Bitcoin Munari (BTCM) is a Solana-based token that will launch a Layer 1 blockchain in early 2027. The project copies Bitcoin’s (BTC) fixed 21 million supply, but incorporates decentralized applications (dApps), private transactions, and deep scalability.

The startup allocates approximately 11 million BTCM tokens to presale buyers, and participants get a theoretical upside of between 100% and 5,900%.

Our Bitcoin Munari price prediction is a must-read before joining the presale. We analyze BTCM’s price potential after the token generation event (TGE) and evaluate whether the token has a legitimate future. Read on to explore how high the BTCM price can go from 2025 to 2030.

Key Takeaways

Bitcoin Munari claims to revolutionize the original Bitcoin blockchain. While it retains BTC’s finite supply, it introduces popular dApp concepts like staking, cross-chain swaps, and privacy-enhanced transfers.

Although the project plans a native network, the roadmap sets a mainnet launch in Q2 2027. In the meantime, BTCM remains an SPL token without real utility.

To help fund development costs, the founders allocate 53% of the BTCM supply to its public presale event. It spans 10 stages, and token prices range from $0.10 to $3 depending on the purchase round.

As per the whitepaper, the team launches BTCM on the Raydium exchange on January 20th, 2026. A $6 launch price resembles a presale upside of up to 5,900%, so an immediate crash is likely.

Our Bitcoin Munari price prediction for 2026 is a potential low of $0.65. Unless the startup meets its mainnet deadline with proven performance metrics, BTCM could decline to $0.025 by the decade’s end.

Bitcoin Munari (BTCM) Price Prediction 2025-2030 Overview

Summarized below is our Bitcoin Munari price prediction for 2025, 2026, and 2030.

2025: The presale event runs until January 2026. The final presale price is $3, which offers a 50% discount from the TGE valuation.

2026: The biggest challenge for the BTCM price is the substantial upside available when the Raydium DEX pool goes live. We expect most early-stage investors will cash out BTCM right away, since they can secure a huge profit of up to 5,900%. As more participants sell, the BTCM price could drop to $2.50 within 24 hours and $0.65 by the end of 2026.

2030: Bitcoin Munari launches a Layer 1 blockchain by June 2027. A successful mainnet release could trigger an extended rally, peaking at $4.78 in 2030. However, a lack of technical evidence suggests that the native network may never arrive. If the team fails to meet its roadmap promises, Bitcoin Munari could trade at $0.025.

| Year | Potential Low | Average Price | Potential High |

| 2025 | N/A | N/A | N/A |

| 2026 | $0.65 | $2.07 | $6 |

| 2030 | $0.025 | $0.087 | $4.78 |

Bitcoin Munari Price Prediction 2025

Bitcoin Munari runs its fundraising event throughout 2025. Due to the presale’s tiered structure, it is essential to consider the various price increases that take place.

