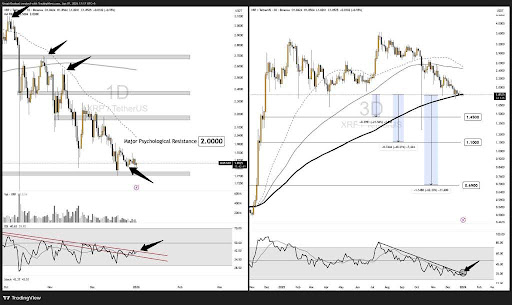

XRP is facing a critical turning point as key long-term support gives way for the first time in over 400 days. After consolidating near $2, the recent break below the 200-day moving average signals mounting pressure, putting the cryptocurrency in a high-stakes zone where the next move could define its near-term trajectory.

Price Stalls Below The $2 Wall As Volatility Compresses

In an X post, Umair Crypto noted that XRP has faced heavy resistance near the psychological $2 level, forcing the price into a tight consolidation range between $1.85 and $1.88. Such conditions often precede a sharp move, suggesting XRP may be nearing a decisive breakout or breakdown phase.

On the daily timeframe, XRP still displays signs of resilience despite the overhead pressure. Buyers have so far managed to defend nearby support zones, preventing a clean breakdown in structure. This defensive price action keeps the broader bullish scenario alive, especially if momentum improves and XRP reclaims higher levels with stronger volume confirmation.

However, a wider view from the 3-day chart introduces caution. The current support region aligns closely with the 200-day simple moving average. XRP’s latest close below this moving average marks the first time in more than 400 days, highlighting a notable technical shift that could weigh on sentiment if not quickly reversed.

This development places XRP at a critical inflection point. The chart shows a relatively thin historical structure following the explosive November 2024 rally that lifted the price from $0.50 to $3. With fewer well-defined demand zones beneath, any acceleration in selling pressure could lead to faster downside moves.

Umair Crypto identified interim support levels around $1.45, $1.10, and $0.69 as potential downside targets if a confirmed breakdown unfolds. Attention remains firmly on the coming sessions, particularly as Ripple’s recent $1 billion token unlock introduces additional supply, adding another layer of pressure to an already sensitive market setup.

XRP Former Ceiling Turns Into A Structural Floor

According to a monthly XRP update shared by crypto analyst Chad, the asset is currently holding above a key level that previously acted as resistance and has now flipped into support. This shift suggests that buyers are still defending the structure, keeping the broader setup constructive despite recent price action hesitation.

A clear double-top formation can be spotted on the chart. However, Chad notes that it does not have to fully play out as long as XRP continues to hold above the 0.786 logarithmic Fibonacci level.

Overall, XRP appears to be in a consolidation phase rather than a decisive move. Price action is currently contained within the 0.786 to 0.886 log Fibonacci range, signaling a period of balance as the market awaits a clearer directional catalyst.