Key Takeaways

Plume is a modular L2 platform built on RWA-friendly EVM-compatible chain, focused on RWAfi, aiming to simplify asset tokenization.

The platform uses native infrastructure and RWAfi-focused functionalities that are unified across the entire Plume ecosystem.

Plume enables the use of tokenized assets like private credit, ETFs, and commodities within the DeFi ecosystem.

Plume’s native support framework includes $PLUME, $USDPLUME, and a fast-growing DeFi infrastructure.

As the world of blockchain technology evolves, there will always be new protocols and applications emerging. The desire to integrate real-world assets (RWAs) onto blockchain has experienced a lot of interest lately.

Plume network emerges as the go-to protocol in this area. But what is Plume network? This guide explains what it is, how it functions, and its place within the blockchain ecosystem.

What is Plume Network?

Plume is a full-stack Layer 1 blockchain specifically designed for the Real World Asset Finance (RWAfi) segment. The platform is designed to support an ecosystem full of applications, DeFi protocols, asset issuers, and platforms. It also integrates DeFi initiative primitives with a modular asset of onboarding schools.

Rather than force RWAs to adapt to existing systems, Plume creates systems around existing needs while maintaining composability and openness. According to the Plume website, its mission is to create a bridge between crypto and traditional finance via demand-driven adoption. The platform facilitates this without sacrificing user experience, transparency, and openness.

Plume addresses the challenges associated with the RWA space by introducing interoperability with other blockchains and facilitating cross-chain transfers. The project also prioritizes safeguarding tokenized assets via robust on-chain compliance mechanisms and custody solutions. Also, the project promotes a permissionless blockchain that encourages transparency and decentralization in the RWA lifecycle.

How Does Plume Work?

The Plume network allows users to take advantage of a streamlined process to bring their real-world assets online. The platform uses a compliance verification method to conduct regulatory and anti-money laundering checks that are relevant to each asset type. The platform operates via a vertically integrated infrastructure that streamlines the process of tokenization and the use of real-world assets on-chain.

Plume introduces an optimized verification process that gives RWA owners the certainty that their assets comply with relevant regulations. The platform utilizes continuous monitoring to identify suspicious activities within the RWA framework to protect the system and its users. Here are what makes Plume stand out:

Full-Stack Tools: There are advanced tools like Nexus and Plume Arc that streamline the process of onboarding real-world assets on-chain.

EVM Compatibility: EVM compatibility facilitates seamless integration with existing DeFi platforms, thereby increasing the network’s reach and usability.

Composable Ecosystem: The platform promotes composability of RWAs, enabling assets to interact with DeFi applications and introducing innovative financial products.