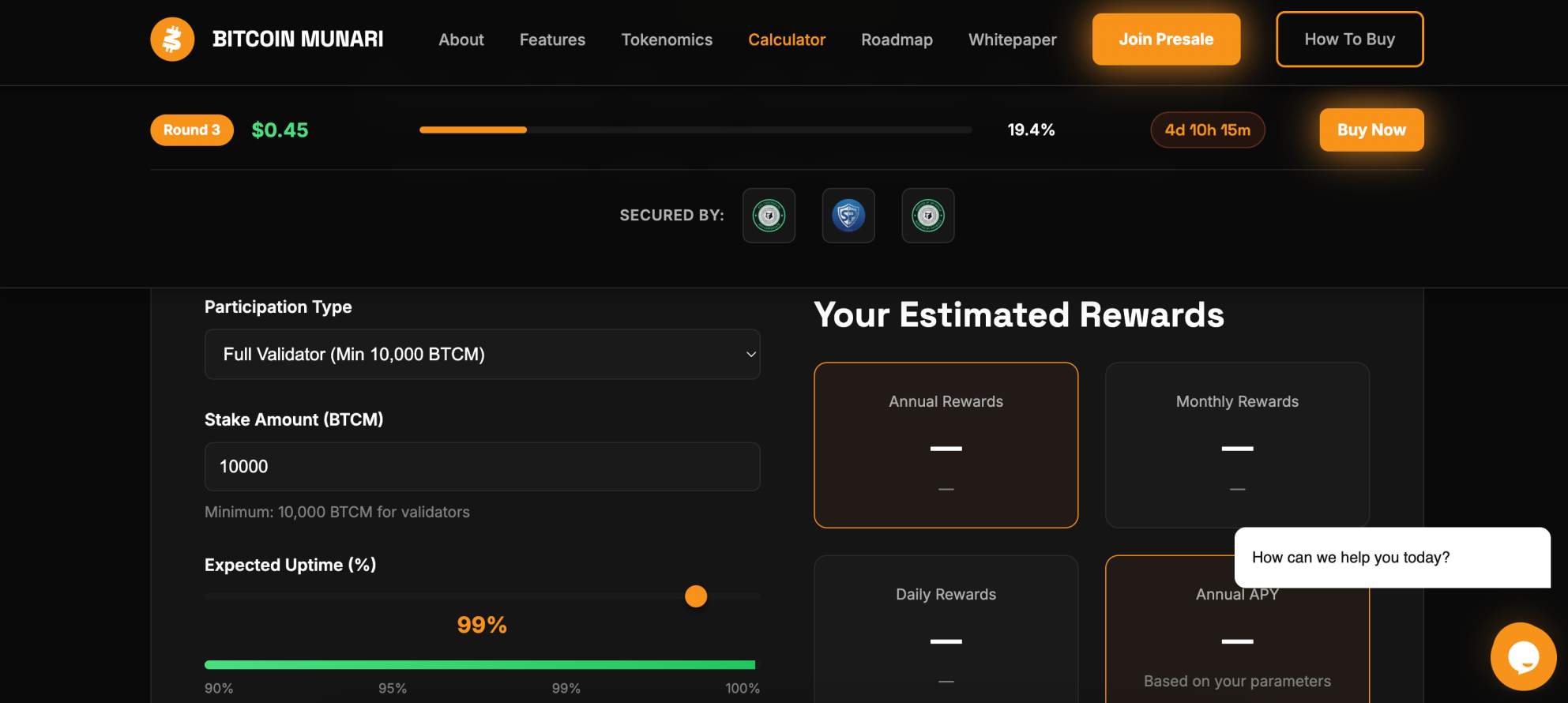

When the presale launched in Q1 2025, stage-one participants purchased BTCM tokens for $0.10. As each stage ends, the event raises the token price. This framework means all presale investors receive an upside. Currently, the presale is in stage three, which offers BTCM for $0.45. This price point is 350% higher than the initial presale rate, so early backers already face big profits. The presale spans 10 stages, and in the final segment, investors pay $3 per BTCM.

Note that during the presale campaign, the roadmap lists various objectives. The project submits applications to centralized exchanges (CEXs), although it is unlikely to secure big listings as a brand-new crypto. It also intends to release operational updates regarding its staking validator program, mainnet blockchain, and strategic partnerships.

As the roadmap schedules these tasks for December 2025, delivering them on time can positively impact the presale raise. Stakeholders must monitor each roadmap objective to ensure the team meets its goals.

Bitcoin Munari Price 2026-2030 Predictions

The final presale stage closes on January 15th, 2026. The team prepares the token distribution event, where BTCM presale buyers claim their tokens. Participants must provide a Solana wallet address on the Bitcoin Munari portal, as BTCM uses the SPL token standard.

The TGE occurs on January 20th, 2026. The whitepaper confirms that the project deposits BTCM liquidity into Raydium, which is the largest decentralized exchange (DEX) in the Solana ecosystem. Bitcoin Munari allocates 8% of the token supply to the Raydium pool, and it claims to lock that liquidity for 12 months. This safeguard prevents the team from withdrawing liquidity, known as a “rug pull” scam. However, the founders cannot provide evidence of the locked liquidity until the BTCM pool launches.

The TGE listing price is $6, which is 100% higher than the final presale rate. Presale gains are significantly greater for those who invested in the earlier stages. Stage-one buyers, who paid just $0.10, could potentially cash out with 5,900% returns. Since these gains translate to up to $5,900 for every $100 invested, we believe most presale participants will sell their tokens right away. This outcome could be catastrophic for the Bitcoin Munari price.

Demand and supply influence exchange dynamics, so as more people attempt to lock in their presale profits, selling pressure puts a substantial strain on the BTCM liquidity pool. Considering that BTCM launches with modest liquidity, we forecast a potential decline to $2.50 within 24 hours of the TGE. This prediction resembles a 58% price drop from the TGE listing price, although it still offers a net return for early presale backers.

After the TGE launch, the project aims for additional roadmap progress. By the end of March 2026, Bitcoin Munari plans to secure its first CEX listing. The roadmap mentions Gate.io, MEXC, and KuCoin, although it provides no evidence of these exchange partnerships. The roadmap phase also releases technical specifications for the mainnet blockchain and community governance.

These operational updates are unlikely to drive the BTCM price in the short term. We forecast a continued decline throughout 2026, with Bitcoin Munari closing the year at $0.65. This prediction reflects a 90% drop from the Raydium listing price. Based on the 21 million token supply, $0.65 gives Bitcoin Munari a $30 million fully diluted valuation (FDV).

In the longer term, BTCM holders hope for a successful Layer 1 launch in Q2 2027. Documents promise a scalable, low-cost, and energy-efficient blockchain with a thriving dApp ecosystem. The network also includes privacy features, a staking program, and decentralized governance. If Bitcoin Munari delivers on these ambitious development objectives, the BTCM price could rally to $4.78 by the end of 2030. This analysis converts to a $100 million FDV.

In our view, the proposed Layer 1 infrastructure may never arrive. We evaluated all available documents and found no credible evidence that technical progress exists. The whitepaper lacks substance, with blockchain aims listed as simple bullet points. Legitimate Layer 1 projects like Solana and Avalanche provided early backers with extensive technical documents, which enabled them to verify the stated claims. This was one of the key factors informing our conclusion in Bitcoin Munari is legit or a scam.

Therefore, due to our bearish sentiment, we predict that BTCM may drop to lows of $0.025 by 2030. If the core team releases technical updates with verifiable performance metrics, we will update this Bitcoin Munari price prediction.

Potential Highs & Lows of Bitcoin Munari

Here is our Bitcoin Munari price prediction summarized, including BTCM’s potential highs and lows:

| Year | Potential Low | Average Price | Potential High |

| 2025 | N/A | N/A | N/A |

| 2026 | $0.65 | $2.07 | $6 |

| 2030 | $0.025 | $0.087 | $4.78 |

Our Bitcoin Munari Price Prediction Methodology

We conducted extensive research into Bitcoin Munari to produce this price prediction. We examined all primary documents from the project website, including its whitepaper, tokenomics, and roadmap. This enabled us to assess whether presale buyers invest in a Web 3.0 startup with real products or a theoretical concept with long-term development requirements. We compared the stated claims with existing Layer 1 solutions, such as scalability, transaction settlement, and consensus.

On the presale side, the research team analyzed the 10-stage campaign. As the presale price ranges from $0.10 to $3, and then $6 at the exchange listing event, we assessed the likely outcome when tokens unlock. Other research angles included the potential presale hard cap, exchange listing partners, and available liquidity at the TGE.

What Is Bitcoin Munari?

Bitcoin Munari is a new Solana ecosystem project that leverages Bitcoin’s store of value narrative. The startup created 21 million BTCM tokens to mirror the BTC supply, and smart contract auditors confirm a finite distribution. Bitcoin Munari claims to expand Bitcoin’s use cases through dApp integration. It enables developers to launch Web 3.0 platforms like staking protocols, play-to-earn games, and real-world asset (RWA) tokenization, yet these objectives arrive later in the roadmap.

By Q2 2027, Bitcoin Munari plans to release a native Layer 1 blockchain. Once BTCM migrates to the proprietary standard, token holders unlock ecosystem utility. The roadmap, while vague in its technical specifications, claims that the Layer 1 will support up to 10,000 transactions per second with minimal fees. It also enables built-in privacy options, similar to the ZCash (ZEC) and Monero (XRM) blockchains.

The long-term goal is to create widespread partnerships and increase its exposure to the decentralized finance (DeFi) industry. Yet, our research shows that most development goals are purely theoretical. Unlike most Layer 1 startups that raise presale capital, Bitcoin Munari offers no evidence of its network capabilities. This raises serious red flags, as early backers must trust that the technology exists without credible proof.

Bitcoin Munari Token Use Cases

From the 21 million capped supply, Bitcoin Munari allocates 53% of BTCM tokens for the presale event. The project uses the remaining tokens for exchange liquidity, validator rewards, marketing, and team incentives.

Presale investors purchase an SPL token only, as use cases arrive in Q2 2027 at the earliest. If the founders launch the mainnet network as stated, holders can stake BTCM tokens to secure the system and earn passive rewards. Staking APYs range from 16% to 40%, depending on whether users become validators, delegators, or basic stakers.

BTCM will also function as a network payment currency. Similar to other decentralized platforms, users pay gas in the native token to cover transfers and smart contract execution. This economic model drives long-term demand, as adoption increases transaction activity.

Further in the roadmap, Bitcoin Munari introduces a decentralized autonomous organization (DAO). BTCM holders cast votes on project decisions, which creates a community-driven ethos. Development documents also mention a custom token standard. This feature lets anyone create secondary tokens on the Bitcoin Munari blockchain. The process resembles other Layer 1 standards like ERC-20, SPL, and BEP-20.

What Drives the Price of Bitcoin Munari?

Market forces determine the Bitcoin Munari price. As a new crypto, the presale remains an important milestone, since the project requires significant funds to build its Layer 1 technology. The presale process offers little transparency, as the startup does not state a hard cap target. The BTCM dashboard also lacks real-time data on invested funds, so we cannot confirm how much the project has raised so far.

