Tom Lee is urging BitMine shareholders to approve a dramatic expansion of the company’s authorized share count. This would make future dilution easier as BitMine doubles down on Ethereum as a core treasury asset.

In a New Year message, Lee asked investors to back a proposal to raise the authorized share limit from 500 million to 50 billion shares. The vote closes on January 14, ahead of BitMine’s annual meeting on January 15 in Las Vegas.

BitMine’s Share Dilution Debate Tied to Ethereum

Tom Lee said the increase does not mean BitMine will issue all those shares immediately.

Instead, he said it would give the company flexibility to support future capital needs and enable stock splits if the share price rises significantly.

BitMine pivoted last year to make ETH its primary treasury asset. Since then, the company has steadily increased its ether holdings, positioning itself less like a traditional mining firm and more like a leveraged Ethereum balance sheet.

In the past month alone, the company bought over $1 billion in Ethereum.

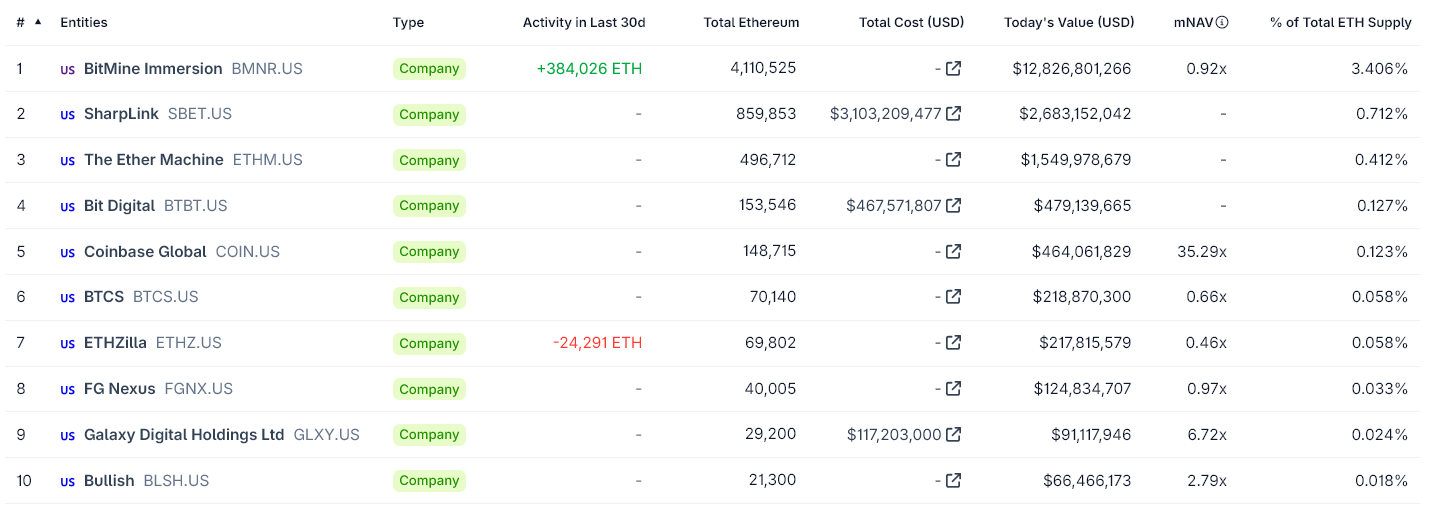

Top 10 Ethereum Treasury Companies. Source: CoinGecko

Lee told shareholders that BitMine’s stock has begun tracking ETH more closely than its operating metrics.

In his view, if Ethereum’s price rises enough over time, issuing new shares to buy more ETH could still benefit shareholders, even if their ownership percentage falls.

If the proposal passes before the January 15 shareholder meeting in Las Vegas, BitMine would have a much larger pool of shares to issue. That could be used for:

Raising capital, including potentially to buy more Ethereum

Acquisitions or strategic deals

Stock splits to keep the share price “accessible” as Lee outlined

Lee emphasized to investors that approving a larger authorization does not automatically create dilution. Actual dilution would occur only if and when new shares are issued.

BitMine Stock Price Since Becoming an Ethereum Treasury Firm. Source: Google Finance

Also, he emphasized stock splits as a key reason for the proposal. If BitMine’s share price rises alongside ETH, splits could be needed to keep shares accessible to retail investors. A higher authorized share count makes those splits easier to execute.

Still, the proposal puts shareholders at a crossroads. Approving it does not dilute stakes today, but it lowers the barrier for future dilution tied directly to Ethereum exposure.