Bitcoin hovers above $87,000, marking a bearish close to 2025 with a 6% decline.

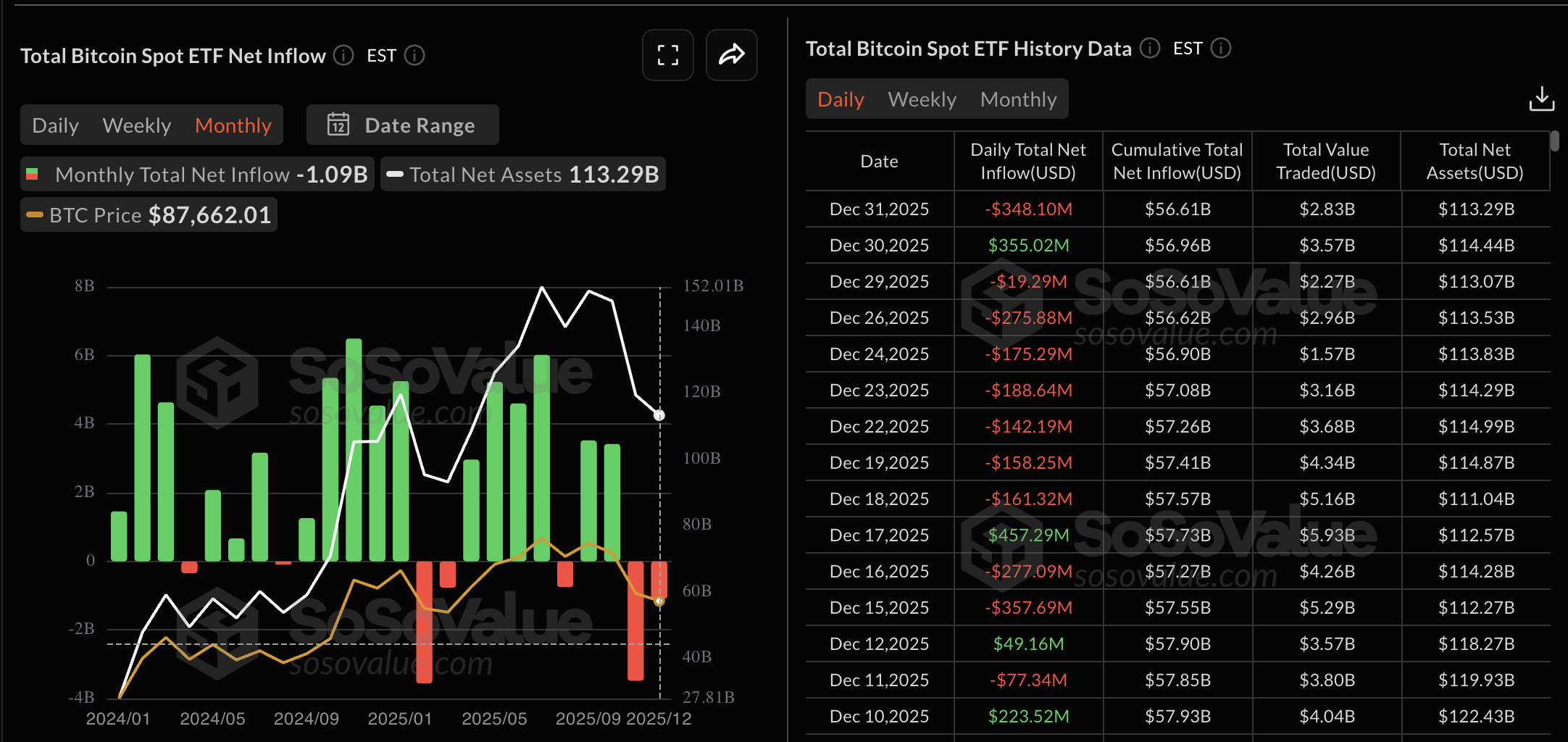

US spot BTC ETFs end the year with a $348 million outflow on Wednesday, while the annual inflow was over $21 trillion.

