The crypto market this year experienced a notable divergence in terms of volatility across different asset classes. For instance, trading XRP and SOL has been twice as volatile as trading BTC over the past 12 months, indicating a lack of maturity in those altcoins and reinforcing the perceived dominance of BTC across the cryptocurrency landscape.

Data tracked on-chain revealed today that XRP and SOL experienced volatility of 80% and 87%, respectively, compared to 43% for BTC. Other altcoins, including Ether and BNB, recorded increases of 76% and 51%, respectively. This trend quashed the hopes that altcoins could surpass BTC’s dominance in 2025 and extend its perceived lead across the crypto landscape.

Altcoins need deeper liquidity to achieve stability

So far, billions have been pumped into SOL and XRP ETFs and CME futures, from which these major cryptocurrencies benefit in terms of liquidity. Except for BNB, other major altcoins, including XRP, SOL, and ETH, have established ETFs with billions in net assets.

For instance, the XRP ETF has received a net inflow of approximately $1.16 billion since its launch, while the SOL ETF has attracted roughly $763 million, based on data provided by SoSoValue.

If demand remains strong across altcoins in 2026, XRP, SOL, and ETH, alongside other altcoins, could help mitigate current price volatility and achieve the stability exhibited by BTC.

The current volatility exhibited by altcoins suggests a persistent difficulty for these tokens in achieving stability. The trend in BTC volatility, especially after the launch of U.S. spot Bitcoin ETFs in 2024, has been declining, underscoring the need for deeper liquidity in altcoins too. These suggest that alternative investment vehicles tied to XRP, SOL, and other altcoins may provide deeper liquidity, enabling the stability achieved in Bitcoin.

Bitcoin ETFs were introduced in January 2024, attracting multiple ETPs, including IBIT, which has attracted the majority of investor money, amassing $62.19 billion since its launch. GBTC, on the other hand, has recorded a negative flow, seeing approximately $25 billion withdrawn since its launch.

BTC ETFs so far have a cumulative total net inflow of $56.96 billion, according to SoSoValue. The surge in inflows has prompted several products, including covered calls on those ETFs. The strong demand has led to a steady decline in volatility in BTC this year.

Meanwhile, Ethereum ETFs, which launched in mid-2024, have exhibited a similar trend, attracting approximately $12.4 billion of investor capital since their launch. BlackRock’s ETHA has attracted roughly $12.59 billion of investor money, while Grayscale’s ETHE has recorded the worst performance, losing approximately $5.05 billion to withdrawals since its launch. We could say the same for ETH ETFs as BTC, which has seen a decline in volatility to the current 76%.

L1 tokens end the year with a negative or negligible return

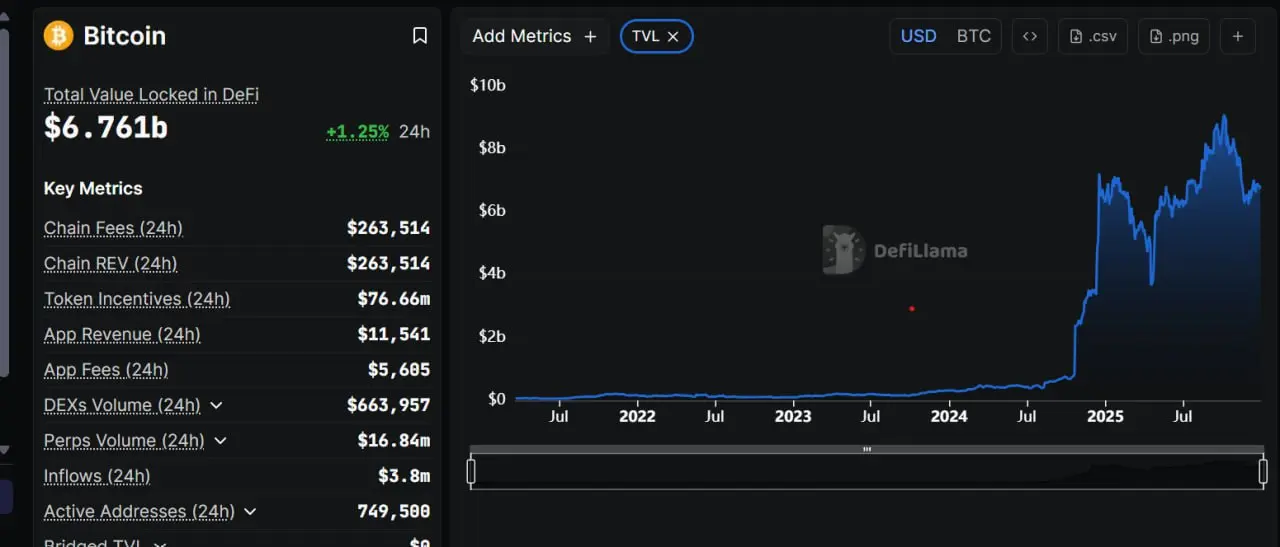

L1 tokens recorded the worst performance this year, resulting in zero or negative returns despite several key advancements across the networks. For instance, the Total Value Locked value for BTC has grown to $6.7 billion as of today, compared to an average of $760 million prior to October 2024.

The same can be said for Ethereum, Solana, and Base networks, which have exhibited a gradual increase in growth since 2021, demonstrating structural maturity across the cryptocurrency landscape.

Despite reaching these significant steps in terms of maturity, returns exhibited this year have been very low across different blockchains. Based on on-chain data, the Bitcoin blockchain recorded a -6.76% return, alongside -12.94% for Ethereum and -11.48% for XRP. BNB has shown a positive return rate of 20.64% over the past 365 days.

If you're reading this, you’re already ahead. Stay there with our newsletter.