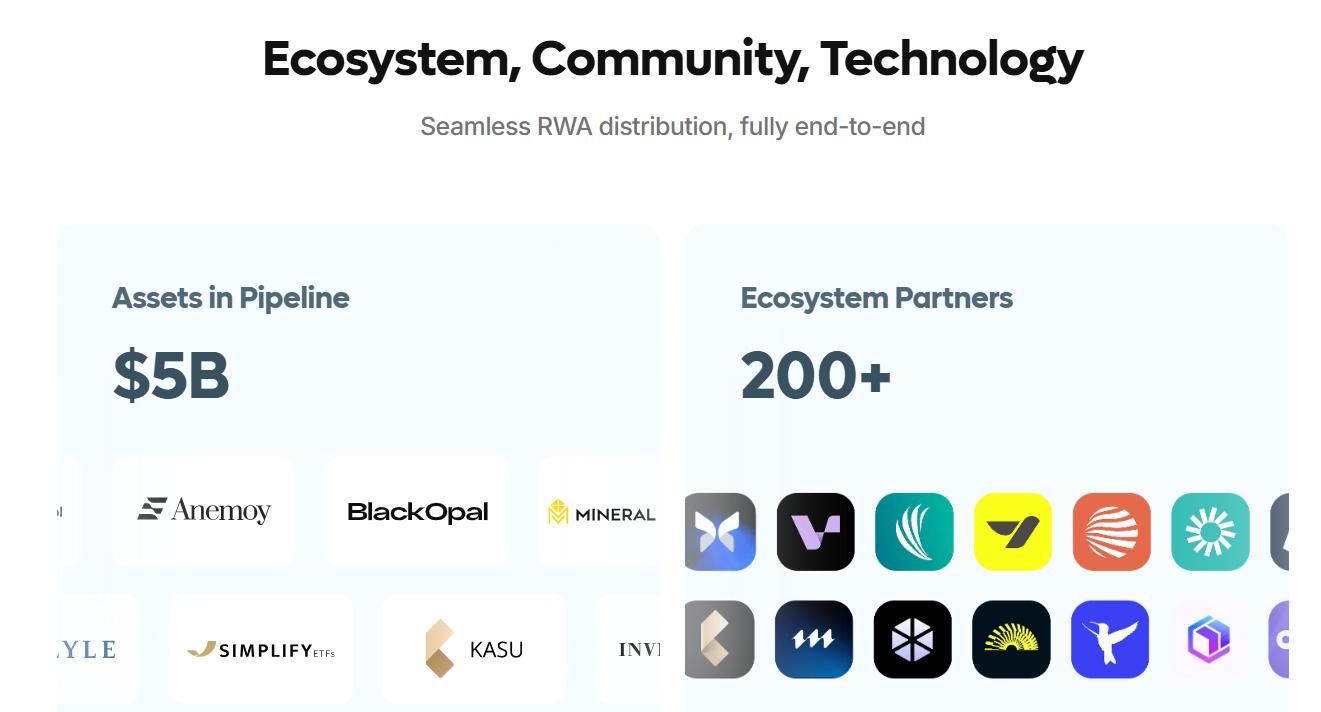

Community Engagement: During the testnet, 3.75 million users executed over 256 million transactions within two months, highlighting the existing demand.

The Plume Company has partnered with several liquidity providers to enable asset owners to use their RWAs immediately. These partnerships with liquidity providers have enabled Plume Network to leverage RWAs for lending, staking, and associated yield-generating activities.

Key Features of Plume Network

The Plume network introduces several innovative features that make it stand out in the blockchain space. They include the following:

Real-World Asset (RWA) Tokenization: Plume crypto project facilitates the tokenization of real-world assets like commodities, real estate, and financial instruments. This enables increased liquidity, fractional ownership, and broader accessibility to assets.

Modular EVM Layer-2 Architecture: The platform uses an EVM-compatible environment that facilitates efficiency and scalability. This architecture promotes seamless integration of assets, besides promoting efficiency and scalability.

Scalability and Performance: Plume Network uses a consensus mechanism that facilitates high throughput and fast transaction processing. This enables the protocol to handle many users and transactions, making it ideal for real-world applications.

Enhanced Security: By using advanced security protocols and multi-layered encryption, Plume safeguards user assets. The platform also uses on-chain compliance mechanisms like KYC/AML verification to ensure regulatory compliance and secure transactions.

Developer Support and Ecosystem: The network provides tools and resources developers need to create and deploy decentralized applications (DApps). This creates an ecosystem where assets can interact across different DeFi applications.

Eco-Friendly Design: Plume chain uses the proof-of-stake consensus mechanism, which means it uses less energy compared to proof-of-work blockchains.

Plume USD: Plume crypto project has a native stablecoin, Plume USD (pUSD), which facilitates secure transactions and payments within the ecosystem.

What is the $PLUME Token?

PLUME ($PLUME) is the native token of the entire Plume crypto project. Since it’s the network’s core utility token, $PLUME fuels all activity within the chain besides aligning incentives between builders, users, and the Plume Chain. The token is designed to facilitate several functions within the Plume ecosystem, including the following:

Gas Fees: $PLUME acts as the primary payment method for all transactions within the network.

Governance: Holders of $Plume Token have governance rights allowing them to vote for key protocol decisions.

Staking: Users and validators can stake their $PLUME to secure the network and earn passive income.

Liquidity Provision: The $PLUME token supports liquidity across the entire Plume ecosystem, thereby enhancing usage.

PLUME Tokenomics

The $PLUME token operates as a deflationary cryptocurrency with its maximum circulation capped at 10 billion tokens. The project released 20% of the total supply, 2 billion tokens, at the launch. The key aspects of the $PLUME token include the following:

Maximum Supply: 10 billion $PLUME tokens.

Initial Circulation: 20% or 2 billion tokens available at the Token Generation Event (TGE).

Token Allocation Breakdown

Community and ecosystem growth (59%): includes incentives, grants, and validator rewards.

Early backers (21%): includes institutional investors and strategic partners.

Core contributors (20%): reserved for individuals playing crucial roles in building the network.

Plume (PLUME) is Now Listed on Binance

Cryptocurrency exchange Binance announced adding the $PLUME token to its spot trading platform on August 18, 2025. The token kicked off trading against pairs like USDC, USDT, TRY, FDUSD, and Binance’s BNB Coin.

According to the announcement by Binance, the listing comes hot on the heels of a HODLer airdrop. Eligible BNB holders received at least 150 million PLUME tokens during the airdrop covering balances from July 24 to July 27, 2024. The statement further indicated the exchange would release its research report on Plume within the next two days.

Plume Technology: Core Products

The Plume blockchain network provides a tokenization engine for traditional finance instruments to enable tokenizing and trading real-world assets. To enable this, the project hosts an EVM-compatible environment for trading these assets using the following core products:

Plume Chain

The Plume Chain is the project’s full-stack Layer 1 blockchain that brings real-world assets on-chain. The project uses a two-tiered consensus mechanism dubbed Proof of Representation that facilitates the process. By creating an EVM-compatible environment, Plume Chain enables the trading and tokenization of different RWAs. This may include assets like renewable energy funding, private credit funds, and mineral rights. The unique two-tiered consensus mechanism leverages existing Ethereum infrastructure and tools to secure the network and validate transactions.