HBAR price recorded a mild decline over the past 24 hours as bearish sentiment strengthened among investors. The token trades lower after failing to sustain recent gains.

This weakness could activate a bearish chart pattern, signaling a potential downside move as selling pressure gradually increases across short-term holders.

HBAR May Distance Itself From Bitcoin

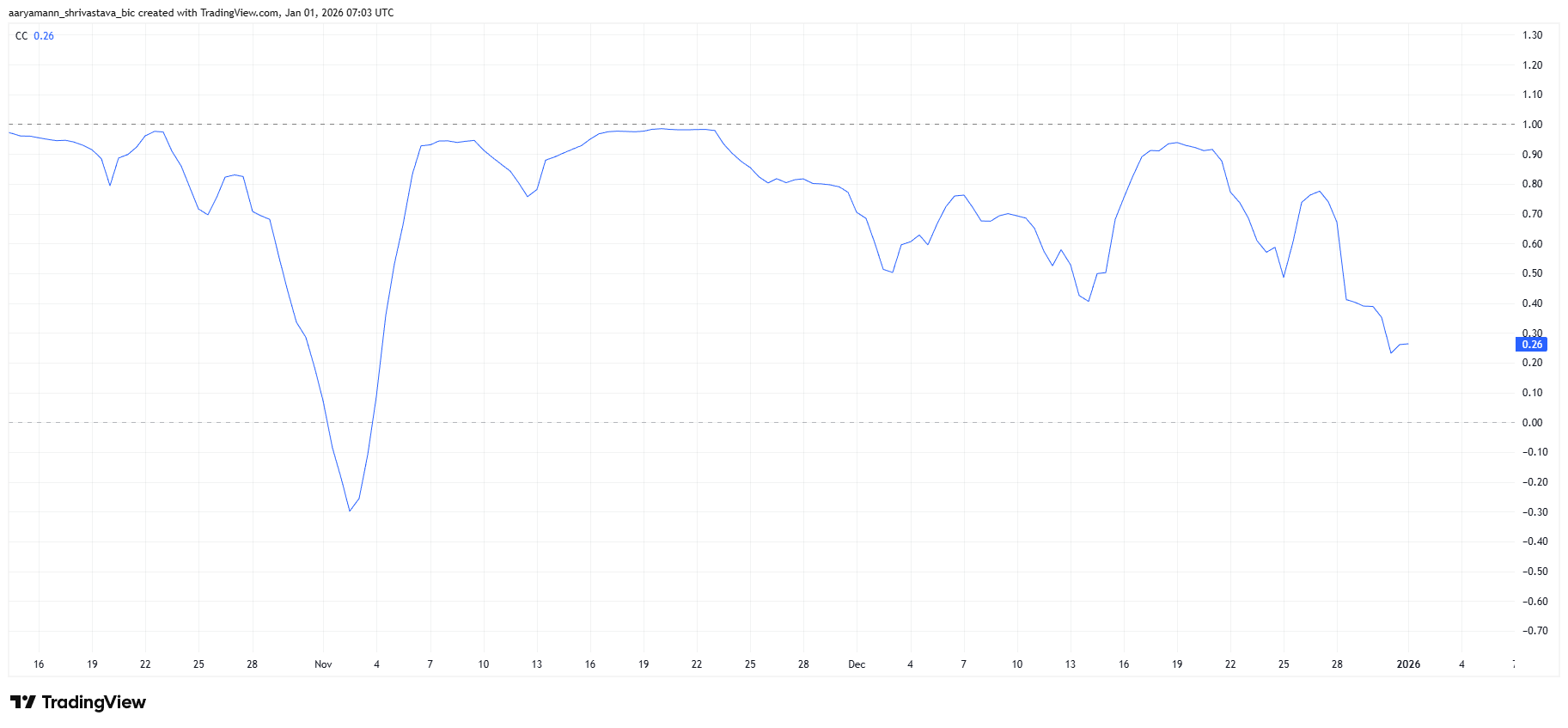

HBAR’s correlation with Bitcoin has declined sharply, now standing at 0.26. This marks the lowest level in nearly two months. The weakening relationship reflects reduced dependency on Bitcoin’s price action, which alters how HBAR reacts to broader market movements.

