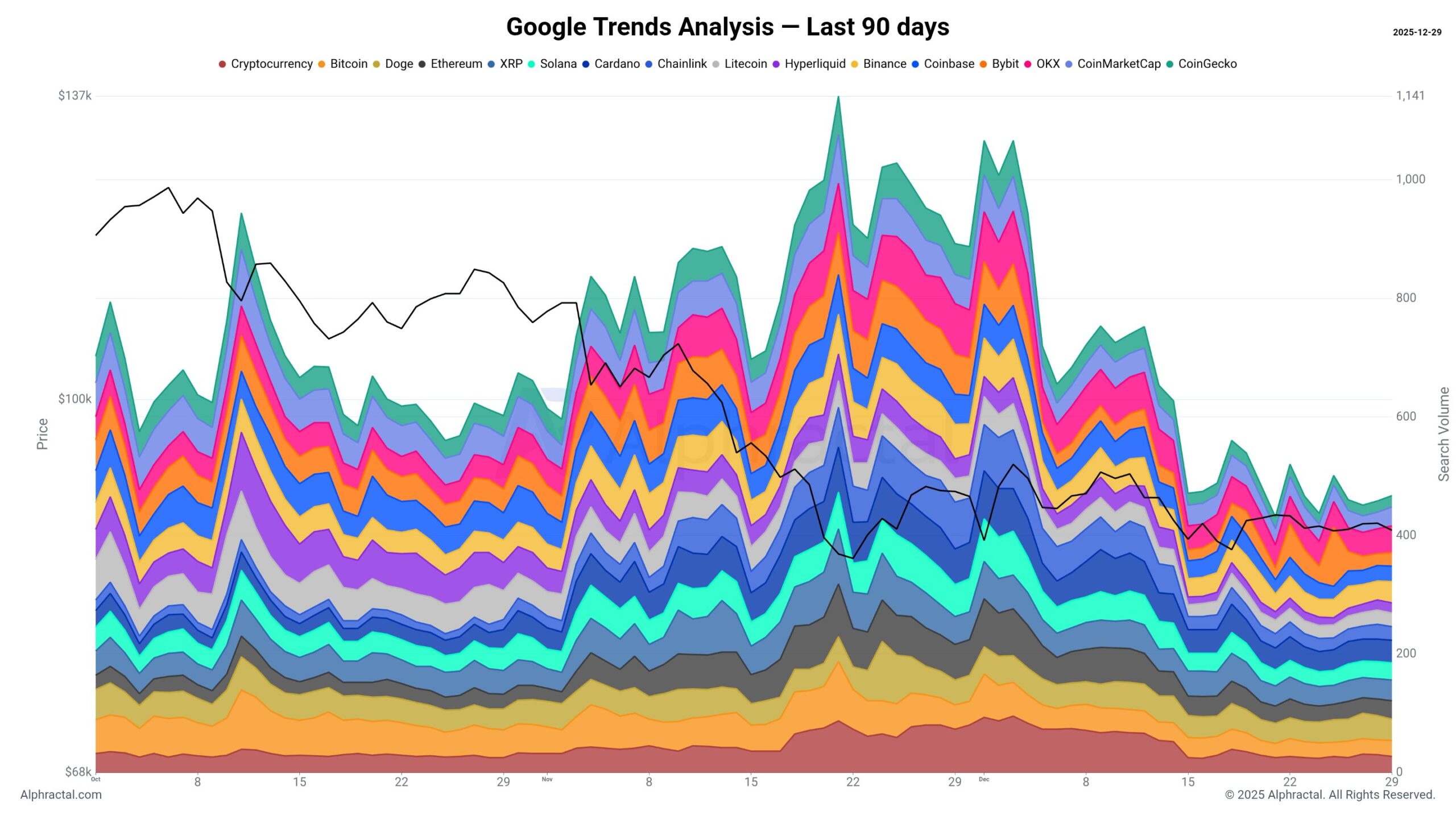

Social engagement around cryptocurrencies has fallen sharply, raising fresh questions about whether the market is entering a prolonged cooling phase or quietly setting the stage for its next cycle.

Recent Google Trends data shows that searches related to major cryptocurrencies and trading platforms have dropped to levels rarely seen outside deep bear markets. The decline is not limited to one asset or region – it spans Bitcoin, Ethereum, altcoins, and exchanges, suggesting broad investor disengagement rather than a short-term narrative shift.

Key Takeaways

Crypto-related search interest has dropped to levels associated with past bear markets

Historically, low attention has preceded long consolidation or extended downside

Some investors see reduced hype as a potential accumulation opportunity

On-chain metrics remain more reliable than sentiment for spotting market bottoms

Market observers note that this collapse in attention is happening while prices remain relatively stable compared to past capitulation phases, creating an unusual disconnect between sentiment and price behavior.

What Low Attention Has Meant in Previous Cycles

Historically, periods of suppressed public interest have rarely been neutral for crypto markets. In earlier cycles, similar conditions tended to lead down one of two paths.

In some cases, prices entered extended consolidation ranges marked by sudden volatility spikes, trapping both bulls and bears while momentum slowly faded. In others, weak participation signaled that bear market conditions were not yet complete, with downside pressure persisting for months before a durable bottom formed.

The key takeaway from past cycles is that low social interest often coincides with market instability rather than immediate recoveries.

Accumulation Thesis Gains Quiet Support

Despite the cautionary tone, not all market participants view the current environment negatively. Some investors argue that fading attention creates favorable conditions for accumulation, as emotional trading declines and speculative excess is flushed out.

This “buy when no one is watching” mindset has historically rewarded patient investors, particularly when combined with confirmation from deeper market data rather than sentiment alone. However, analysts warn that social interest by itself is an unreliable timing tool.

On-Chain Data Seen as the Missing Piece

While sentiment indicators highlight mood and participation, on-chain metrics have proven more effective at identifying genuine market bottoms. Data related to long-term holder behavior, realized losses, exchange flows, and supply distribution often provides earlier signals of structural shifts than social metrics.

Analysts stress that sentiment weakness should be evaluated alongside on-chain trends rather than treated as a standalone bullish or bearish signal. In previous cycles, true market reversals only occurred once on-chain conditions aligned with pessimistic sentiment.