Lighter’s LIT token saw an explosive debut, drawing strong early demand after launch. Momentum faded quickly as the price dropped, following claims of a potential secret token sale circulating over the past day.

These allegations unsettled investors, triggering sharp volatility and prompting questions around transparency and early token distribution.

Lighter CEO Addresses Concerns

Concerns intensified after reports claimed Lighter secretly sold nearly 10 million LIT to five wallets during the airdrop phase. As speculation spread, Lighter CEO Valdimir Novakovski addressed the issue publicly through Discord.

Novakovski explained that Lighter signed an agreement with a third-party liquidity provider in 2024. Under this arrangement, 5 million LIT liquidity support to the LLP was to be provided by the LP during the private beta. According to the founder, the wallets in question belonged to this liquidity partner rather than internal sales.

“There is no financial or personal relationship between any member of Lighter and this provider. They made the commitment before we had any data about how strong LLP performance was going to be. It was important to make sure there is enough liquidity to bootstrap trading, so it was fair to reward taking this risk and providing a valuable service to the early ecosystem,” Vladimir stated.

Outflows Take Over LIT

Despite the clarification, market response since the token launch has remained decisively bearish. Fear, uncertainty, and doubt, aka “FUD,” have continued to dominate discussions across trading channels. Many short-term holders appear unconvinced, opting to reduce exposure amid lingering transparency concerns.

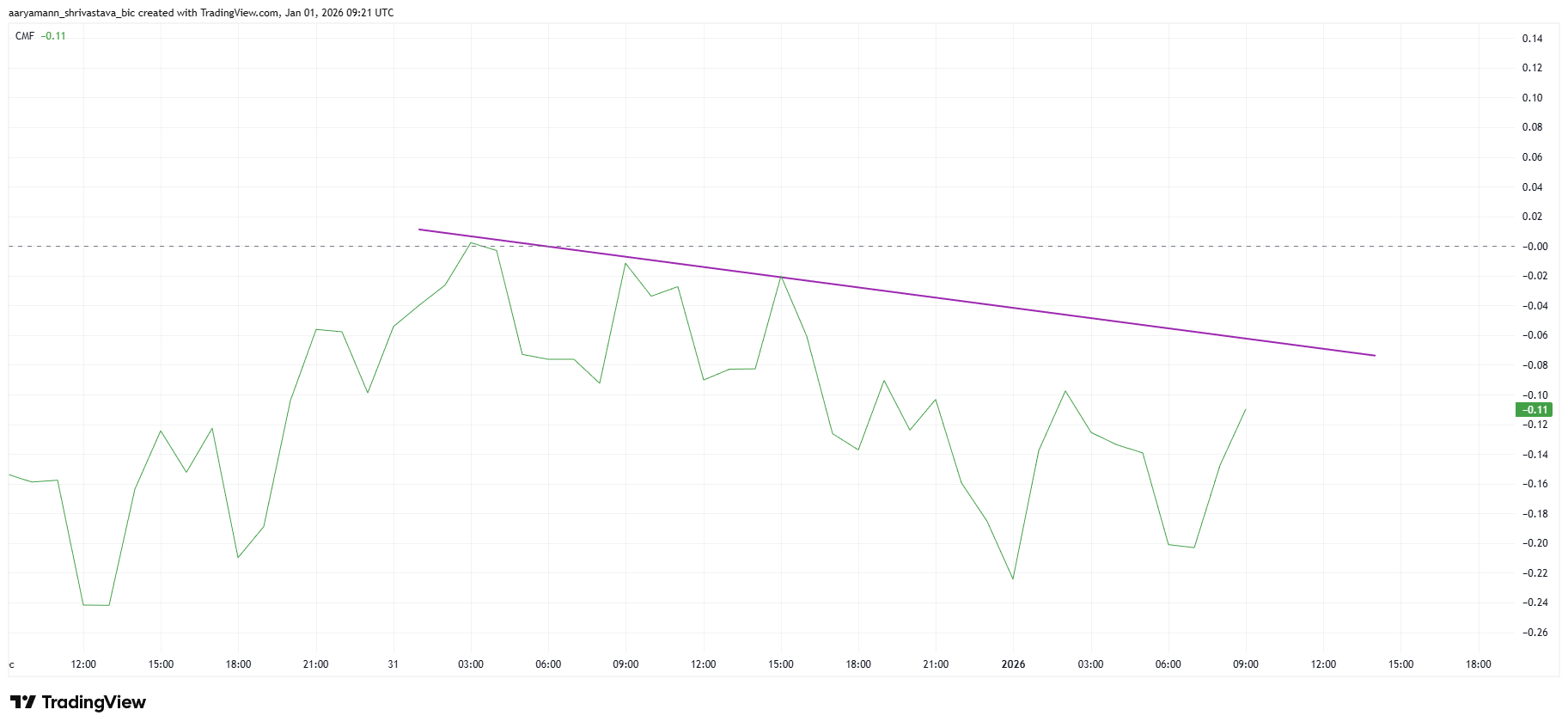

This sentiment is reflected in technical indicators. The Chaikin Money Flow has slipped below a descending trend line, signaling sustained capital outflows. Selling pressure currently outweighs accumulation, suggesting investors are exiting positions quickly rather than waiting for confirmation of a reversal.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

