Dogecoin price has declined in recent weeks, reflecting broader market weakness and fading speculative demand. This pullback has led to the formation of a bullish divergence on technical charts.

The signal is reinforced by improving on-chain cues, suggesting selling pressure may be losing strength as DOGE stabilizes.

Dogecoin Whales Anticipate Recovery

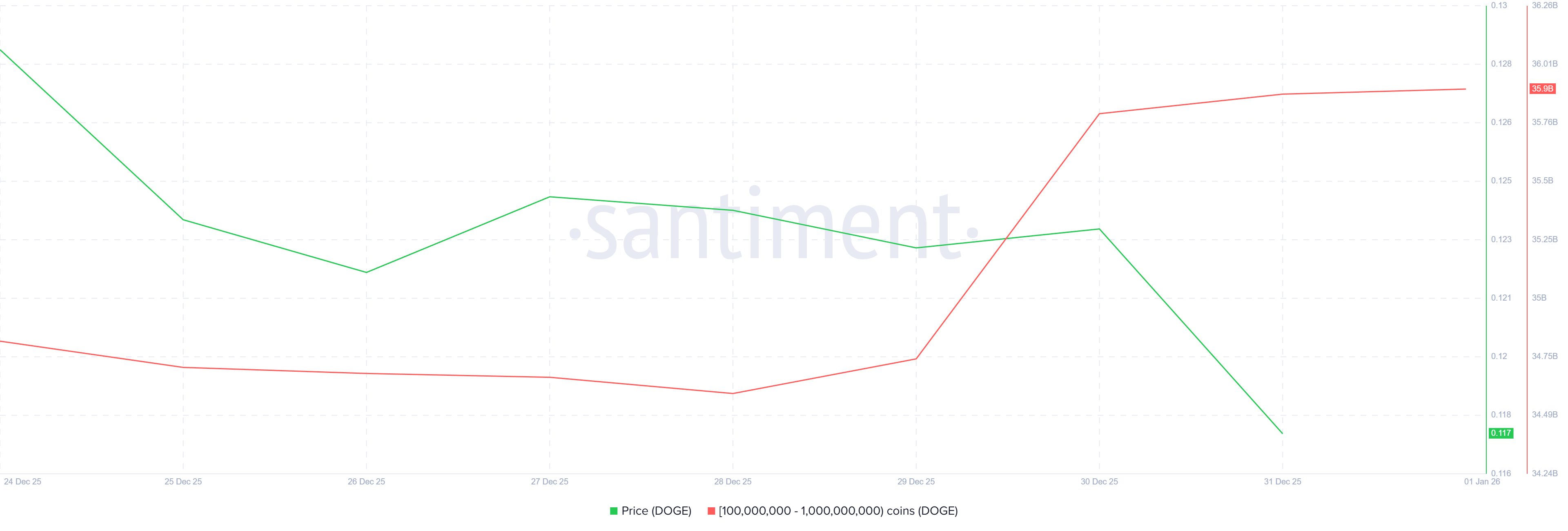

Large Dogecoin holders have shown renewed optimism toward the end of 2025. Whale addresses holding between 100 million and 1 billion DOGE shifted into accumulation mode. Over three days, these wallets acquired roughly 1.5 billion DOGE, valued at $185 million.

While this accumulation does not guarantee an immediate rally, it remains constructive for the Dogecoin price. Whale behavior often reflects longer-term positioning rather than short-term trading. Their willingness to buy during weakness suggests growing confidence that downside risk may be limited near current levels.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Dogecoin Whale Holding. Source: Santiment