The TGE event also plays a major role in the BTCM price. The team confirms a $6 listing rate, so we anticipate early selling pressure, with presale backers selling their tokens to make a quick profit. Bearish conditions in the broader crypto market could create an even bigger threat to BTCM’s post-TGE valuation.

Long-term investors depend on roadmap progress with verifiable product updates. As the markets see legitimate development, sentiment turns bullish, and demand for BTCM may rise. For Bitcoin Munari to experience sustainable growth over time, its ecosystem must attract real user adoption. This dynamic demands an extensive range of Web 3.0 dApps with rising transaction activity.

The oversaturation of Layer 1 networks is a potential challenge for Bitcoin Munari. Dozens of competitors outperform Ethereum for scalability, fees, and transaction speeds, yet the world’s largest smart contract platform dominates the dApp market. Other high-performance networks like Sui (SUI) and Sei (SEI) offer superior transaction metrics, but total value locked (TVL) is a fraction compared with Ethereum.

Alternative Presales to Consider

Among other red flags, if Bitcoin Munari was a serious Layer 1 startup, it wouldn’t offer presale ROIs of almost 6,000%. The presale event employs profit-driven marketing tactics, with loose promises of life-changing returns. In reality, most participants will attempt to lock in those gains as soon as the TGE goes live, causing unprecedented price declines.

We prefer presales with sensible token dynamics, since these projects may generate long-term growth over time. Discussed below are Bitcoin Munari alternatives to consider.

Bitcoin Hyper (HYPER)

Bitcoin Hyper offers a legitimate Layer 2 solution for the Bitcoin blockchain. Its mainnet network, which launches in Q4 2025 or Q1 2026, lets BTC holders connect to its ecosystem without relinquishing control of their coins. Users connect to Bitcoin Hyper via a secure Canonical Bridge, which unlocks DeFi applications for the Bitcoin community. Stakeholders generate yields through liquid staking, savings accounts, and lending protocols, or increase BTC exposure through collateralized loans.

The Layer 2 project also expands BTC’s use case as a medium of exchange. Rather than wait 10 minutes to send and receive BTC, Bitcoin Hyper reduces settlement times to single-second blocks. It also amplifies scaling capabilities, as the network handles thousands of transactions per second. Although the Bitcoin Hyper presale reaches its final stages, investors can still buy HYPER tokens at a reduced valuation. As one of the best crypto presales in 2025, participants have invested $28 million so far.

Maxi Doge (MAXI)

Maxi Doge is a meme coin pure-play; it promises no development goals, token use cases, or long-term purpose. This authentic approach serves successful meme tokens well, with billion-dollar projects like dogwifhat (WIF) and Pepe (PEPE) relying solely on hype and social virality. Maxi Doge uses a unique project theme. The meme mascot, MAXI, is a crypto degen that trades 1000x perpetual futures without stop losses.

MAXI, which resembles a jacked Shiba Inu dog, also enjoys pumping weights. The presale project features a fixed token supply with audited smart contracts, which prevents rug pulls at the TGE. The team receives no tokens from the supply, and it allocates non-presale tokens to marketing, staking rewards, and exchange liquidity. Maxi Doge has raised about $4.3 million to date, and once you join the presale, you can earn staking APYs of up to 73%.

Pepenode (PEPENODE)

Pepenode ranks as one of the best play-to-earn gaming concepts for presale investors. The project launches an innovative mining simulation game that rewards time, effort, and skill. The objective is to create and manage successful mining businesses, where players build server rooms. They purchase nodes and upgrade facilities to increase mining hash power, which enables them to earn higher rewards.

The player-vs-player aspect adds additional earning elements. As players climb the global leaderboard, they earn top meme coins like Fartcoin (FARTCOIN). The fixed PEPENODE supply uses sustainable tokenomics. The founders allocate tokens to node rewards, protocol development, and infrastructure growth, so as more players join, demand for PEPENODE rises. The presale event sells a small percentage of PEPENODE at a discounted price, and participants have invested over $2.2 million.

Bitcoin Munari Forecast Conclusion: Is Bitcoin Munari a Buy?

Our Bitcoin Munari forecast takes a bearish view on the presale startup. Despite the roadmap citing a native Layer 1 blockchain with private transactions and high scalability, public documents provide no evidence of real network development.

The key red flag is the presale pricing structure. Since early buyers pay just $0.10, the $6 TGE listing price enables them to sell BTCM at a 5,900% profit. This unsustainable dynamic makes a significant token dump likely from the get-go.

While we do not recommend Bitcoin Munari, several other presale events offer stable token supplies, sensible presale frameworks, and verifiable development progress. Read our guide on the best crypto presales to learn more.