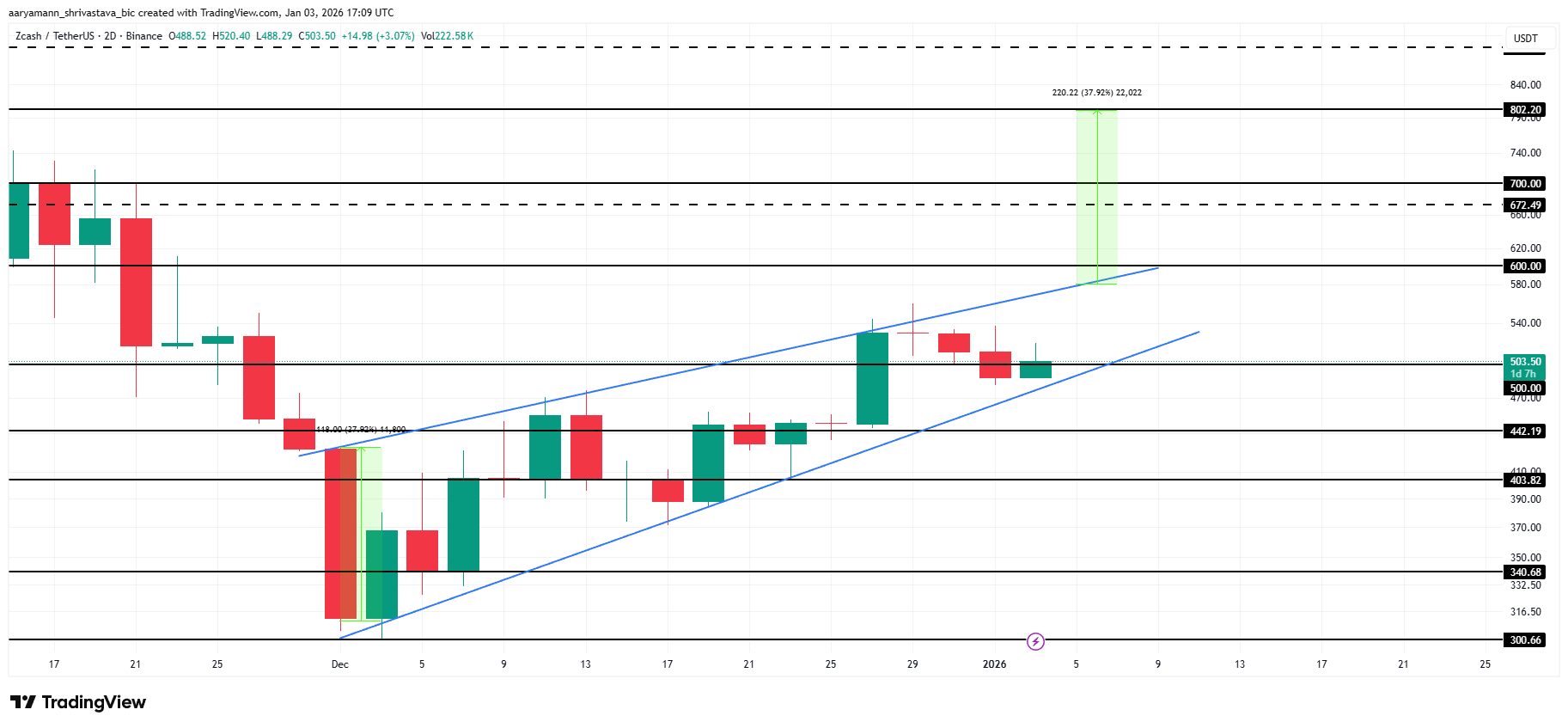

Zcash price has remained in an established uptrend, pushing higher within an ascending wedge formation. This structure often signals a potential breakout, drawing attention from traders.

However, the rally faces headwinds as weakening investor sentiment threatens to undermine momentum despite ZEC’s technically constructive price pattern.

