The Bitcoin Coinbase Premium Gap has witnessed a sharp decline into the negative zone recently, with its value now sitting at one of the lowest in the last 18 months.

Bitcoin Coinbase Premium Gap Has Plunged

In a new post on X, CryptoQuant community analyst Maartunn has talked about the latest trend in the Bitcoin Coinbase Premium Gap. This indicator keeps track of the difference between the BTCUSD price on Coinbase and BTCUSDT price on Binance.

Coinbase is mainly used by traders in the US, especially the large institutional entities, while Binance hosts a global traffic. As such, the Coinbase Premium Gap reflects the difference in behavior between American and offshore whales.

When the value of the metric is greater than zero, it means the asset is trading at a higher value on Coinbase than Binance. Such a trend implies users of the former are applying a higher amount of buying pressure (or lower amount of selling pressure) as compared to the userbase of the latter.

On the other hand, the indicator being negative suggests Binance may be observing a higher amount of accumulation as the cryptocurrency is going for a higher price on the platform.

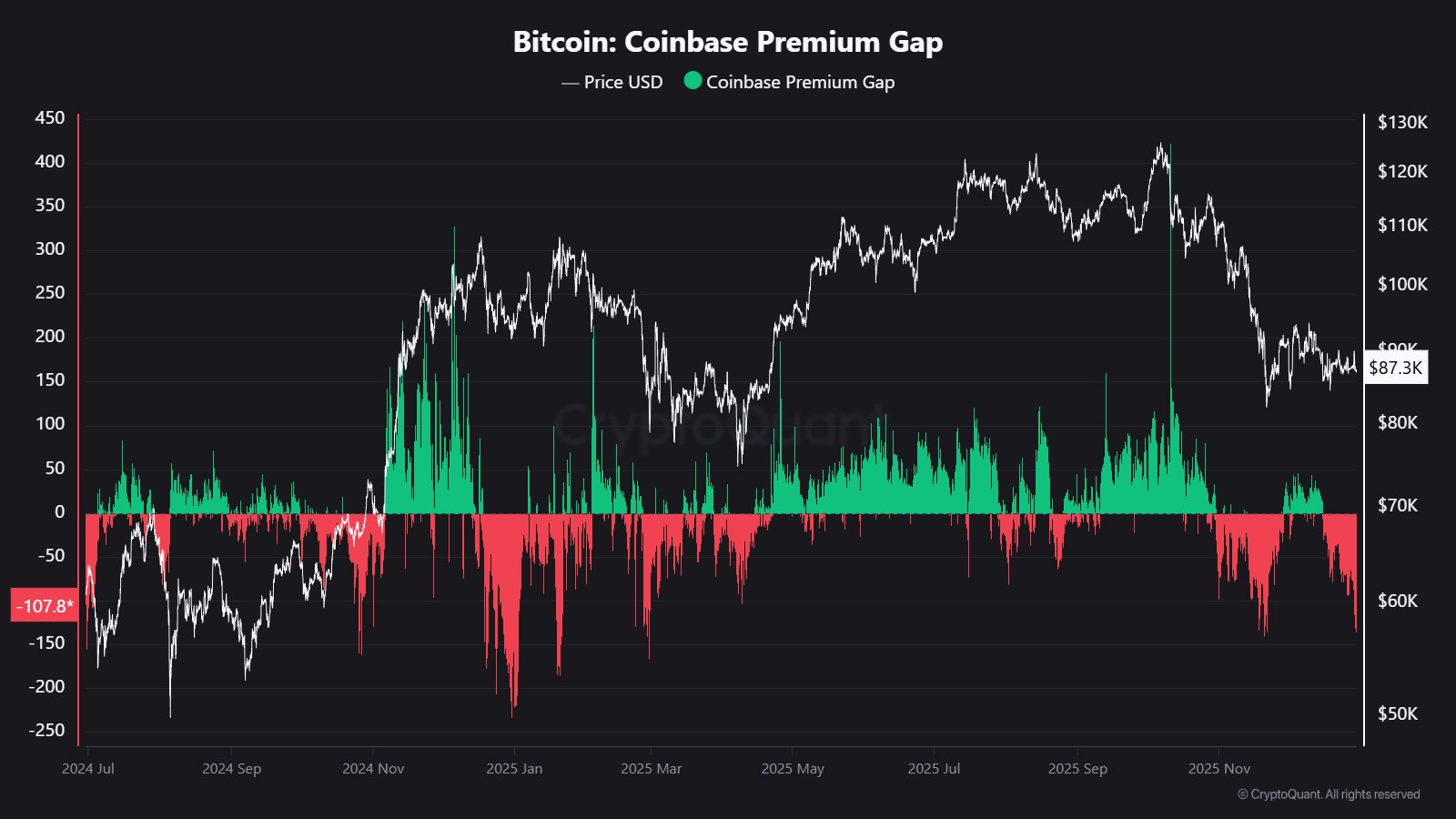

Now, here is the chart shared by Maartunn that shows the trend in the Bitcoin Coinbase Premium Gap over the last year and a half:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap has fallen into the negative territory recently, implying the American investors have shifted their behavior to one of higher selling pressure/lower buying pressure. In other words, demand from US traders has gone down.

Currently, the indicator is sitting at a value of -$122, which means the cryptocurrency’s price is trading at a discount of $122 on Coinbase relative to Binance. The last time that the metric fell to such a low level was during the price crash in November.

In recent times, US institutional entities have played an impactful role in the market, so the Coinbase Premium Gap, which acts a proxy of their behavior, has tended to have some correlation with the asset’s spot price. This pattern was once again seen in November, when a drawdown occurred in the cryptocurrency alongside a plunge into the red zone for the metric.

So far, Bitcoin has managed to be relatively stable even with the low demand from the American whales, but it only remains to be seen how long that will continue, given the scale of the discount on Coinbase.

The current value of the Coinbase Premium Gap is one of the lowest in the last 18 months, being seen on only five occasions in this window.

BTC Price

Bitcoin has been following an overall sideways trajectory recently as its price is still floating around $88,900.