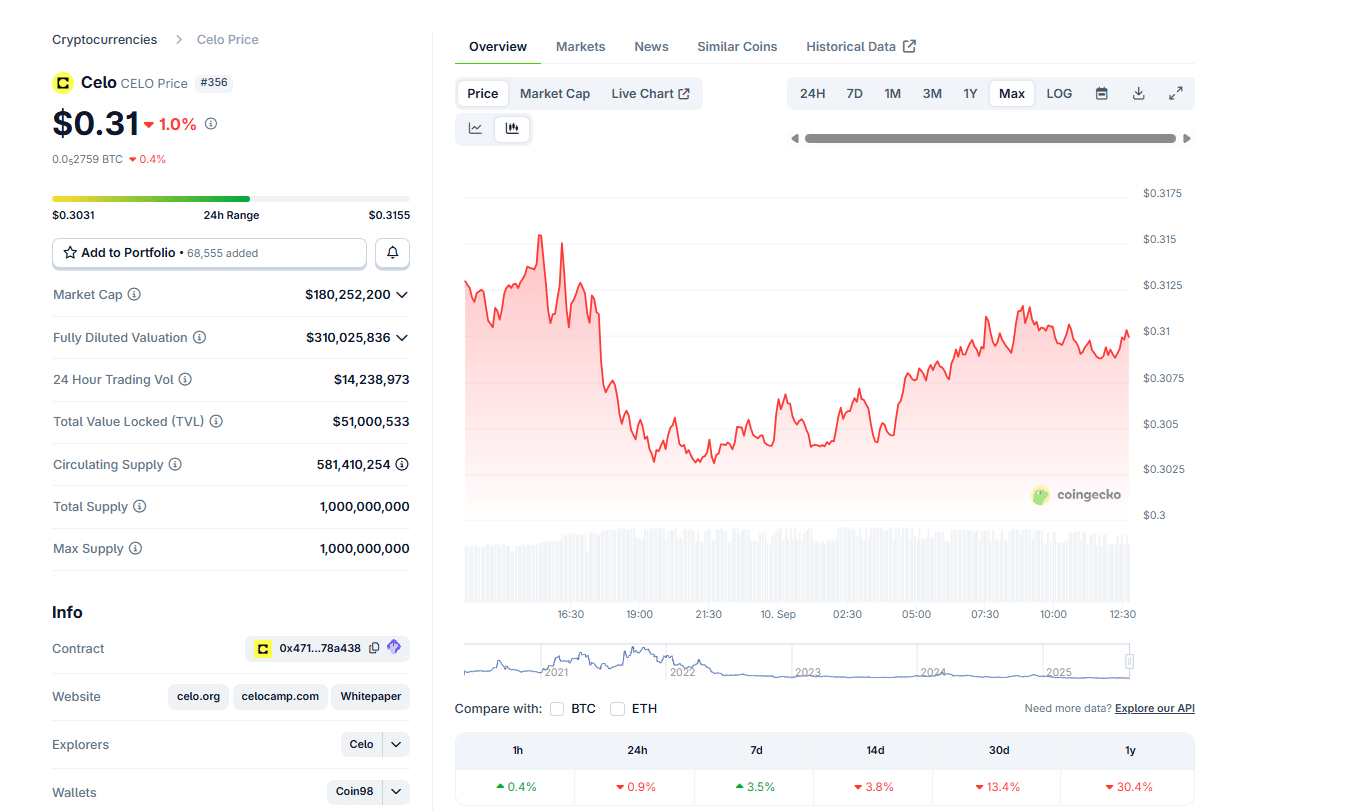

It has been a tough 2025 for CELO crypto. In June 2025, CELO USD fell to an all-time low, sinking below $0.25 as sellers pressed on. The good news is that the CEO price has been steadily printing refreshing higher highs, a reason why CELO is the best new crypto to consider. Since the CELO/USDT plunge, the CELO price has gained nearly 30%. Celo traders expect even more price gains now that there are hints of strength from the daily chart.

According to Coingecko, CELO crypto is down 30% year-to-date, and remains in the red in the last month of trading, shedding nearly 15%. However, in the past week of trading, CELO USD has been strengthening, rising nearly 4%. Still, it is a long way for CELO holders because the CELO price is down 97% from all-time highs last printed in August 2021.

