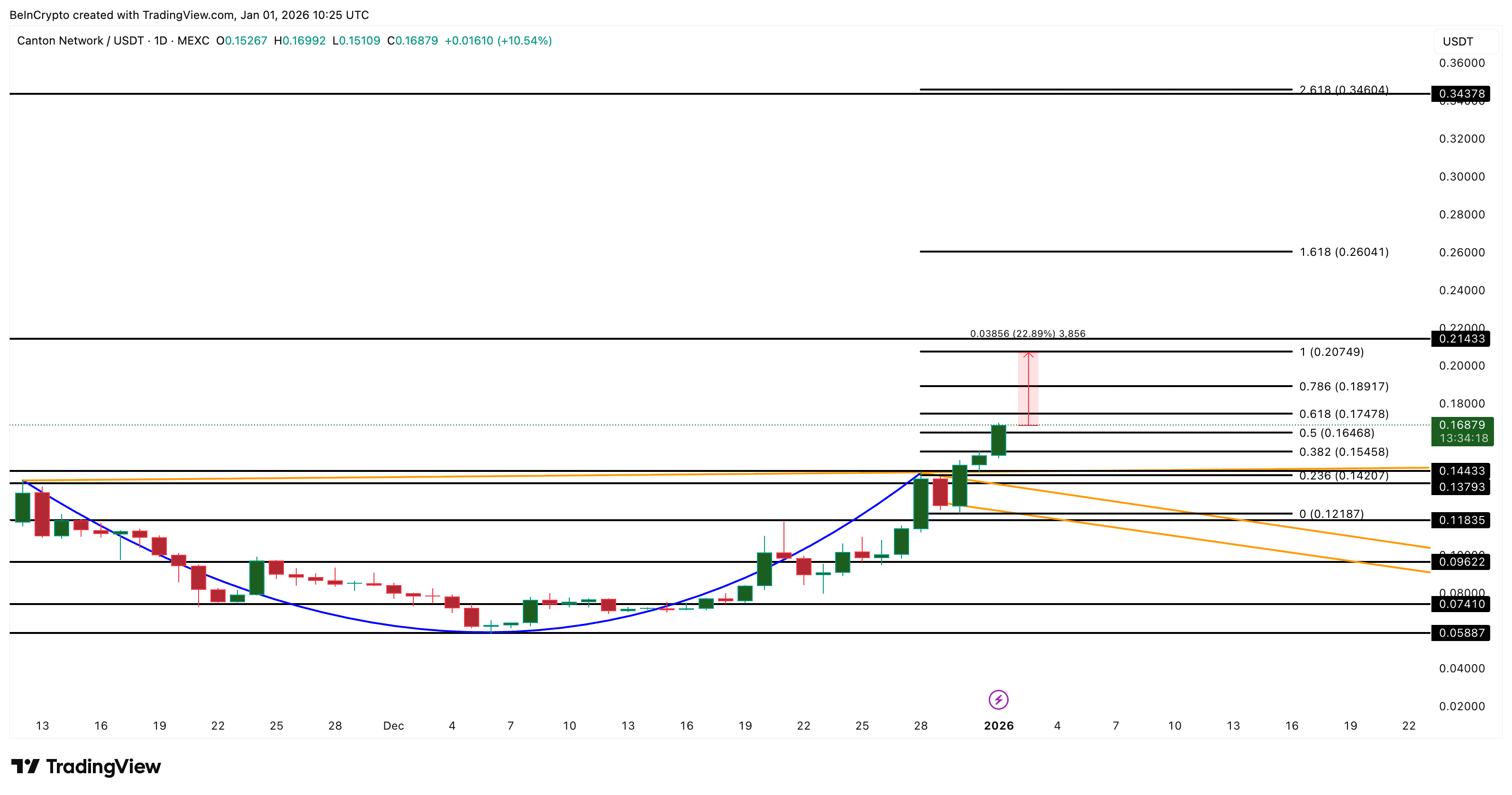

Canton Coin (CC) broke out from its cup-and-handle neckline and entered price discovery, as predicted. The Canton price breakout was confirmed with a daily close above $0.13, and the current move trades near $0.16.

The projected neckline target is near $0.34, representing a 141% move from the pattern. The breakout is valid, but two charts now hint that the path might not be a straight line.

Breakout Confirmed, Projection Holds Above $0.21

The neckline breakout happened cleanly and respected the cup-and-handle structure from November to late December. Canton finally cleared the neckline zone between $0.13 and $0.14 on December 30, per previous analysis. From that point, the first serious hurdle sits at $0.21, according to the preliminary breakout chart.

Successful CC Breakout: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

If Canton confirms a daily close above $0.21, the extension toward $0.34 opens up. That is the full projection of the pattern height. The breakout is valid on the chart, but the question now is whether the market can support the target without a correction first.

Volume Flatlines While Capital Flow Weakens

The Canton Coin price is rising, but two charts raise concern.

On-balance volume (OBV) has flatlined since the breakout. OBV measures volume pressure, so flat action during upside suggests fewer new buyers are joining. It is not a trend failure, but it limits vertical continuation.

Volume Support Is Missing: TradingView

Chaikin Money Flow (CMF) is doing the same thing in a different way. While price has trended higher from December 13 to now, CMF has made lower highs. That is a bearish divergence. It signals that big capital is not flowing in with the same strength. CMF is still positive, but the slope is tilting down relative to mid-December levels, showing hesitation.

Capital Flow Is Not Coming In Strongly: TradingView

Together, OBV and CMF create friction. The chart supports the $0.34 target, but momentum underneath says there might be a pause or pullback before continuation.

Canton Price Levels Decide If Pullback Or Continuation Comes First

Canton can still retain the breakout structure even with a pullback. A retest toward $0.14 remains healthy. That region sits near the neckline and keeps the structure intact. A deeper pullback toward $0.12 still fits the handle logic from the original pattern. Only a sustained close under $0.12 starts to weaken the breakout and opens risk toward $0.09.

Below $0.09, the structure breaks, and the Canton price can target $0.07 or lower.

If momentum returns before any retest, $0.20- $0.21 is the first serious checkpoint. A clean break above this zone increases the probability of testing higher levels. The bullish path then targets $0.26 and, finally, $0.34, in line with the earlier projection.

In that scenario, the flat OBV and CMF divergence become background noise instead of reversal signals.

Canton Price Analysis: TradingView

For now, the chart carries a bullish breakout. The two metrics lean toward a pullback. And the Canton price levels determine which outcome becomes real.

Canton Coin sits between a free path to the projected 141% move and the first technical test of the breakout. For now, the $0.20-$0.21 zone (to the upside) and the $0.12-$0.14 zone (to the downside) decide the next path.