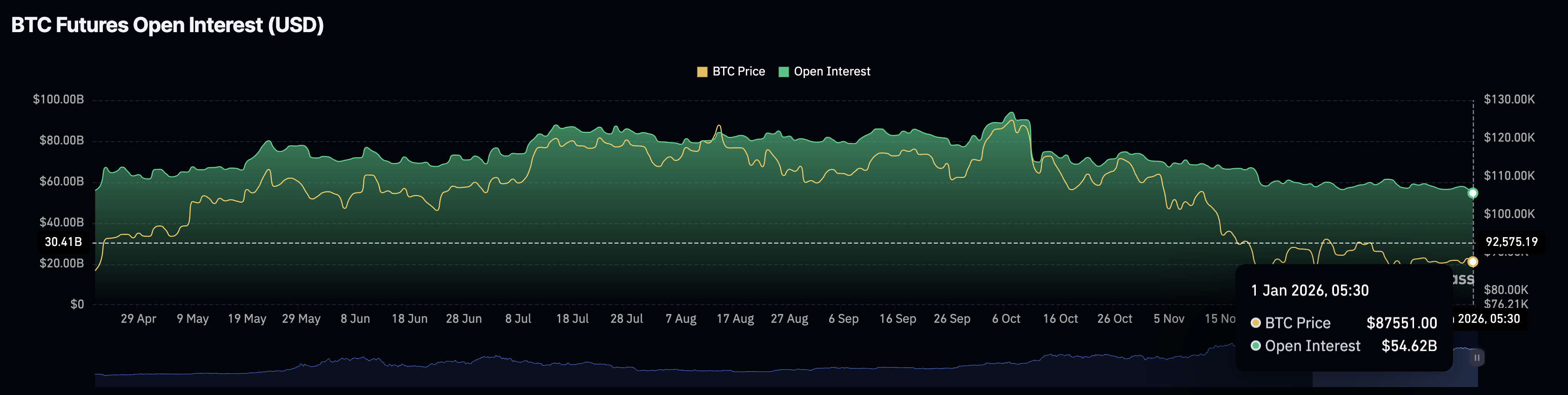

Derivatives data shows a decline in Open Interest, suggesting risk-off sentiment among traders.

Bitcoin (BTC) price hovers above $87,000 a press time on Thursday, holding steady after a 1% drop on the previous day. Institutional interest weakened by the end of last year, while corporate demand continues to accumulate. Derivatives data suggest a weakness in retail interest as BTC futures Open Interest declines.

Bitcoin starts the New Year with reduced demand

Bitcoin-focused Exchange Traded Funds (ETFs) in the US recorded an outflow of $348 million on Wednesday, nearly erasing the $355 million of inflow on the previous day. These ETFs recorded an outflow of $1.09 billion, advancing the withdrawal streak after $3.48 billion was offloaded in November.

Additionally, this marked the fifth bearish month last year, while the annual inflow stood at $21.07 trillion.