LIT CMF. Source: TradingView

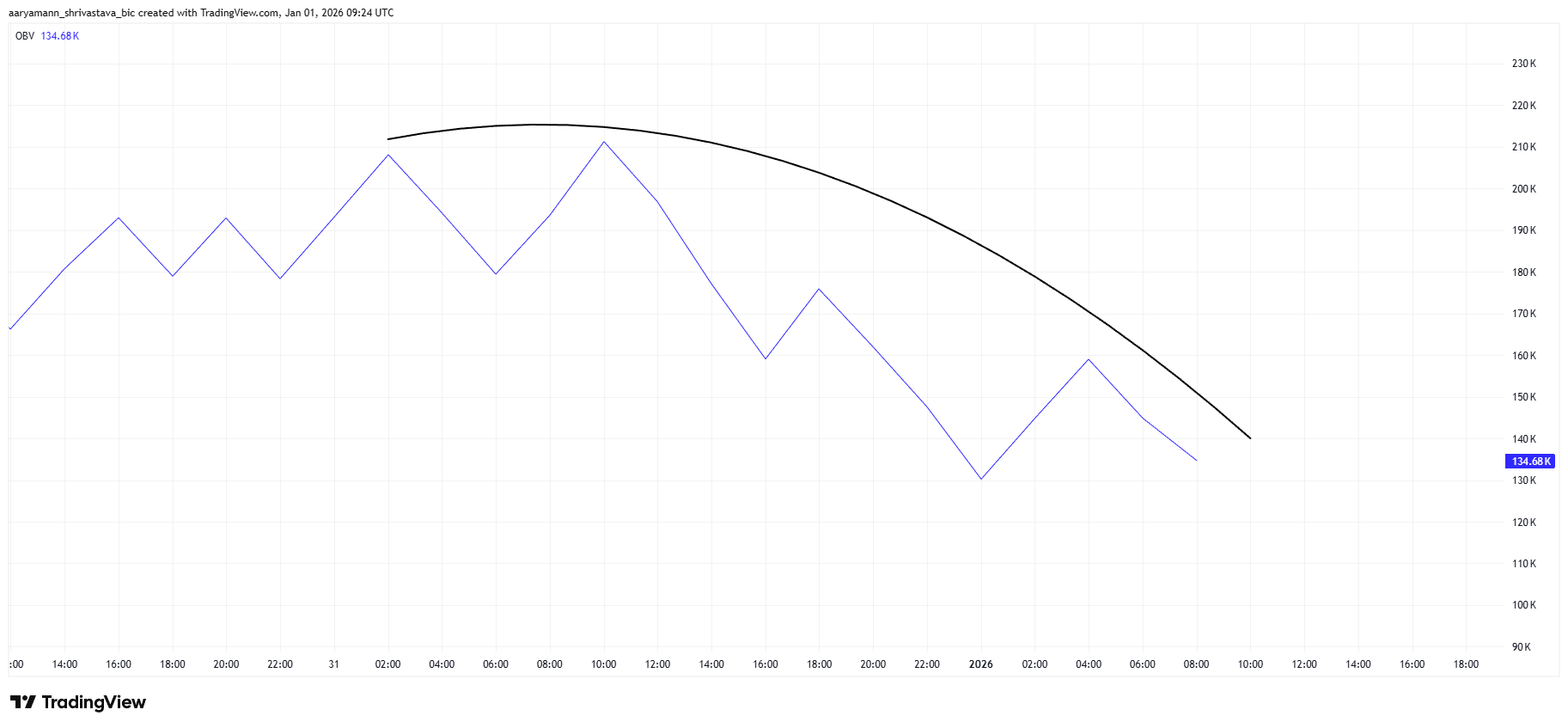

Macro momentum indicators reinforce the cautious outlook. On-Balance Volume is trending lower, aligning with recent price weakness. OBV tracks volume flow to gauge conviction behind price moves, making it a useful confirmation tool during volatile periods.

