The price of Bitcoin seems to be positioning for a renewed bullish phase following its positive start to the new year. The premier cryptocurrency closed 2025 with a range-bound price performance, recording no significant movement in the past month of December.

However, beneath this early price strength, recent on-chain evaluation reveals that Bitcoin may be at a critical point, where positive price action contrasts with underlying market dynamics.

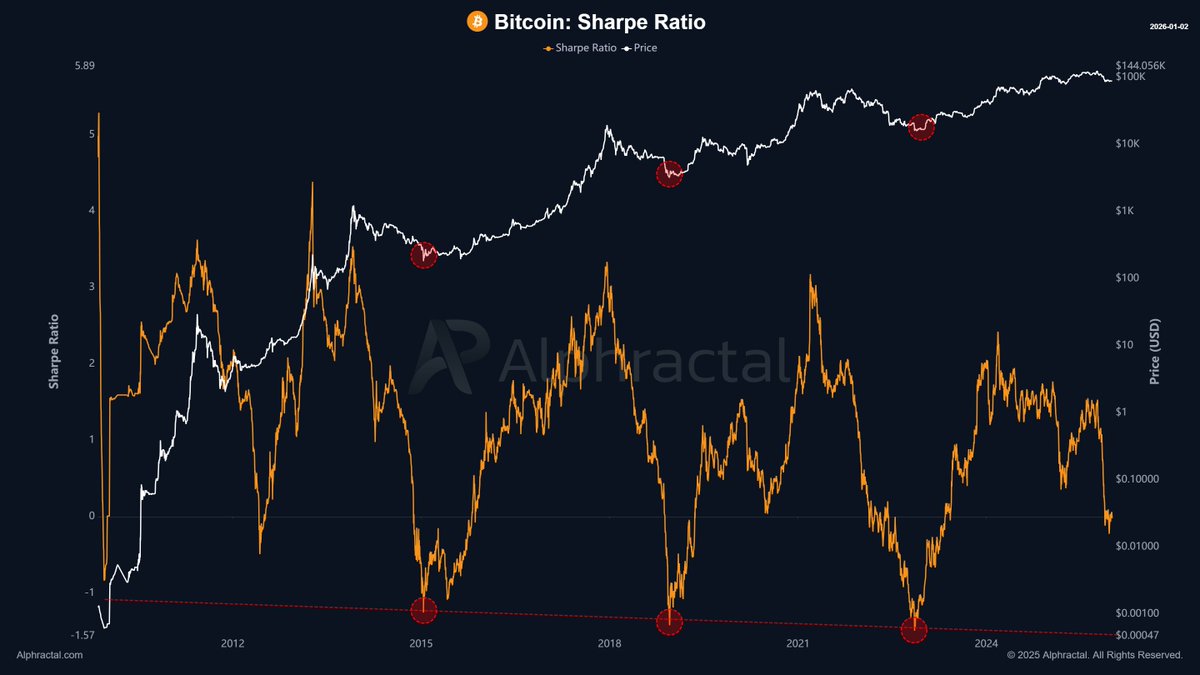

Negative Ratios Don’t Mean Price Bottoms: Alphractal CEO

Alphractal CEO Joao Wedson recently took to X to explain what a negative Sharpe Ratio could mean for the Bitcoin price. For context, the Bitcoin Sharpe Ratio is a metric that measures how efficiently Bitcoin’s returns compensate investors for the level of volatility (risk) taken over a given period.

Readings above 1 from this metric signal a healthy market, where investors are getting rewards for their stakes. On the other hand, values under 0 typically indicate that the market is in a high-risk, low-return state. Simply put, Bitcoin’s investors, in this scenario, are not being efficiently rewarded for their contributed capital.

As observed in the chart above, the ratio recently slipped below the 0 threshold. Seeing as this is occurring while price regains previous levels, it becomes clear that there is an inefficiency between risk allocation and returns.

Wedson further shared, based on historical data, that Bitcoin typically displays its best performance when its Sharpe Ratio is well above zero, particularly at levels 1 and above. This positive signal is usually proof of a consistent state of balance between risk and reward.

In contrast, negative readings often correlate with prolonged consolidation periods, choppy price movements, or even cycle transitions, providing context to long-term investors on current market dynamics.

Historically, these periods have appeared during cooling phases, or before sentiment resets, rather than precisely at market bottoms. By extension, this means that while downside risk may not be high, upside efficiency remains limited until market conditions see relevant improvement.

Ultimately, Wedson concluded that the current level of the Sharpe Ratio calls for cautious optimism, especially as the low doesn’t necessarily mean the bottom is in.

Bitcoin Price 2026 Outlook

After closing 2025 in the red, the question has been swirling around how the Bitcoin price would perform in the new year. While various verdicts have filtered across the crypto community, weighted sentiment suggests that the market leader would continue its struggles in 2026.

The lack of apparent demand growth shows that BTC might have already entered a bear market, with the bottom not due until the last quarter of 2026. In essence, the premier cryptocurrency might see an extended period of correction over the next few months.

As of this writing, Bitcoin is valued at approximately $89,886, reflecting a 1.4% price jump over the past day.

Featured image from iStock, chart from TradingView