Monad (MON) showed signs of reawakening in the early days of the new year, rising to a one-week high. The token is expected to recover after trading lower following its November airdrop and exchange debut.

Monad (MON) is one of the post-airdrop tokens expected to make a recovery. MON rose by over 17% ahead of the weekend, peaking at $0.028. The token is still lagging from its initial peak of $0.045 after its long-awaited launch.

MON has been expected to pump for a while, based on its underperformance in December. However, the token remains risky as the crypto market recovery is still questioned. Monad also launched a new L1 chain at a time when demand for new platforms was low. Despite this, Monad has been building up a DeFi stack.

Monad builds up a record value locked

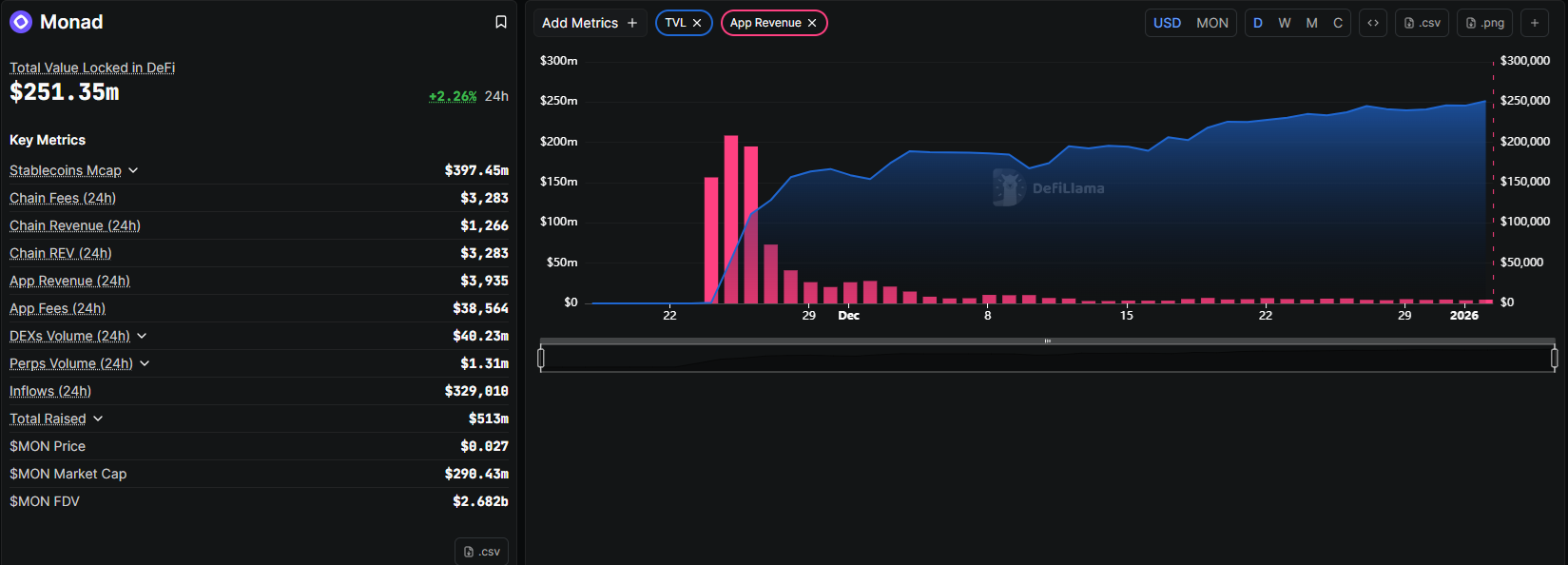

Monad has built up value locked since its launch, recently rising to a record of $251M. The chain carries over $397M in stablecoins and hosts several DeFi apps.

Activity on Monad generates relatively low fees for node operators, but apps are picking up speed. App revenues peaked at the end of 2025, with over $200M in daily fees. Since then, the chain slowed down its activity, coinciding with overall weak post-holiday trading.

Monad’s flagship app is Upshift, an online capital allocator. The app increased its liquidity by over 82% in the past month, now holding $476M based on its own reporting. App-based liquidity may also signal much higher usage for Monad, based on its app-based economy.

Results and fees may vary depending on app incentives and campaigns. Some of the apps may also extract fees for their own teams. Monad is repeating Solana’s model, focusing more on the chain’s economy and successful apps, rather than on incentives for block production, which remain much smaller.

The Monad project shows a further shift to chains as infrastructure, where apps are the main value centers, offering services and transfers. MON still offers staking, with around 14% of the supply locked for an annualized yield of up to 12%. The end results of staking may vary depending on the token’s market performance.

MON open interest rises near an all-time peak

MON derivative trading is picking up, with open interest near an all-time high. The MON derivative market carries more than $127M in positions, with more active trading in the past two weeks, betting on a directional move.

MON traders tend to take long positions, with only limited risk-taking by shorting the token. The asset remains volatile and continues to cause liquidations during attempts at shorting. In the past day, over $133M in short liquidations added to the MON rally.

The recent MON climb liquidated all available short positions before the downturn, signaling the price action may be due to a short squeeze. An organic MON recovery based on the performance of Monad is yet to happen, as the market reassesses risk and the appeal of altcoins.

Don’t just read crypto news. Understand it. Subscribe to our newsletter. It's free.