A prominent XRP commentator is pushing back on a familiar critique of Ripple’s business model, arguing that skeptics have the causality backwards when they claim the company sells XRP merely to amass traditional assets. In a post on X on Wednesday, CryptoInsightUK founder Will Taylor said the “haters” are “so close to being right,” but miss what he framed as the single step that changes the entire equation.

What ‘Haters’ Get Wrong About XRP

Taylor’s central claim is that Ripple’s token sales are not designed to swap out a volatile crypto asset for safer, conventional holdings. Instead, he described the sales as a means of funding infrastructure and integrations that ultimately increase the token’s long-term utility and value.

“Haters say Ripple sell XRP so they can buy real-world companies and assets, because that’s how Ripple ‘makes money’,” Taylor wrote. “In my opinion, that completely misunderstands the business model and more importantly, the direction of causality. Yes, Ripple monetises some XRP. But not to replace XRP with traditional assets.”

In Taylor’s telling, the misunderstanding starts with treating XRP like operating cash rather than a strategic, asymmetric asset. He argued that a large holder of an asset with outsized upside potential would not logically liquidate it simply to “stack normal companies,” especially if that asset could become worth more than the firm’s balance sheet at scale.

“If you hold roughly 40% of an asset that, at scale, could be worth more than your entire balance sheet, you don’t treat it like operating cash,” he wrote. “You don’t say: ‘Let’s sell the most asymmetric asset we own just to stack normal companies.’ That would be insane.”

From there, Taylor reframed Ripple’s acquisitions, integrations, and buildout efforts not as a pivot away from XRP but as “multipliers” that increase the odds XRP becomes a viable global settlement instrument. Traditional assets, he argued, are inputs to expand distribution, compliance, and liquidity: conditions that would make a bridge asset more useful at institutional scale.

“When Ripple acquires or integrates with firms like Hidden Road, stablecoin infrastructure, or tokenised treasury rails, those assets are not the end goal,” Taylor wrote. “They are multipliers. Those companies are not replacing XRP. They are building the pipes that require XRP to function efficiently.”

Taylor positioned this as a flywheel: XRP sits at the “strategic core” on the balance sheet, Ripple builds a full stack around payments and liquidity, institutions adopt because the rails are complete, and the token becomes a neutral settlement layer whose demand compounds over time. Under that framework, he said, short-term monetization is better understood as capital deployment in service of a long-term network effect rather than straightforward dilution.

“That’s not dilution. That’s capital deployment,” Taylor wrote, adding that if Ripple simply wanted to be “a profitable TradFi-style company,” it would not “obsess over neutral settlement,” keep XRP “architecturally central,” or push it into “regulated institutional rails.”

The distinction matters because it changes how observers interpret Ripple’s incentives. In Taylor’s model, the objective is not to sell the token in order to accumulate off-chain assets; it is to use off-chain assets—licenses, liquidity venues, compliance infrastructure, and institutional integrations—to increase XRP’s necessity as a settlement tool.

“The endgame is not: ‘Sell XRP to buy assets,’” he wrote. “The endgame is: ‘Use assets to make XRP unavoidable.’”

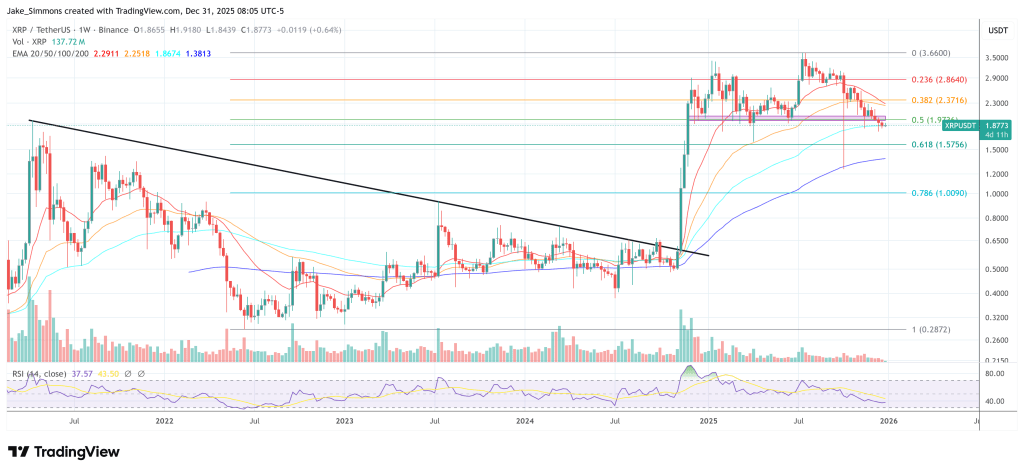

At press time, XRP traded at $1.8773.