This shift presents mixed implications for the HBAR price. If Bitcoin experiences a downturn, HBAR may avoid mirrored losses. However, Bitcoin’s recovery could fail to lift HBAR meaningfully. Lower correlation may limit upside momentum during periods of broader market strength, increasing reliance on project-specific demand.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

HBAR Correlation To Bitcoin. Source: TradingView

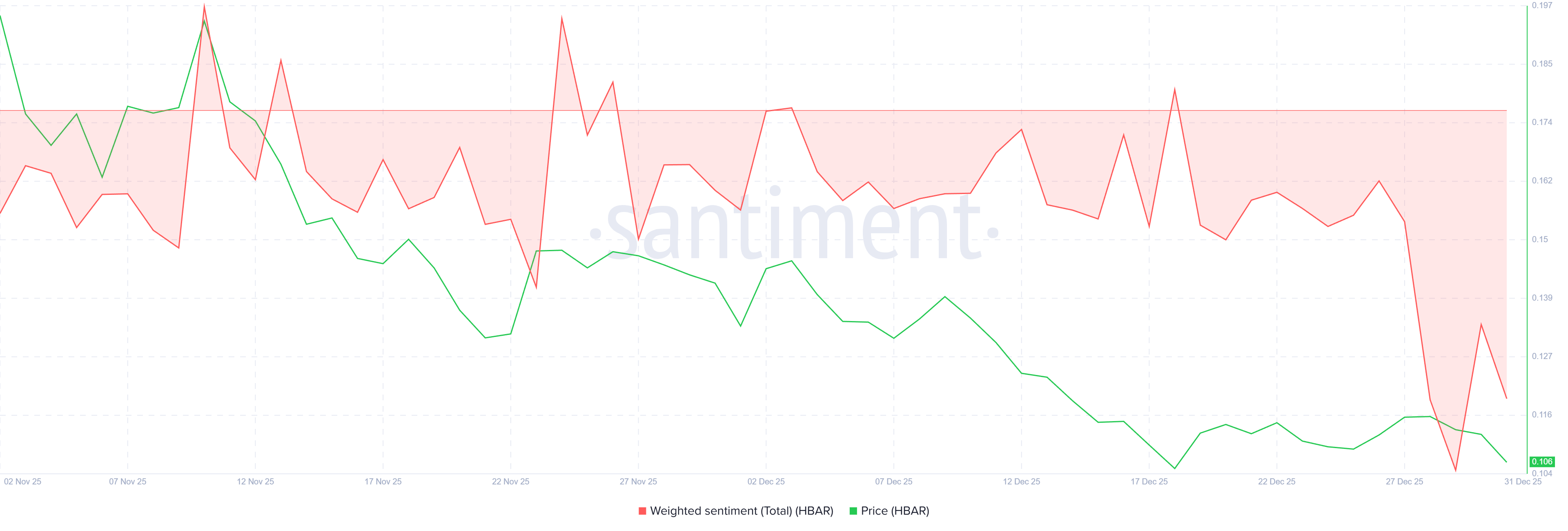

Investor sentiment toward HBAR remains largely bearish based on macro indicators. The weighted sentiment metric continues to sit in negative territory. This suggests a lack of confidence among participants, reducing buy-side support during periods of price weakness.

Negative sentiment often reflects caution rather than panic, yet it still impacts price stability. Without renewed confidence, HBAR remains exposed to further corrections. Bearish positioning could pressure the token if broader market conditions fail to provide external support in the near term.

HBAR Weighted Sentiment. Source: Santiment

HBAR Price To Note A Drop

HBAR price is projected to drop by 5%, targeting $0.102. This outlook stems from a double-top pattern formed earlier last month. The structure typically signals trend exhaustion, often preceding a corrective phase when confirmed by follow-through selling.

The altcoin has already broken below the neckline during the last 24 hours. HBAR trades near $0.107, with $0.106 acting as short-term support. While this level triggered a brief rebound, prevailing conditions suggest another decline that could validate the pattern near $0.102.

HBAR Price Analysis. Source: TradingView

Invalidation of the bearish scenario requires a decisive recovery. HBAR must reclaim $0.109 as a support level. A sustained bounce from this zone, followed by a move toward $0.113, would signal renewed strength and confirm a short-term trend reversal.