Midnight (NIGHT) trades near $0.088, down about 7% today. It still holds weekly gains near 18%, but the short-term picture has changed.

A bearish structure has formed on the chart, and buyers are struggling to defend a support that only held because of a sharp, last-second reaction. Midnight price barely avoided a breakdown. The risk is that it was saved, not defeated.

The question now is simple: Was it just a scare, or is it fate delayed?

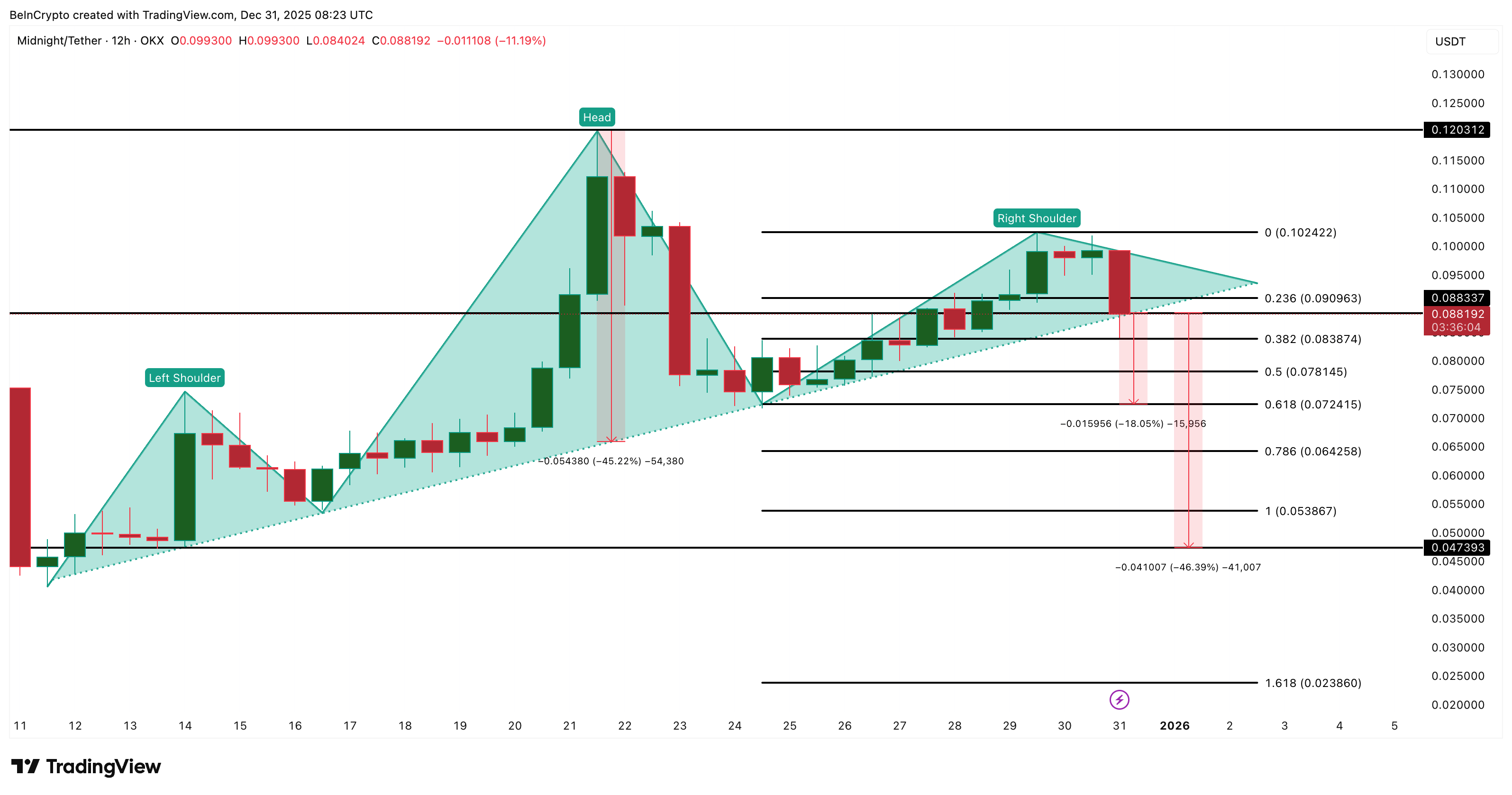

Head And Shoulders Meets Fragile Support

A head and shoulders pattern has formed on the 12-hour chart with an upward-sloping neckline. If confirmed, the technical projection points to roughly a 45% drop from current prices. NIGHT already slipped under the neckline near $0.088 before buyers forced a bounce. That bounce prevented an instant continuation lower and looked more like a rescue than a reversal.

Note: The neckline slopes upward, which means buyers are still forcing higher lows even as the topping structure forms. This often makes the pattern slower to break, but a confirmed breakdown is usually more violent because it traps late buyers.

Chaikin Money Flow (CMF), which measures large capital flow using volume-weighted pressure, does not support the rescue. CMF has broken its rising trendline and is aggressively heading toward the zero line.

Price Faces Capital Weakness: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That break creates a clear bearish divergence: between December 24 and December 31, the price pushed higher while CMF kept falling. It implies larger wallets may be exiting during a price rise, which is usually a warning that support is not organic.

If CMF drops under zero, the neckline becomes exposed again. Retail interest and small spot buying may not be enough to absorb the pressure.

Spot Flows Save The Day, But Not Midnight Price Trend

A sharp shift in spot flows explains why the Midnight price did not collapse the moment it breached support. On December 30, about $1.37 million in NIGHT moved onto exchanges, which likely triggered the drop alongside the CMF dip. But by early December 31, that flipped.

Roughly $2.02 million moved off exchanges in the next 12 hours, signaling buyers stepping in and forcing the price back above $0.088.

Late Buyers Trying To Defend: Coinglass

This behavior validates the defense. Buyers are present and are using this level as an entry. That buying is the core reason the 45% projection hasn’t been activated yet.

It also means the level still matters. If buying continues, $0.088 can serve as a reset point, creating room for a move back toward $0.090 and $0.102.

Clearing $0.102 pressures the right shoulder and improves the chance of retesting higher levels. A move above $0.120 (would be a new NIGHT peak) could invalidate the bearish pattern.

Midnight Price Analysis: TradingView

But the defense is not convincing. CMF weakness means the support relies on short-term effort, not long-term confidence. If $0.088 fails again, the breakdown revives instantly. And that could even trap the spot buyers trying to grab the NIGHT price dips.

The first major target sits near $0.072, where the Fibonacci 0.618 support holds. A failure there opens $0.053. A deeper move toward $0.047 (a strong support) that also aligns almost perfectly with the pattern’s 45% technical projection.

The entire chart now rests on one line. If buyers keep it above $0.088, a recovery can start. If they lose it, the projection takes control.