Altcoin season 2026 is already being questioned across the market, with many traders asking whether altcoins are dead or simply going through another structural reset. After months of underperformance, shrinking volumes, and failed narratives, capital concentration has become extreme.

Bitcoin dominance remains elevated, liquidity is selective, and most legacy altcoins continue to bleed. But history shows that altcoin cycles rarely start with hype. They usually begin quietly, during periods of boredom, skepticism, and uneven rotation.

That is the backdrop forming now, as attention starts shifting toward infrastructure-driven projects like Bitcoin Hyper at the edge of the market.

Altcoin Season 2026 Is Not Following Old Playbooks

Previous altcoin seasons were fueled by excess liquidity and fast speculation. In contrast, altcoin season 2026 is developing under tighter market conditions, where capital is more cautious, and narratives must justify themselves.

Many high-profile altcoins from earlier cycles remain structurally weak, with declining developer activity and no clear demand drivers. This has created the impression that altcoins as a category are dying.

What is actually happening is fragmentation. Instead of broad rallies, capital is rotating into fewer projects with clearer utility, better token mechanics, and visible demand. This environment favors selective accumulation rather than indiscriminate buying. Altcoins are not dead, but the threshold to attract capital is much higher than before.

Why Capital Is Rotating Away From Legacy Altcoins

One of the clearest signals in recent months has been where capital is not going.

Many older altcoins continue to struggle despite market stability, suggesting investors are no longer willing to hold assets with weak incentives or unclear use cases. Liquidity is flowing away from passive ecosystems and into projects offering infrastructure, yield, or new access points.

This rotation is typical during late bearish or transitional phases. When traders lose confidence in broad narratives, they start looking for asymmetric setups with defined upside and controlled risk. That shift often precedes the early stages of a new altcoin cycle, even if price action has not yet confirmed it.

Bitcoin Hyper Signals a Different Type of Altcoin Demand

Bitcoin Hyper has emerged during this period as an example of how altcoin season 2026 may actually form. Rather than competing with Bitcoin, it extends it.

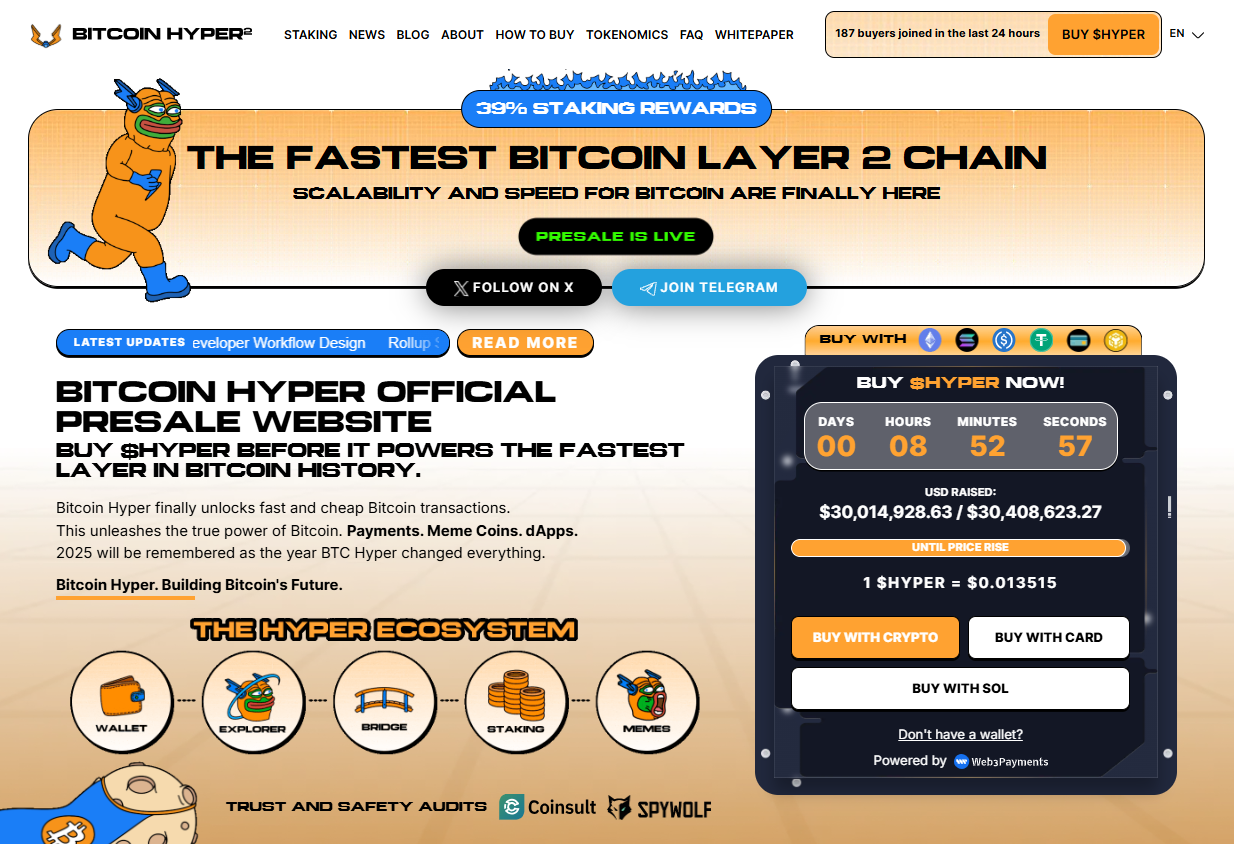

Built as a Bitcoin Layer-2 on the Solana Virtual Machine, Bitcoin Hyper targets Bitcoin’s long-standing limitations around speed, cost, and programmability.

The project introduces faster execution, lower fees, staking, decentralized applications, and meme coin ecosystems, all while anchoring security back to Bitcoin’s base layer. This structure has resonated with investors looking for exposure that aligns with Bitcoin’s dominance rather than betting against it.

Presale Data Suggests Accumulation, Not Speculation

Unlike earlier cycles dominated by private allocations and venture-led launches, Bitcoin Hyper’s demand appears to be largely public-driven.

The presale has raised $30 million, reaching a key milestone without reliance on private or seed rounds. That structure matters in the current market, where transparency and fair access are becoming more important to investors.

Pricing remains discounted during the presale phase, with the token trading around $0.0135, while staking incentives near 39% APY encourage longer-term holding rather than short-term flipping. These mechanics point toward accumulation behavior, not hype-driven speculation.

What This Means for Altcoin Season 2026

The question is not whether altcoins are dead. It is whether the old version of altcoin season is gone. Altcoin season 2026 is shaping up to reward projects that integrate with dominant chains, solve real bottlenecks, and offer incentives aligned with long-term participation.

Bitcoin Hyper fits that profile by combining Bitcoin’s credibility with Solana-style performance, positioning itself as infrastructure rather than narrative noise. If broader market sentiment turns bullish again, history suggests that projects accumulated during periods of skepticism are often the first to move.

For now, altcoin season is not loud, obvious, or euphoric. It is quiet, selective, and built on rotation. And as capital searches for structures that make sense in this environment, Bitcoin Hyper is increasingly being watched as one of the few altcoin candidates aligned with how this next cycle may actually unfold.