Altcoin season was widely anticipated for 2025, but the reality has unfolded very differently. Instead of a broad-based rally, most altcoins suffered deep and prolonged drawdowns, erasing years of gains and forcing many investors out of the market.

As 2026 approaches, sentiment around altcoins remains fragile. A growing number of analysts now warn that the worst may not be over, arguing that structural weakness, declining liquidity, and fading retail participation could drive another leg lower across the sector.

Market data reinforces this cautious outlook. The Crypto Total Market Cap, excluding the top 10 assets—commonly referred to as the OTHERS index—has collapsed by more than 50% since December 2024. Market capitalization has fallen from roughly $451 billion to around $182 billion in just twelve months, highlighting the scale of capital destruction across mid- and small-cap tokens.

This sharp contraction reflects aggressive de-risking, weak demand, and sustained selling pressure across the altcoin market.

However, not all analysts are convinced the altcoin cycle is finished. A smaller group points to historical precedents, arguing that periods of extreme underperformance and investor capitulation have often preceded powerful altcoin recoveries. From this perspective, 2026 could mark the delayed arrival of an altcoin season—if liquidity conditions improve and capital rotation resumes.

Altcoin Trading Activity Remains Elevated Despite Price Weakness

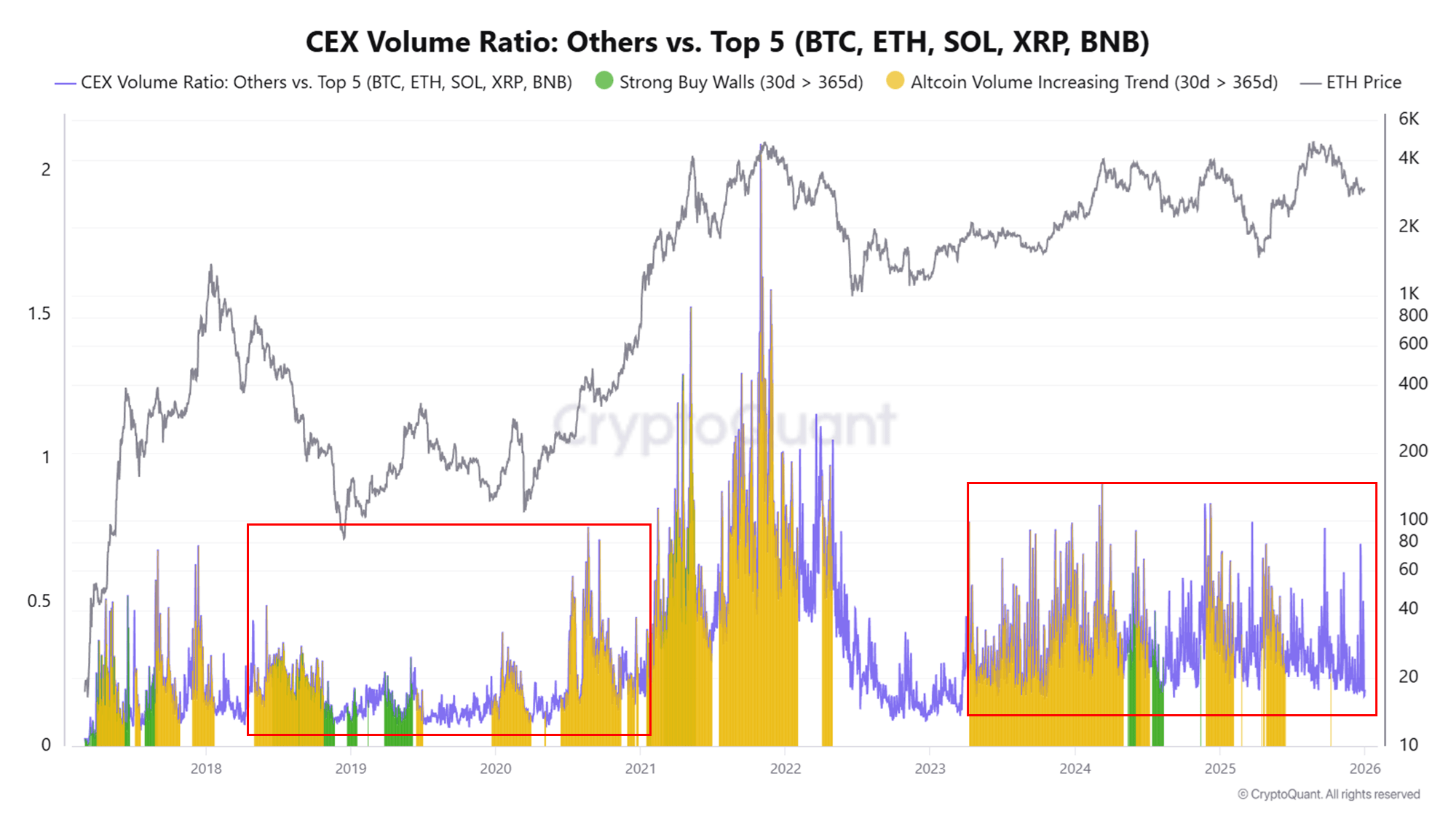

A recent CryptoQuant report challenges the widely held belief that this cycle has produced “no altcoin season.” According to the data, centralized exchange trading volume for altcoins—excluding the top five assets—has reached levels significantly higher than those seen in previous market cycles. In other words, altcoins are being traded more actively than ever, even as prices remain deeply depressed across much of the market.

This divergence between volume and price helps explain the prevailing confusion. While many tokens have lost a substantial portion of their value, on-chain and exchange data show that activity has not disappeared. Instead, the market has undergone a structural shift.

Retail participation has largely faded after months of losses, with many smaller investors capitulating and exiting positions. Their absence, however, has not resulted in lower overall trading activity.

CryptoQuant’s analysis suggests that altcoin dominance has increasingly concentrated among larger players. Whales and professional participants now account for a growing share of altcoin volume, using periods of low liquidity and weak sentiment to accumulate positions or actively rotate capital.

From this perspective, the current phase may not signal the absence of an altcoin cycle, but rather its transformation. If whale-driven positioning continues and broader market conditions improve, these participants are likely to push prices higher to maximize returns.

OTHERS Market Cap Shows Prolonged Compression

The OTHERS chart, which tracks the total crypto market capitalization excluding the top 10 assets, highlights the depth and duration of the ongoing altcoin correction. After peaking near $450 billion in late 2024, the market has lost more than half of its value, stabilizing around the $200–210 billion zone. This sharp contraction confirms that the altcoin market has experienced a full reset rather than a shallow pullback.

From a technical perspective, the structure reflects prolonged compression. Price is currently oscillating around the 200-week moving average (red), a level that historically acts as a long-term equilibrium zone during transitions between bearish and recovery phases. The failure to reclaim the 100-week and 50-week moving averages suggests that upside momentum remains weak and that buyers lack conviction at higher levels.

Volume dynamics reinforce this view. While periodic spikes appear during sell-offs and relief rallies, there is no sustained expansion in volume that would signal broad-based accumulation. This implies selective positioning rather than widespread risk appetite.

Importantly, the market is no longer making aggressive lower lows, indicating that forced selling may be largely exhausted. However, the absence of higher highs keeps the structure neutral-to-bearish. For a meaningful altcoin recovery, OTHERS would need to reclaim the $260–280 billion range and hold above key moving averages.

Until then, the chart suggests consolidation, dominance by larger players, and a market still searching for a durable bottom rather than the start of a classic altcoin season.

Featured image from ChatGPT, chart from TradingView.com