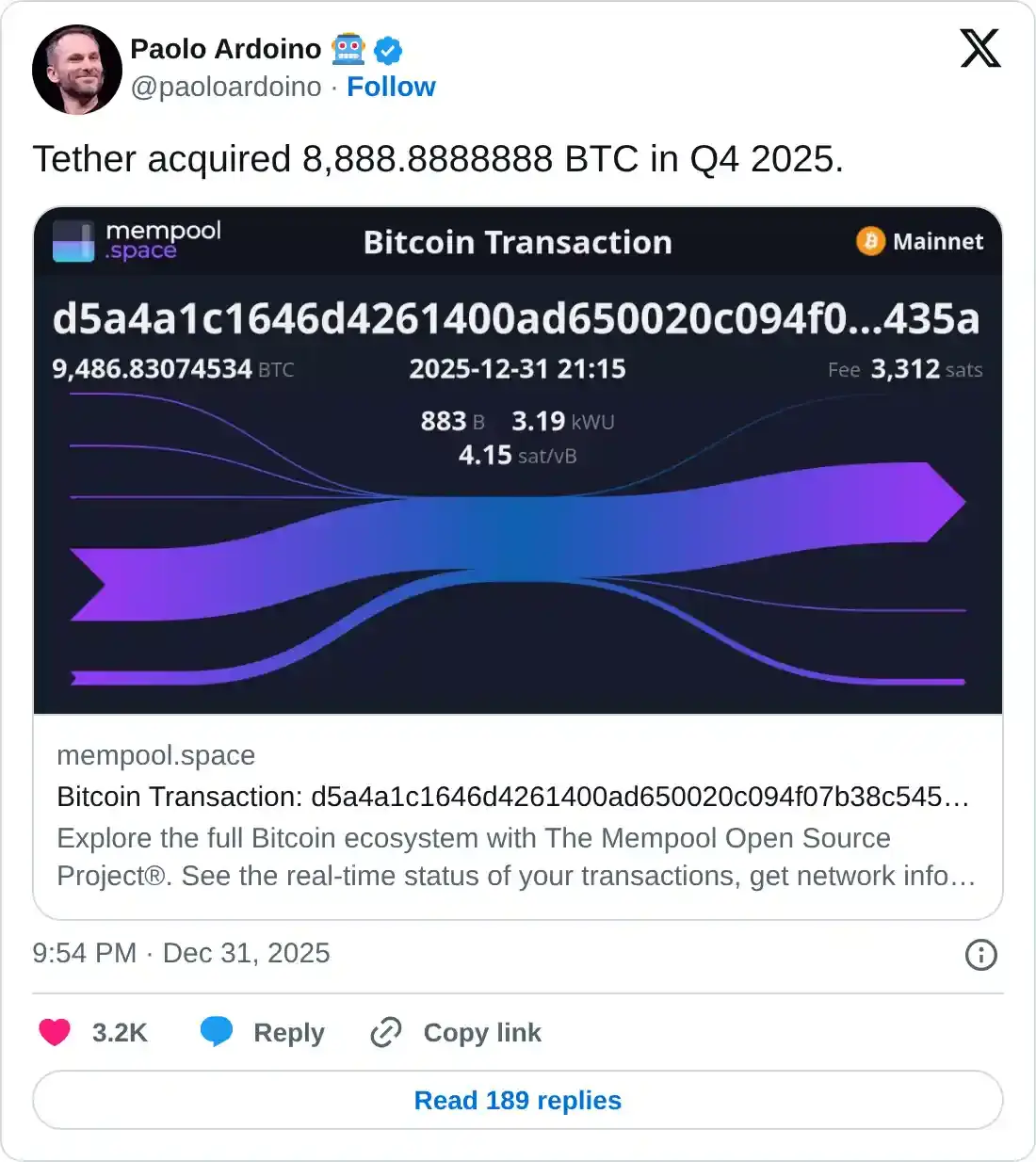

On the corporate side, Tether, a US Dollar-stablecoin issuer, announced acquiring 8,888 BTC over the past three months. Tether’s move alongside Michael Saylor’s Strategy and Metaplanet boosted their holdings to 672,497 BTC and 35,102 BTC, respectively, which reflects an increase in corporate demand.

However, short-term volatility in Bitcoin has led to a decline in retail risk exposure in its derivatives market. CoinGlass data shows a decrease in BTC futures Open Interest (OI) to $54.62 billion on Thursday, from $94.12 billion on October 7. Typically, a decline in OI indicates that traders are either closing positions or reducing leverage, signaling risk-off sentiment.

