Solana price prediction models are flattening as 2025 ends, raising concerns about short-term upside. While Solana continues to dominate headlines due to its ecosystem and recent ETF approvals, the actual price projections from top platforms point to a stagnating year.

With both technical indicators and sentiment metrics turning cautious, many investors are reconsidering exposure. One project gaining rapid attention as an alternative is Bitcoin Hyper, now in the final stage of its presale, with a price jump imminent and momentum building across retail channels.

Solana Forecasts Show Weak Upside Across All Scenarios

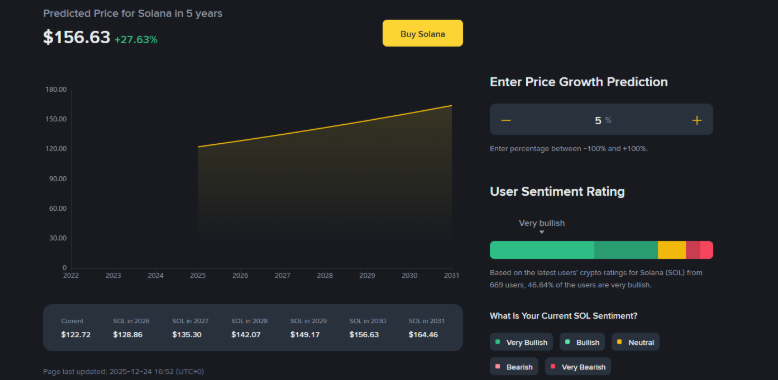

According to data published by Finst.com, the Solana price prediction for 2025 going into 2026 is underwhelming across the board. In a neutral scenario, the platform expects Solana to trade at €106.18 by the end of the year, which is a 0.11% drop from its current price.

Even in a so-called bullish scenario, the forecast only rises to €106.21, or a 0.09% decrease. The bearish model drops slightly further to €106.11, representing a 0.18% decline. These marginal differences indicate no meaningful directional conviction and signal a sideways year unless major catalysts emerge.

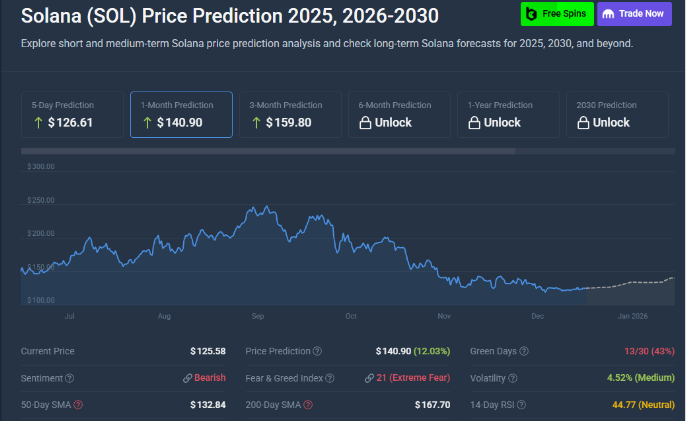

CoinCodex offers a more optimistic short-term prediction but still within restrained bounds. Based on technical indicators, the platform forecasts a rise to $140.90 by January 30, 2026 – a gain of just 12.03%. Yet the sentiment data paints a bleaker picture.

The Fear & Greed Index sits at 21, which is classified as Extreme Fear, while the 14-day RSI reads 44.77, falling squarely in the neutral zone. Despite the modest price target, these metrics confirm that broader market confidence in Solana is low heading into Q1 2025.

Momentum Cools as Solana Hits Critical Resistance

On-chain and technical analysis from MEXC confirms that Solana recently rebounded over 150% from its 2025 low of $95.31. However, the token now sits just below its critical $250 resistance.

The parabolic trendline from April has carried the asset through its summer recovery, but recent daily candles suggest fading momentum. While the MACD remains positive and the RSI has crossed above 50, analysts warn that Solana’s current setup lacks the volume required for a sustained breakout.

Even with the FireDancer upgrade and Solana ETFs bringing $351 million in institutional inflows, the impact on near-term price action has been minimal. Long-term projections from MEXC analysts range from $500 to $1,000 by 2030 in conservative models, and up to $3,211 in highly bullish cases.

But these scenarios depend on years of ecosystem expansion and uninterrupted scalability. In contrast, traders looking for short-term growth are increasingly rotating out of SOL and into emerging microcaps with lower market caps and higher velocity.

Solana Struggles to Justify Accumulation While Hyper Heats Up

Retail sentiment for Solana is at a crossroads. The fundamentals remain strong, the ecosystem is growing, but price behavior is not responding. That disconnect is leading many to reallocate into smaller projects with accelerated price mechanics.

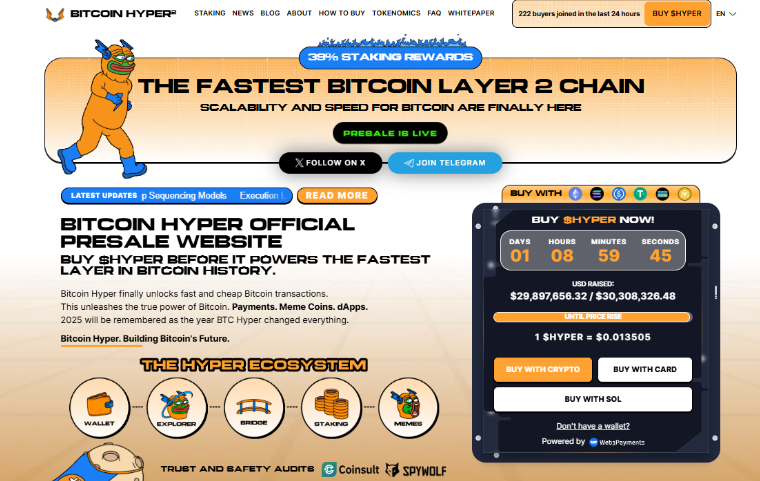

Bitcoin Hyper, now approaching its final $30.3M milestone, has become a top altcoin for those seeking early-stage exposure with a high-volume funnel and clear roadmap.