Zcash Holders Exhibit Mixed Signals

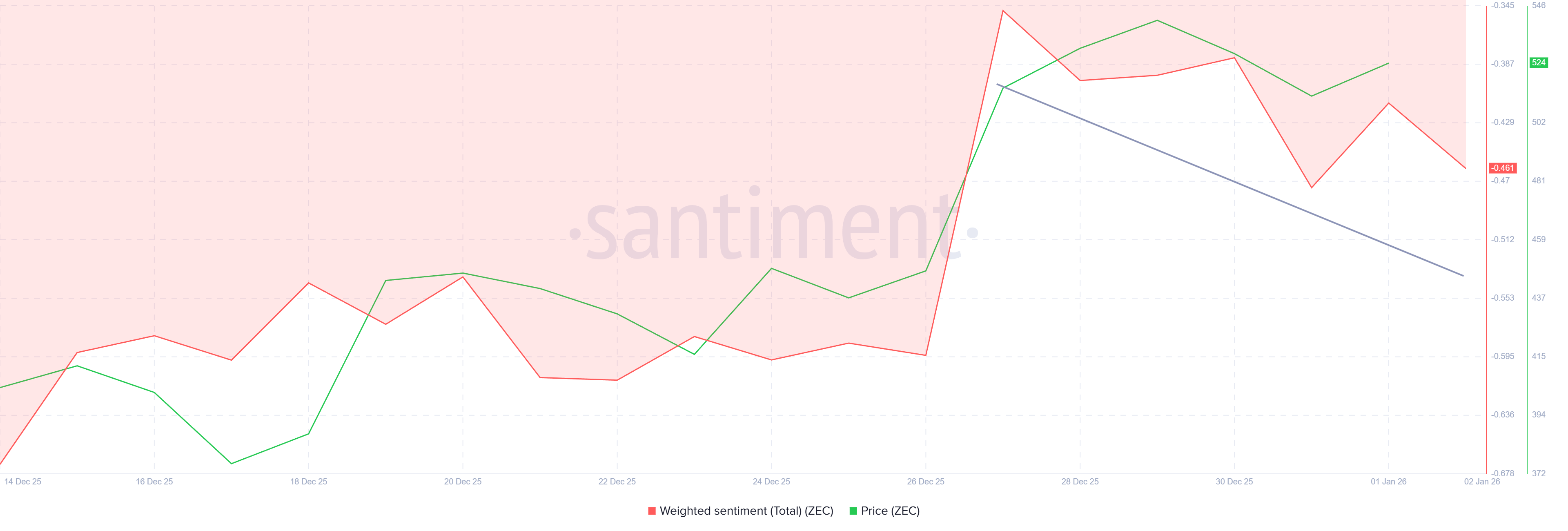

Investor sentiment around Zcash briefly improved during the final days of 2025. This shift raised expectations for a sustained recovery as price action remained elevated. However, optimism failed to hold into the new year, with sentiment turning negative once again.

Negative sentiment influences trading behavior and risk appetite. As confidence fades, investors become less willing to add exposure, even during uptrends.

This hesitation limits follow-through buying, increasing the risk that ZEC’s current structure loses support before a breakout materializes.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Zcash Weighted Sentiment. Source: Santiment

