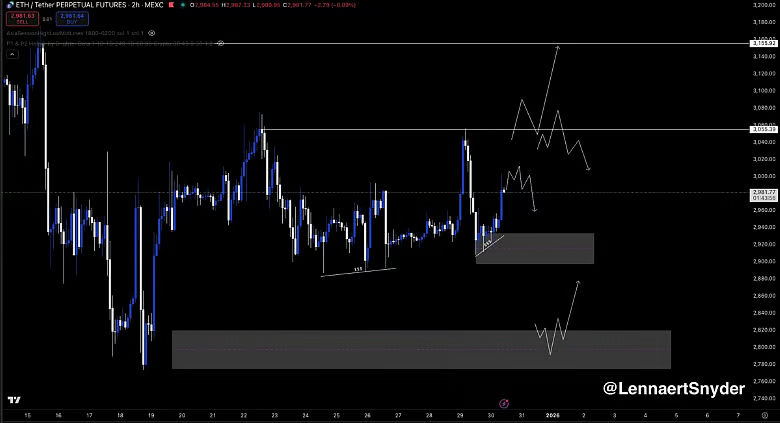

The Ethereum market is in crisis at this time. Its value is at about $2,921. Its recent fall from $3,000 was caused by a sell-off by large investors which caused its price to briefly touch $2800. Long-term holders are now gradually accumulating more ETH, although wallets that contain between 100,000 and 1,000,000 ETH are selling.

Meanwhile, a new crypto called Mutuum Finance (MUTM) is currently attracting investors as predictions show it could soar high in a short period. Mutuum Finance is expected to rally from its current price of $0.04 to $1.60 in 2026. This translates to 40x rise while ETH aims for a rebound. The new project is currently in its 7th presale phase. Investors buying today have been drawn to the project by its recently completed Halborn security audit. The audit covered MUTM’s lending and borrowing contracts and raised some recommendations, which the team was quick to integrate. This follows another security audit that was carried out by blockchain security giant CertiK, where MUTM was awarded a 90/100 security score. Consequently investors have been scrambling to accumulate this next crypto to explode.

MUTM’s Audit Completion Changes the Narrative

Whereas the Ethereum network is slowing down, the pace of Mutuum Finance is accelerating. However, the most important development for this project is that the full audit of the V1 lending and borrowing protocol by Halborn Security is complete.

Following the audit, the project is now set for the launch of its V1 lending and borrowing protocol. The release will introduce core components including liquidity pools, mtTokens, debt tokens, and automated liquidation mechanisms, enabling users to lend, borrow, and collateralize assets like ETH and USDT. This indicates the transition of Mutuum from the development stage to implementation. It is among the reasons why many investors view MUTM as the next crypto to explode.

Since the presale started, Mutuum Finance has managed to raise $19,550,000 and has 18,650 wallets. The current phase is Phase 7, which sells for $0.04. The token will rise higher, with analysts projections pointing to a 40x price increase. This will the token zoom past $1 and touch $1.60 by mid-2026.

A complete lending and borrowing platform is being developed by Mutuum Finance, allowing one to earn yield or borrow funds without having to divest their holdings. This feature is likely to ensure genuine activity on this platform, as opposed to mere hype. With increased usage, the subsequent rise in the demand for the MUTM token is likely to drive the prices up, making Mutuum Finance attractive for long-term investors.

Moreover, there are additional incentives from Mutuum Finance to encourage participation. A 24-hour leaderboard rewards the highest-ranked individual in terms of daily buying with a $500 MUTM bonus if there is a completed transaction before the cycle resets at 00:00 UTC. The bonus serves to encourage activity before the product launch in 2026.

Why Investors are Attentive

Paying $0.06 at launch, means leaving a huge ROI in the table. However, joining Mutuum Finance presale now means securing a $0.04 price with potential to see growth past $1 in 2026. Even more importantly, having an audited V1 protocol, a comprehensive security review by Halborn Security, and preparations for launch set it apart from much of the early-stage competition. In the wake of Ethereum’s recent strength challenges, Mutuum Finance is one of the brightest alternatives out there that offers technologically audited technology and strong early demand.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance