Amid the cheers of the new year, Ethereum achieved a decisive breakout above the long-standing price resistance around $3,000. According to market analyst Amr Taha, this price gain has been accompanied by significant changes in the derivatives market, which suggest an aggressive shift in investors’ positioning.

Ethereum Traders Flood Market With Long Positions To Usher In 2026

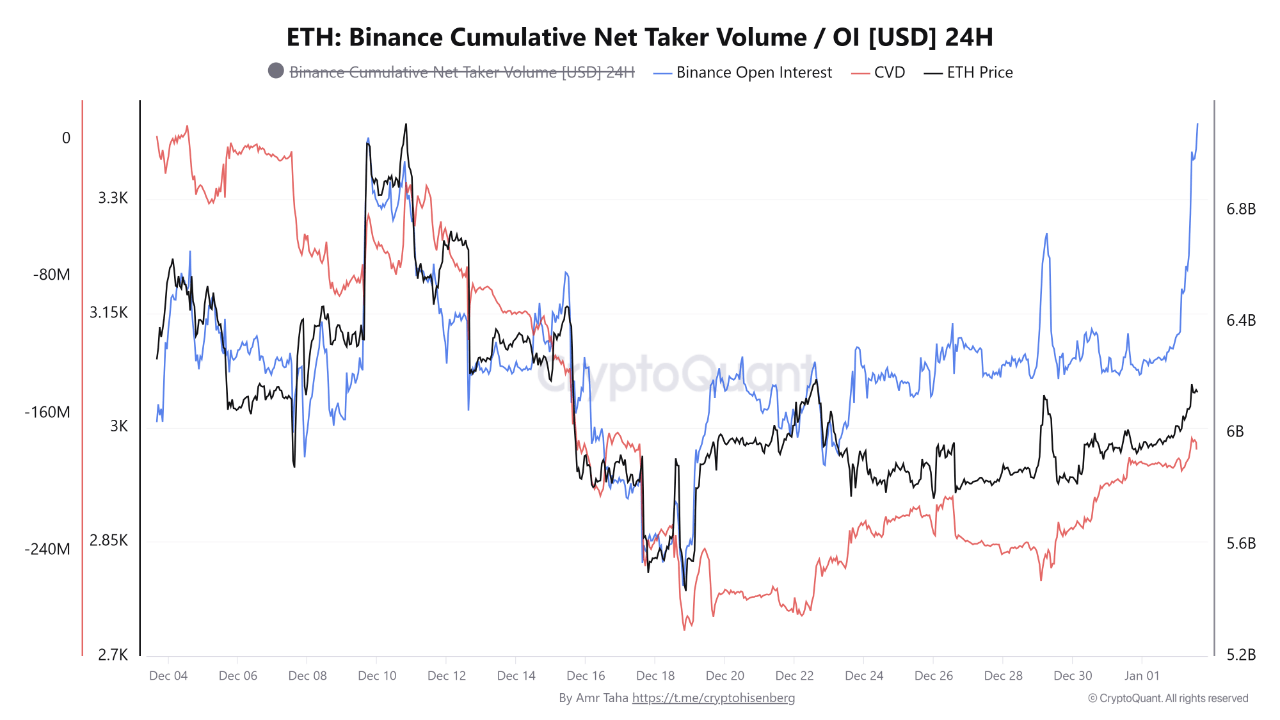

In a QuickTake post on CryptoQuant, Amr Taha shares an in-depth analysis of the Binance derivatives market following ETH’s recent surge in the first days of 2026. Notably, the market expert reports an impulsive rise in ETH open interest on the world’s largest exchange, in what they described as “one of the strongest single-day increases seen recently.

As the spot price climbed above $3,100, data from CryptoQuant shows that ETH open interest rose from approximately $6.2 billion to around $7.1 billion, representing a 12% increase in the last day. Taha highlights the importance of the coincidence, stating a rise in open interest amid price appreciation suggested that traders were opening fresh positions, rather than the move being driven solely by short covering.

Interestingly, more data showed the ETH Cumulative Volume Delta – which measures the net difference between buying and selling volume over time – also rose alongside open interest, implying several positive developments. One of which is that long positions comprised the majority of the newly opened positions in the market, citing a heavy bullish sentiment around Ethereum.

In addition, ETH buyers demonstrated heightened urgency by favoring market orders over passive limit bids, indicating aggressive taker-side demand, implying a strong market conviction that preferred to engage the market immediately rather than wait for lower prices.

A Potential Bull Trap?

In analyzing the liquidation heatmap for the ETH derivative market, Amr Taha unveiled other critical price developments. Notably, ETH’s recent surge was partly driven by a short-squeeze effect around the $3,100 price level. Notably, when the altcoin touched this level, over-leveraged short traders had to defend their positions, effectively creating a market demand that translated into a sudden price gain.

While the recent price increase and open interest boost represent positive moments for the market, Taha warns that forced liquidation often results in temporary resistance zones on the lower timeframe, especially when accompanied by rising funding rates. The analyst also explains that Ethereum’s price move appears leverage-driven and highly sentimental rather than structural, suggesting equal room for both opportunity and risk.

At press time, the prominent altcoin trades at $3,087, representing a 2.51% gain in the last day.