KEY TAKEAWAYS

PIPPIN has flipped bullish on the 4-hour chart, with six green candles

Negative funding, while prices rise, suggests shorts may get squeezed.

If momentum holds, PIPPIN’s price could push toward $0.53 to $0.86.

Solana-based memecoin PIPPIN has registered a 25% price increase over the last 24 hours.

This comes after the token experienced a decline last week, which took it further away from its all-time high.

However, it appears that PIPPIN’s price is ready to reach another peak after the recent rebound. Here is why.

PIPPIN Surges Again

On the 4-hour chart, PIPPIN’s price printed six consecutive green candlesticks, driving the price higher and signaling a substantial short-term shift in momentum.

The memecoin now trades within an ascending parallel channel, suggesting that the recovery has developed into a more structured uptrend rather than a one-off bounce.

The move followed last week’s correction, where bulls successfully defended support near $0.33.

Longer-term support has also played a role.

As seen below, PIPPIN has held the $0.15 level for several weeks, providing a base that appears to have reinforced buyer confidence.

Likewise, several technical indicators support the bullish case. For example, the Bull Bear Power (BBP) has moved into positive territory.

Also, PIPPIN’s price has risen above the 20-period Exponential Moving Average (EMA), indicating a bullish trend.

While the technical setup reveals a bullish bias, resistance lies around $0.49. This is one zone that bulls need to clear before the memecoin can reach a new all-time high.

Short Squeeze Likely

Beyond spot price action, derivatives positioning also leans in a bullish direction. Santiment data shows that PIPPIN’s funding rate has remained negative, even as the price has pushed higher.

A negative funding rate typically indicates that short positions are paying longs, suggesting bearish positioning remains dominant in perpetual futures markets.

When price rallies against that bias, it often forces short sellers to cover, which can amplify upside momentum through short squeezes.

While funding alone is not a guarantee of continuation, the divergence between rising price and negative funding suggests the rally may still be climbing a “wall of worry,” rather than being driven purely by overcrowded long leverage.

PIPPIN Price Prediction: Higher

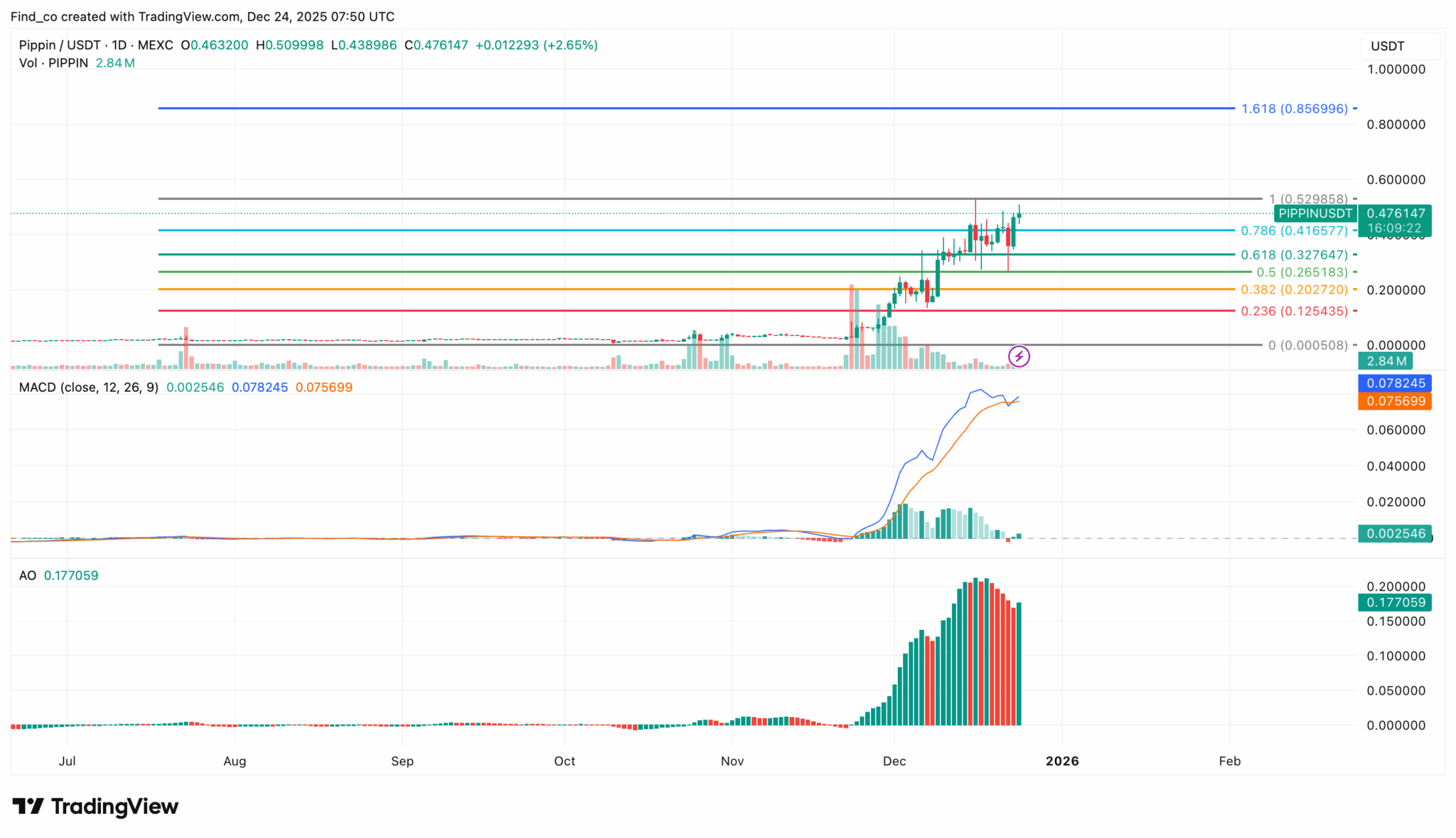

On the daily chart, momentum indicators have begun to align with the bullish case.

The Moving Average Convergence Divergence (MACD) has printed a bullish crossover, signaling a shift in trend strength.

The Awesome Oscillator (AO) remains in positive territory, reinforcing the bullish momentum.

If these signals hold and follow-through demand remains intact, PIPPIN’s price could extend gains toward the $0.53 level.

In a more aggressive bullish scenario, where momentum accelerates and liquidity remains supportive, the price could push as high as $0.86.

However, the outlook remains sensitive to a reversal in sentiment.

A resurgence in selling pressure could invalidate the bullish structure and drag PIPPIN back toward $0.33, which now serves as a key support zone to watch.