(Source: Coingecko)

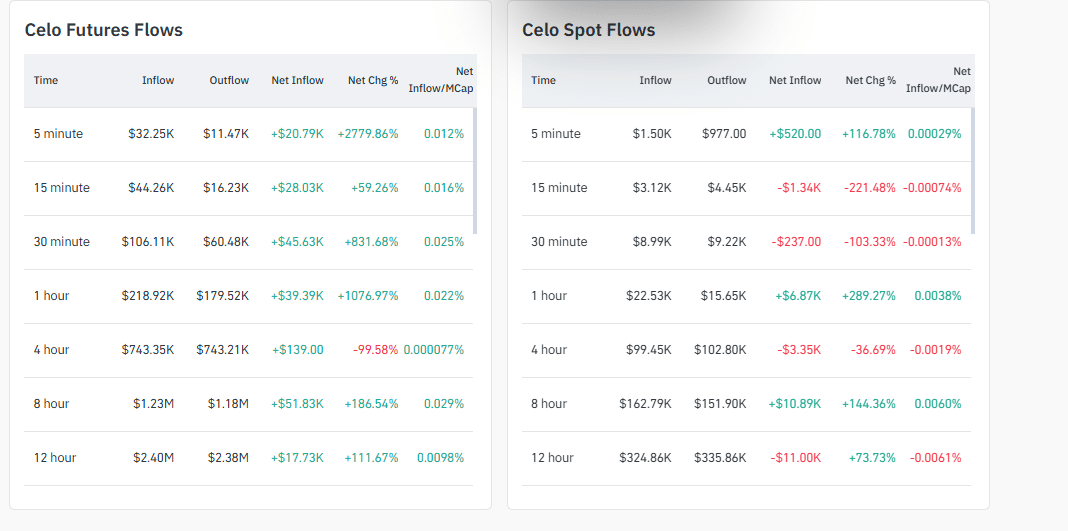

As CELO/USDT prints higher highs, reversing losses, momentum is building up. On Coinglass, traders appear to be positioning themselves for more gains. CELO futures flows are up by over $51,000 in the last eight hours, with steady net inflow in the last few hours of trading. As capital flows to the CELO futures market, speculators could drive the CELO price above key resistance levels, possibly triggering FOMO.

(Source: Coinglass)

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Is CELO The Best New Crypto? Will The CELO Ice Cream Upgrade Push Prices Higher?

If the CELO price is to fly, the coin must extend its gains of the past two days. A decent, high-volume close above $0.36 will trigger even more capital inflow, explaining why CELO is the best new crypto to consider in early September.

(Source: CELO USDT, TradingView)

In that event, CELO USD will even bid higher, possibly breaking $0.40 in a buy trend continuation formation, confirming gains of July 2025.

While Celo’s activities, including its mission of bridging the gap between traditional finance and the unbanked population via a mobile-first approach, help draw demand, analysts are closely monitoring the impact of the upcoming Ice Cream hard fork.

After transitioning to an Ethereum layer-2 in March 2025, attracting top DeFi platforms like Aave, CELO developers are preparing for the Ice Cream hard fork, scheduled for September 10.

This update combines the Isthmus hard fork, aligning CELO with Ethereum’s Pectra upgrade and Holocene components, paving the way for EigenDA v2 integration via Blazar.

The CELO Ice Cream upgrade enhances Ethereum layer-2 compatibility, improves tool deployment, and simplifies gas fee management with Holocene activation. Beyond this, the hard fork makes CELO more stable and scalable.

Ahead of the hard fork, node operators must update to compatible releases for the mainnet and supported testnets, including Baklava.

DISCOVER: 20+ Next Crypto to Explode in 2025

Attention Shifts To Bitcoin Hyper: Nearly $15M Raised

In the race for layer-2 dominance, Bitcoin Hyper is gaining traction.

While CELO operates as an Ethereum layer-2, Bitcoin Hyper is building a layer-2 for Bitcoin, combining Bitcoin mainnet security with Solana’s low-fee, high-scalability model.

Bitcoin Hyper developers are launching a secure, private Canonical bridge linking the Bitcoin mainnet to its layer-2. This bridge allows BTC holders to transfer assets and earn higher yields in a low-fee environment.

All Bitcoin Hyper smart contracts have been audited by Coinsult and SpyWolf.

So far, nearly $15M has been raised, with each HYPER token trading at $0.012885.

HYPER presale investors can stake for a 75% APY, earning passive income.