Ethereum price prediction is holding strong despite steady selling pressure in the crypto market. The second-largest cryptocurrency has failed to close strongly above $3,000, but has held the $2,900 support firmly.

At the time of writing, Ethereum was trading at approximately $2,974, up 1.95% over the past 24 hours. However, the altcoin is still trading down 40% from its August all-time high of $4,950.

Tom Lee, chairman of digital asset treasury firm Bitmine, explained the reason for this sluggish performance, noting, “Market activity tends to slow as we enter the final holiday weeks of a calendar year.” Fundamentals have also improved slightly as staking inflows have turned positive after six months despite wobbly ETF flows and high volatility in price.

Update:

ETH validator entry queue is now bigger than the exit queue, for the first time in six months

The last time this happened in June, ETH doubled in price shortly after

2026 going to be a movie https://t.co/GWMCjxfigo pic.twitter.com/3dMttYpB4B

— Abdul (@0x_Abdul) December 28, 2025

Another standout project attracting attention this week is Bitcoin Hyper, a Bitcoin-backed presale approaching the $30 million milestone. As the broader crypto market ranges sideways and volatility rises, savvy investors are shifting their focus to high-upside potential presales like Bitcoin Hyper.

Staking Turnaround As Ethereum Sees 745K ETH Staked

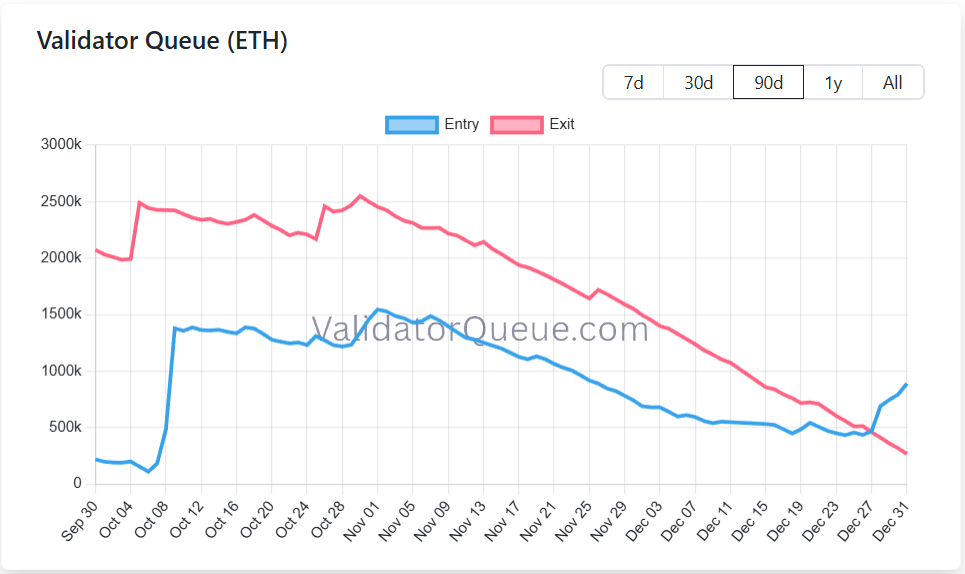

Ethereum is showing early signs of renewed strength after months of dull price action. For the first time in six months, staking activity has shifted into positive territory, with far more ETH being committed than withdrawn. More than 890,000 ETH is currently waiting to enter staking, while only about 267,000 ETH is lined up to exit. This has shifted Ethereum price prediction to bullish.

Source: Validatorqueue

This gap shows an apparent change in behavior. More than three times as much Ether is moving toward staking as is withdrawing, pointing to rising confidence among holders. Instead of keeping ETH ready to trade, many are choosing to lock it up for rewards.

When stakeholder queues grow, it usually reflects a long-term mindset. Validators are signaling that they expect value over time, not quick exits. At the same time, smaller exit queues reduce the risk of sudden selling pressure. Together, these trends suggest that the supply of freely tradable ETH is shrinking, which could support stronger market conditions ahead.

Head of DeFi at Monad recently noted, “ETH validator entry queue is now bigger than the exit queue, for the first time in six months.” The analyst pointed out that this happened last time in June, and the Ethereum price doubled shortly after. He optimistically added, “2026 going to be in a movie.”

Ethereum Price Prediction Eyes $3,000 Psychological Level

In the last two weeks, ETH has attempted to regain the $3,000 mark several times but has failed as bearish pressure continues to dominate. Analysts believe that reaching the psychological level could spark a fresh bullish momentum in the price.

The 20-day Exponential Moving Average (EMA) has been acting as a steady barrier to the price achieving the target. The technical chart shows an ascending triangle pattern with a breakout neckline around $3,000.

Ethereum Price Chart. Image Courtesy: TradingView

A decisive breakout accompanied by substantial volume could see Ethereum’s price flip the local resistance levels, including the 50-day EMA, and test higher resistance around $3,400-$3,500. However, the failure to hold the current support level could lead to a drop towards the $2,800 and $2,500 support levels.

The Relative Strength Index (RSI) is testing its neutral level with a rising trend. This forming bullish momentum in established tokens has intensified the search for the next top gainer in the crypto market.

Bitcoin Hyper Near $30 Million, Accumulation Skyrockets

As the Ethereum price prediction shows recovery in the coming days, Bitcoin Hyper is already seeing growing demand in its presale. The project has raised $29.94 million in its ongoing presale, and the $30 million milestone is just a few hours away. This milestone could make Bitcoin Hyper the best crypto presale of 2026 and could trigger a sharp price surge.

Bitcoin has already earned its place as a store of value. What it hasn’t proven yet is speed. Limited throughput remains Bitcoin’s most significant constraint, and that’s precisely the problem Bitcoin Hyper is built to fix.

Bitcoin’s base layer stays focused on final settlement, while a separate execution layer handles fast activity. Users lock their BTC into a secure, native contract, and a wrapped version of Bitcoin is created on the Hyper network. This network runs on the Solana Virtual Machine, delivering high performance: transactions confirm in under a second and cost almost nothing.

To keep everything secure, Hyper groups transactions together and verifies them using zero-knowledge proofs before recording the final result on the Bitcoin blockchain. This approach delivers scale without weakening Bitcoin’s security model. The same bridge also lets users move their wrapped BTC freely within Hyper’s ecosystem, whether for DeFi, NFTs, or other on-chain use cases, and then return it to Bitcoin just as easily.

Currently, each HYPER token is priced at just $0.013505; however, analysts predict the crypto could reach $0.2-$0.3 after its exchange listing.