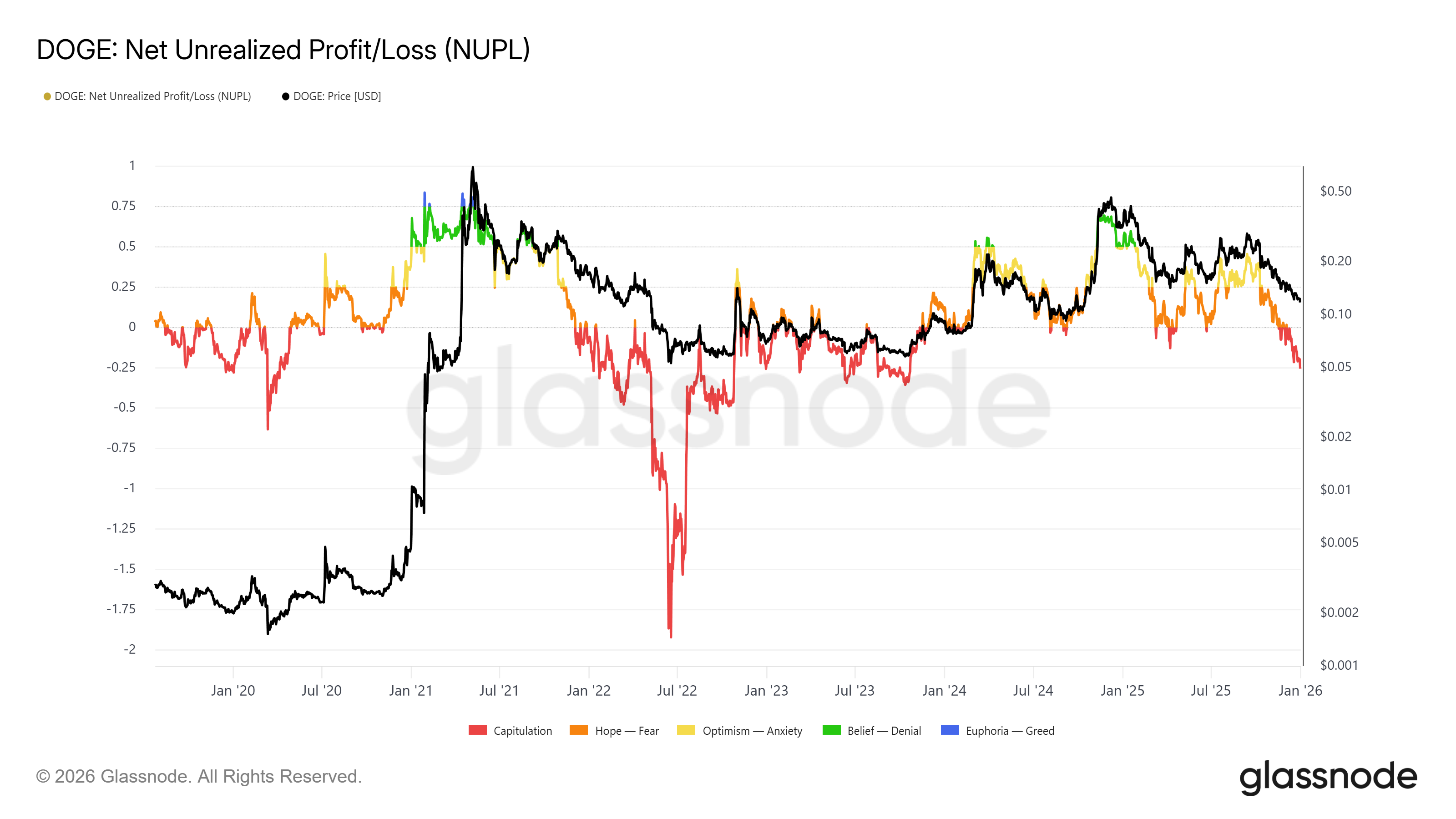

Macro indicators point to deep capitulation across Dogecoin holders. Net Unrealized Profit and Loss, or NUPL, has dropped to a two-year low. Current readings sit near -0.25, reflecting widespread unrealized losses across the network.

Historically, DOGE reversals have emerged as NUPL approaches the -0.27 threshold. At such levels, selling pressure often saturates as losses peak. With profits collapsing to October 2023 levels, conditions may be forming for stabilization and a gradual recovery phase.

Dogecoin NUPL. Source: Glassnode

DOGE Price Prepares For Bounce Back

The Dogecoin price is currently forming a bullish divergence. Over the past two weeks, price action posted a lower low. Meanwhile, the Relative Strength Index established a higher high, signaling weakening downside momentum despite continued price pressure.

This divergence often precedes trend reversals as buyers regain control. If confirmed, DOGE could reclaim $0.122 as support. At the same time, a sustained move above this level may open a path toward $0.131, with $0.143 acting as the next upside target.

DOGE Price Analysis. Source: TradingView

Failure to confirm the divergence would expose DOGE to renewed losses. As a result, the price could slip toward $0.113 if selling resumes. Losing this support would invalidate the bullish setup and may drag Dogecoin toward $0.110 or lower under bearish conditions.