As January trading picks up and price volatility returns, Solana’s predictions may improve, but for now, the data is clear. Momentum is elsewhere. And in crypto, timing is everything.

Bitcoin Hyper Gains Trader Attention as Price Surge Nears

While the Solana price prediction remains muted, traders are shifting their focus to Bitcoin Hyper, a fast-moving presale token that has already raised over $29.9 million. The token currently trades at $0.013505, and only around $400,000 remains before the next automatic price rise.

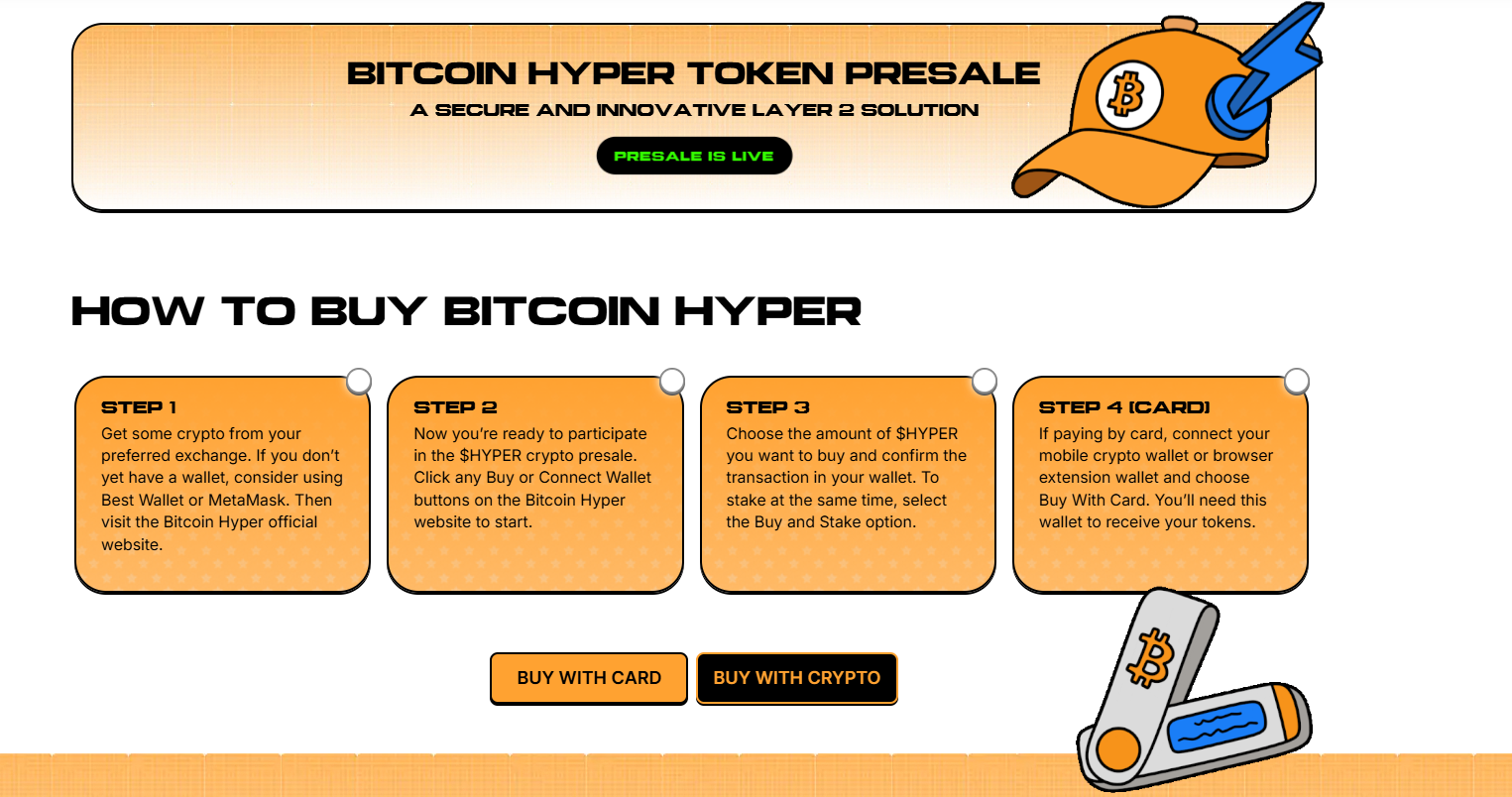

With the final presale stage nearly full, the urgency is growing. Bitcoin Hyper allows purchases via ETH, USDT, BNB, and even SOL. This is a symbolic shift that some traders interpret as capital rotation away from the large-cap chains into presale speculation.

What’s driving this shift is simple: Bitcoin Hyper offers a price movement structure that favors early entries, with transparent tokenomics and a strong narrative centered around reimagining Bitcoin’s execution layer. Traders see a clean funnel, timed scarcity, and marketing alignment.

With Solana facing resistance and predictions pointing sideways, Bitcoin Hyper provides a clearer short-term upside story.