In LIT’s case, both price and OBV are declining simultaneously. This alignment confirms a downtrend rather than isolated profit-taking. Weak volume support indicates fading confidence, as fewer participants are willing to accumulate at current levels despite the protocol’s underlying fundamentals.

LIT OBV. Source: TradingView

LIT Price’s Short-Term Outlook

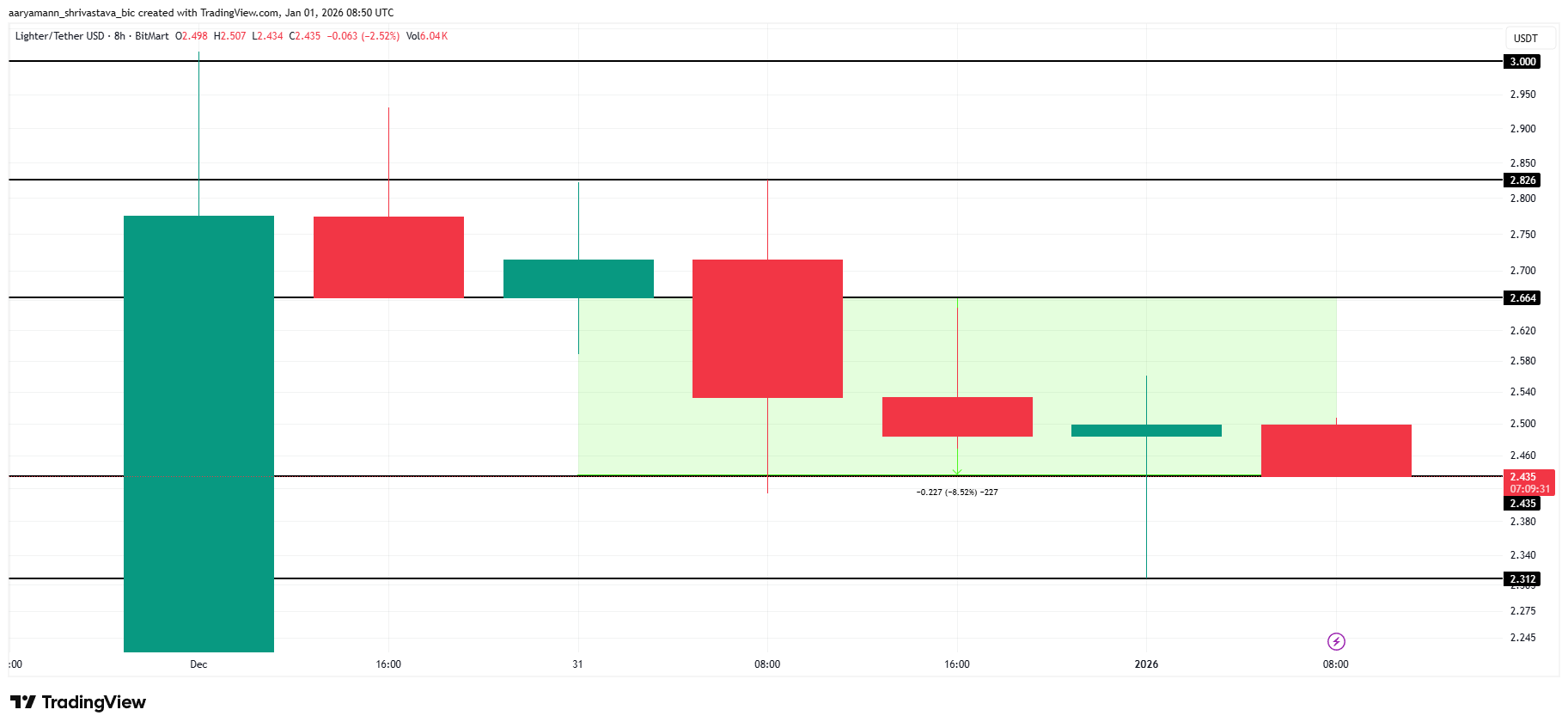

LIT price dropped 8.5% over the last 24 hours, trading near $2.43 at the time of writing. This decline reflects the combined impact of negative sentiment, persistent outflows, and weakening technical structure. Short-term outlook remains pressured unless buyers regain control.

The $2.43 level now acts as immediate support. Failure to hold this zone could expose LIT to further downside. If bearish momentum continues, the price may test the next key support at $2.31, where buyers could attempt to slow losses.

LIT Price Analysis. Source: TradingView

Invalidation of the bearish thesis requires a decisive recovery. LIT must reclaim $2.66 as support to offset the recent decline. A sustained move above this level could open a path toward $2.82, signaling renewed confidence and stabilizing market structure.