Ethereum has returned to focus following a bullish technical crossover, prompting analysts to evaluate the possibility of a move toward the $4,800 level if momentum continues. The current surge in ETH has continued to boost overall confidence while also underlining a gap that exists between top-level projects that have long existed, as opposed to emerging ones that have been gaining momentum lately.

Amid the rise of Ethereum, investors are also currently taking a keen interest in Mutuum Finance (MUTM), a DeFi-based project that is currently within its presale with undeniable momentum. Thus far, this new crypto coin project has raised more than $19.6 million with more than 18,660 members signing up for its presale, making it a top crypto to buy now for investors looking for early opportunities.

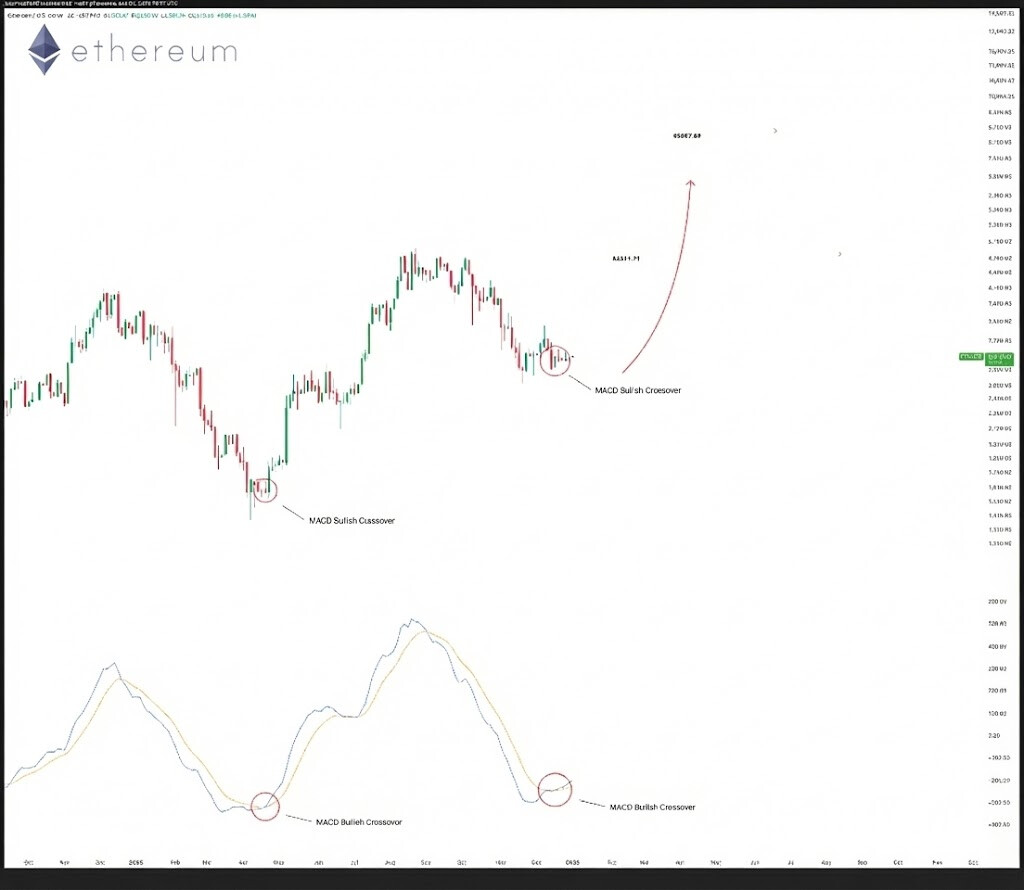

ETH Price Analysis

Ethereum (ETH) has just made a bullish cross-over around $2,900, a pattern that occurred before a situation where it increased by approximately +217% from $1,550 to above $4,950. Currently, it is expected to reach $4,811.71, even $8,557.68, showing its massive structural potential. ETH’s price action points to a much larger issue with crypto markets. While there is established upside in market giants, newer projects like the new crypto coin Mutuum Finance provide higher, more rapid percentage increases.

Mutuum Finance in Early Stage at $0.04

Mutuum Finance (MUTM) is still in the initial valuation stage in the ongoing presale. With the token price now set at $0.04, while the launch price is set at $0.06, investors have a great chance to capture meaningful upside even before market launch. The project has managed to raise a cumulative value of $19.6 million, with the support of more than 18,660 investors in the initial seven presale stages. As an emerging new crypto coin, it has already become one of the most talked-about crypto to buy now in the DeFi space and for a good reason.

Those joining in phase 7 have the potential of enjoying a near 2x jump at launch. This is before a 40x ROI predicted by analysts when MUTM launches. Market strategists have pointed to factors such as passive income streams, community-driven funding, buy-backs and staking as some of the factors that could trigger a 40x climb for MUTM by mid-year.

This shows just how much the newcomer differs from an asset like Ethereum. ETH is a strong market player, but its days of sharp rises are far behind it. By mid-2026 ETH could soar as little as 100%, yet MUTM is on track for a 3900% jump. In fact, analysts have stated that buying MUTM now is similar to being an Ethereum investor in 2017. This was the year ETH saw its biggest rally. If indeed, MUTM captures similar upside, and fundamentals show it could, a 40x rally past $1.60 could just be the beginning for the newcomer.

Passive Earnings For Users

One of the features of Mutuum Finance is its mtToken concept. mtTokens enable users to accrue passive income immediately while still enjoying liquidity. For instance, a user with an idle 5000 USDT in their portfolio could choose to deposit it in MUTM to earn an interest. The lender will receive mtUSDT, and ERC-20 receipt minted 1:1 to their deposit. The mtUSDT accrues yield, around 8-12% APY without requiring users to sell their assets.

Buybacks & Staking

Mutuum Finance’s buy and distribute and staking solution works to ensure the value of the MUTM token in the long run by pegging its value to the usage of the protocol. Some of the revenue generated from the lending platform is used to buy back MUTM tokens. The purchased tokens are then used to reward the stakers. This means that on top of a 8-12% APY on mtToken deposits, stakers in the project are eligible for periodical dividends.

Ethereum (ETH) is eyeing $4,800 as it makes progress. However, Mutuum Finance (MUTM), at $0.04 in Presale Phase 7, shows strong potential for growth. Its projected 40x ROI that could launch it past $1.50, juicy APY and periodical dividends are drawing a huge crowd looking for the next DeFi giant and the best crypto to buy now.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance