

A recent CryptoQuant report highlights a sharp decline in XRP reserves on Binance, pointing to a continued outflow of coins from the exchange. This reduction means fewer tokens are readily available for immediate sale, a dynamic that on-chain analysts typically associate with easing sell-side pressure.

Instead of positioning to exit, investors appear to be moving XRP into private wallets, signaling a preference for holding or using assets outside of active trading venues.

Arab Chain adds important context to this development. XRP’s price has fallen to around $1.80 after failing to sustain levels above $3, a zone that previously defined the bullish peak of the move. Crucially, this price decline has not been accompanied by an increase in exchange reserves.

In past market cycles, sharp bearish reversals were often driven by rising reserves, as large inflows to exchanges reflected aggressive selling. That pattern is notably absent this time.

The current setup suggests that XRP’s weakness is more a function of fading demand than heavy distribution. Sellers do not appear to be flooding exchanges, even as price trends lower. This distinction matters for assessing downside risk.

With XRP reserves now at their lowest level since 2024, the market may be building a more supportive base. If buying momentum returns, reduced exchange supply will amplify price reactions, triggering faster and more pronounced moves than periods of high reserves.

XRP Tests Long-Term Support As Bearish Structure Persists

XRP price continues to trade in a clearly weakened structure, with the chart highlighting a prolonged corrective phase following the sharp rejection from the $3.60–$3.70 highs. After peaking in late summer, XRP entered a steady downtrend marked by lower highs and persistent selling pressure, eventually breaking below the $2.00 psychological level. This breakdown shifted market structure decisively in favor of bears and accelerated the move toward the current $1.85–$1.90 zone.

From a technical perspective, XRP is trading below its 50-day and 100-day moving averages, both of which have rolled over and are now acting as dynamic resistance. The 200-day moving average, currently rising near the $1.75–$1.80 region, has become the most critical level to monitor.

Price is hovering just above this long-term support, suggesting that selling pressure is slowing but not yet fully exhausted. At the same time, declining volume during recent sessions points to reduced participation rather than clear accumulation.

As long as XRP fails to reclaim the $2.10–$2.20 range, downside risks remain elevated. A decisive breakdown below the 200-day moving average would likely open the door to a deeper correction toward the $1.60 area. On the upside, bulls would need a strong reclaim of $2.00 followed by acceptance above short-term moving averages to signal a meaningful trend reversal.

Featured image from ChatGPT, chart from TradingView.com