Crypto analyst Crypto Whale has explained why the Bitcoin price could still crash to as low as $25,000. The analyst also stated this would form the macro bottom for the leading crypto, as it recovers from this bear market.

Why The Bitcoin Price Could Drop To As Low As $25,000

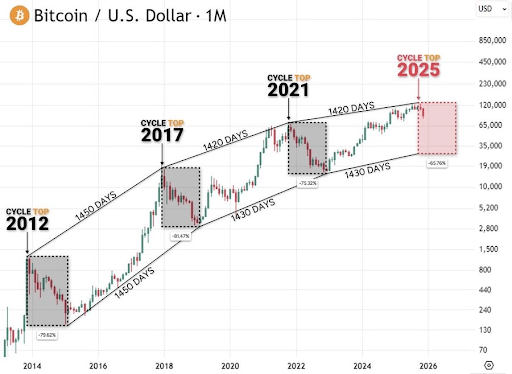

In an X post, Crypto Whale stated that the monthly chart suggested that the Bitcoin price could form a macro bottom near $25,000 sometime in 2026. The analyst further remarked that if history rhymes, these deep retracements tend to mark long-term accumulation zones. He added that this doesn’t signify the end of the cycle but the reset before the next expansion.

However, in another X post, Crypto Whale suggested that the Bitcoin price isn’t yet in a bear market, highlighting how the 2026 bull run is likely to unfold. He stated that this month, the crypto market will see a Bitcoin-led rally, while there will be a broad altcoin expansion in February. The analyst expects the bull trap to set in in March, which he predicts would lead to volatility and panic selling.

Related Reading: Analyst Reveals Why The Bitcoin Price Is Extremely Bearish Right Now

Once that happens, Crypto Whale predicts that May will usher in the capitulation phase, while a full bear market confirmation will happen in June. This outlook for the Bitcoin price comes as research firm XWIN Research noted that BTC has not clearly entered a new bullish trend. The firm further stated that the crypto market remains in a high-volatility range environment, which is neither decisively bullish nor bearish.

Meanwhile, XWIN Research raised the possibility that the Bitcoin price could drop to as low as $50,000. They stated that this could happen if recession risks intensify, with deleveraging and ETF outflows pushing the leading crypto below $80,000 and making $50,000 a possibility.

BTC Death Cross Signals Drop To $38,000

In an X post, crypto analyst Ali Martinez drew attention to a death cross, which has been recurring on the BTC weekly chart. The analyst noted that if history repeats itself, the Bitcoin price could record a similar 50% to 60% correction, dropping to as low as $38,000 in the process.

This death cross between the 10-week and 50-week simple moving averages is said to have occurred in September 2014, leading to a Bitcoin price correction of 67%. It also occurred in June 2018, March 2020, and January 2022, resulting in price corrections of 54%, 53%, and 64%, respectively.

Martinez opined that the zone between $50,000 and $38,000 is starting to become interesting from a long-term spot accumulation standpoint. He added that the market will confirm the next move for the Bitcoin price in its own time.

At the time of writing, the Bitcoin price is trading at around $88,700, up in the last 24 hours, according to data from CoinMarketCap.