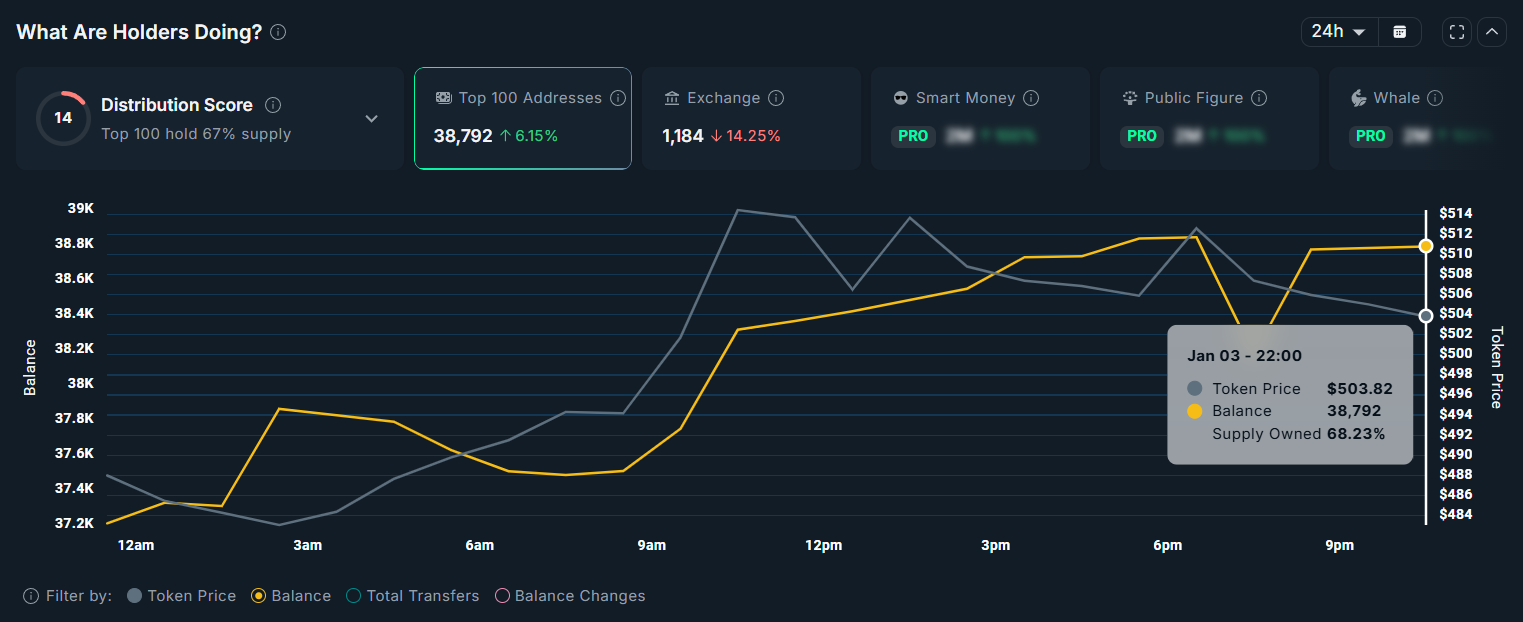

Macro data offers a counterbalance to declining sentiment. The top 100 Zcash holders have maintained a bullish stance over the past week. Their combined holdings have grown by approximately 6%, even as price action showed uncertainty.

Their continued accumulation suggests confidence in ZEC’s medium-term prospects. This steady demand could help stabilize prices and reduce downside risk during periods of broader market hesitation.

Sustained support from major holders can absorb selling pressure from smaller investors. This dynamic often prevents sharp declines and allows prices to consolidate constructively. If accumulation persists, ZEC may retain the structure needed for a future breakout attempt.

ZEC Top 100 Holders. Source: Nansen

ZEC Price Hovers Around $500

ZEC price is currently moving within an ascending channel, trading near $503 at the time of writing. Price has hovered around this level for an extended period. This consolidation reflects a balance between buyers and sellers as the market awaits a decisive catalyst.

A confirmed breakout from the ascending wedge could trigger a rally of up to 38%, targeting $802. Achieving this move requires a clear shift in investor outlook. Flipping the $600 level into support is critical to validating bullish continuation.

ZEC Price Analysis. Source: TradingView

The bearish scenario remains relevant if sentiment continues to deteriorate. A lack of investor support could drain upside momentum and trigger a breakdown.

In that case, the ZEC price may fall toward $442, invalidating the ascending wedge and the bullish thesis.