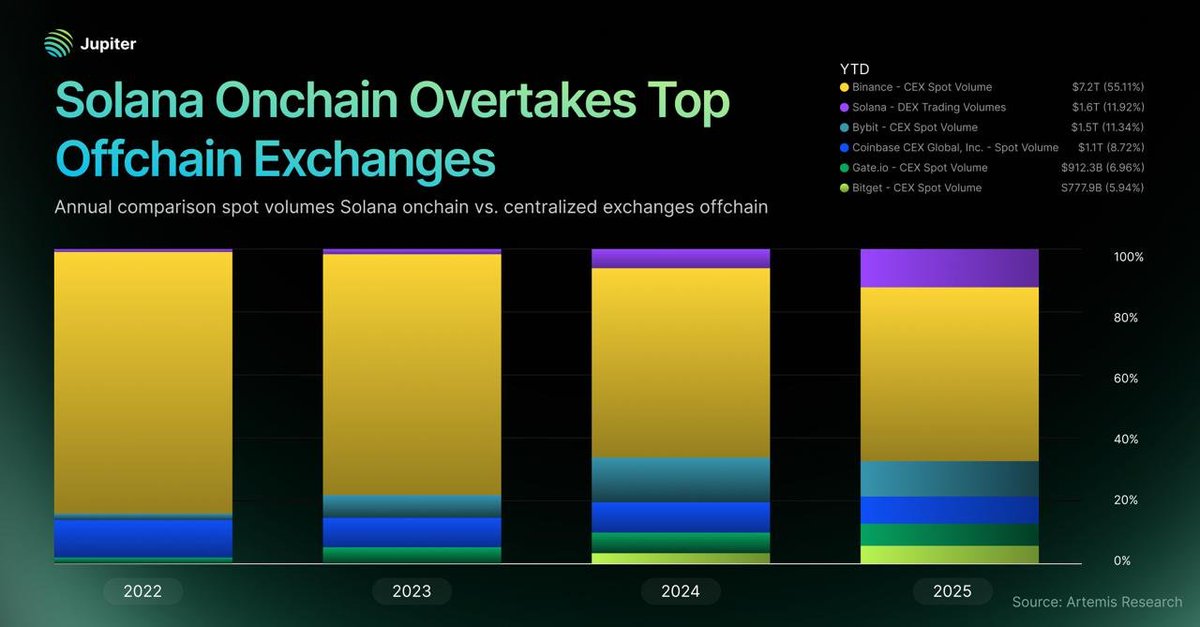

Solana’s onchain economy reached a new milestone in 2025, as spot trading activity on the network climbed to levels that now rival - and in most cases exceed - the world’s largest centralized exchanges.

According to data shared by The Kobeissi Letter, Solana-based onchain spot volume hit $1.6 trillion last year, overtaking every major offchain venue except Binance. The shift highlights how quickly trading activity is moving away from centralized platforms and deeper into blockchain-native infrastructure.

Key Takeaways

Solana onchain spot volume reached $1.6 trillion in 2025, surpassing all major exchanges except Binance.

Onchain trading grew from about 1% of total volume in 2022 to roughly 12% in 2025.

Solana outpaced Coinbase, Bybit, and Bitget in total spot volume last year.

Binance remains the largest venue, but its market share has declined sharply over the past three years.

Just a few years ago, Solana accounted for a negligible share of global crypto trading. In 2022, onchain volume represented roughly 1% of total market activity. By 2025, that figure had grown to around 12%, marking one of the fastest structural changes the crypto market has seen.

The expansion has been fueled by rising usage of Solana-based decentralized applications, faster settlement times, and lower transaction costs compared to many competing networks. Data referenced by Jupiter Exchange suggests that traders are increasingly comfortable executing large spot trades directly onchain rather than routing orders through centralized intermediaries.

Solana surpasses major exchanges

In absolute terms, Solana’s onchain spot volume in 2025 surpassed several heavyweight centralized exchanges, including Coinbase Global, Bybit, and Bitget. This places Solana in a category that was once reserved exclusively for centralized platforms with deep order books and institutional access.

While Binance remains the single largest venue by volume, its dominance has narrowed considerably. Since 2022, Binance’s share of global spot trading has fallen from around 80% to roughly 55%, reflecting broader fragmentation across both centralized and decentralized markets.

What this shift means for crypto markets

The rise of Solana onchain trading points to a deeper transformation underway. Traders are no longer relying solely on centralized exchanges for liquidity discovery, execution, and settlement. Instead, blockchain networks themselves are becoming the primary venues where volume accumulates, prices form, and liquidity migrates.

If the trend continues, onchain platforms could increasingly compete not just with smaller exchanges, but with the entire centralized exchange model – especially as institutional-grade tools and compliance layers begin to integrate directly into DeFi ecosystems.