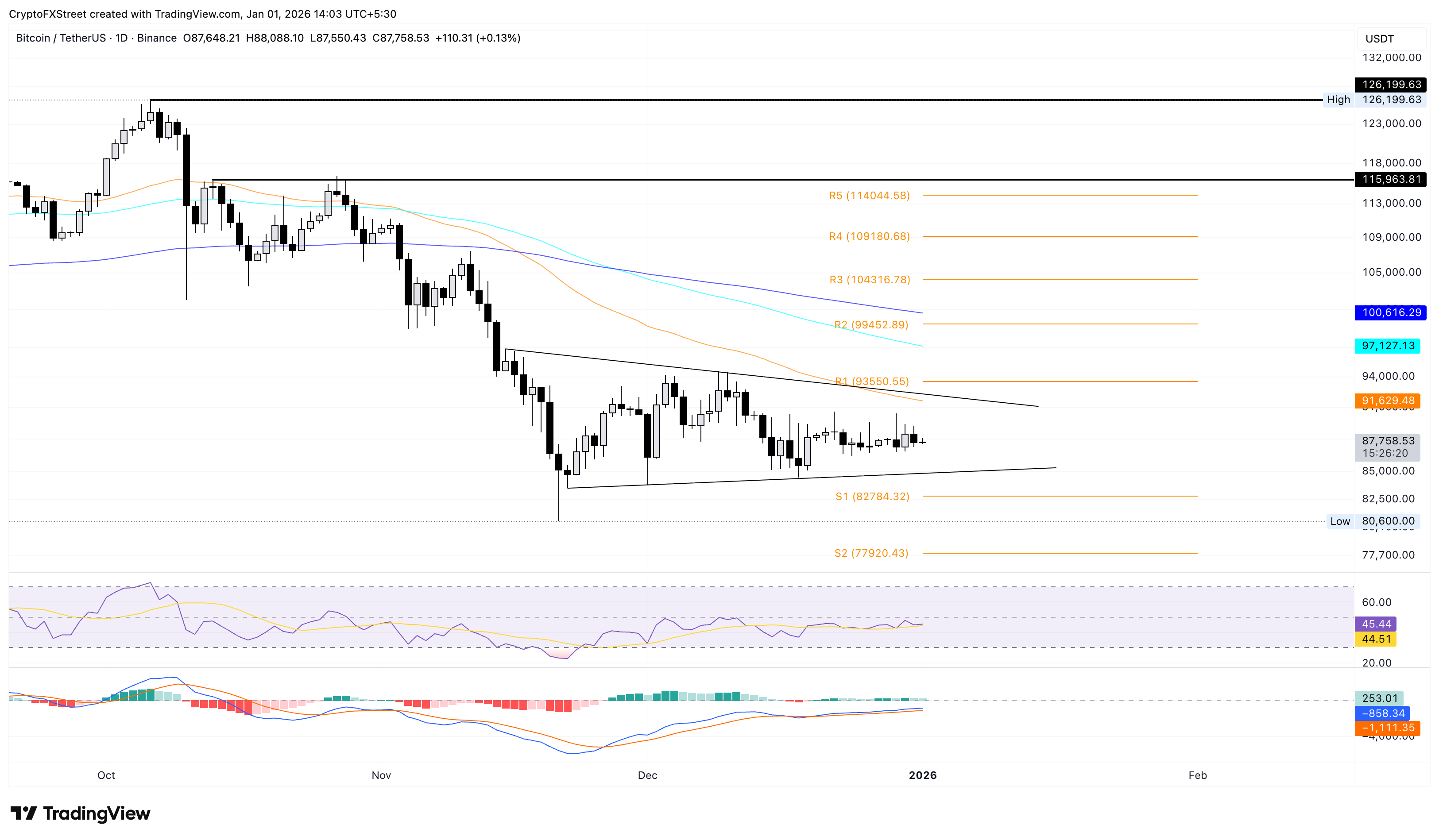

Technical outlook: Bitcoin consolidates in a triangle pattern

Bitcoin price is trading below $88,000 at the time of writing on Thursday, down 1% from Wednesday. The BTC is extending its sideways trend within a symmetrical triangle pattern, as previously reported by FXStreet.

The overhead resistance trendline near $92,000 is slightly above the 50-day Exponential Moving Average (EMA) at $91,629.

Technically, Bitcoin is losing momentum in the short term. The Relative Strength Index (RSI) at 445 hovers near the halfway line, indicating a neutral stand. Meanwhile, the Moving Average Convergence Divergence (MACD) steadily approaches the zero line, but fluctuating green histogram bars indicate a potentially unsustainable bullish momentum.

If BTC price slips below the support trendline near $85,000, it could test the S1 Pivot Point at $82,784.