An alleged case of insider trading on the crypto-based prediction platform Polymarket has sparked renewed scrutiny of how sensitive geopolitical information may be monetized through on-chain markets, after a newly created account reportedly turned a relatively small wager into a six-figure profit tied to the arrest of Venezuelan leader Nicolás Maduro.

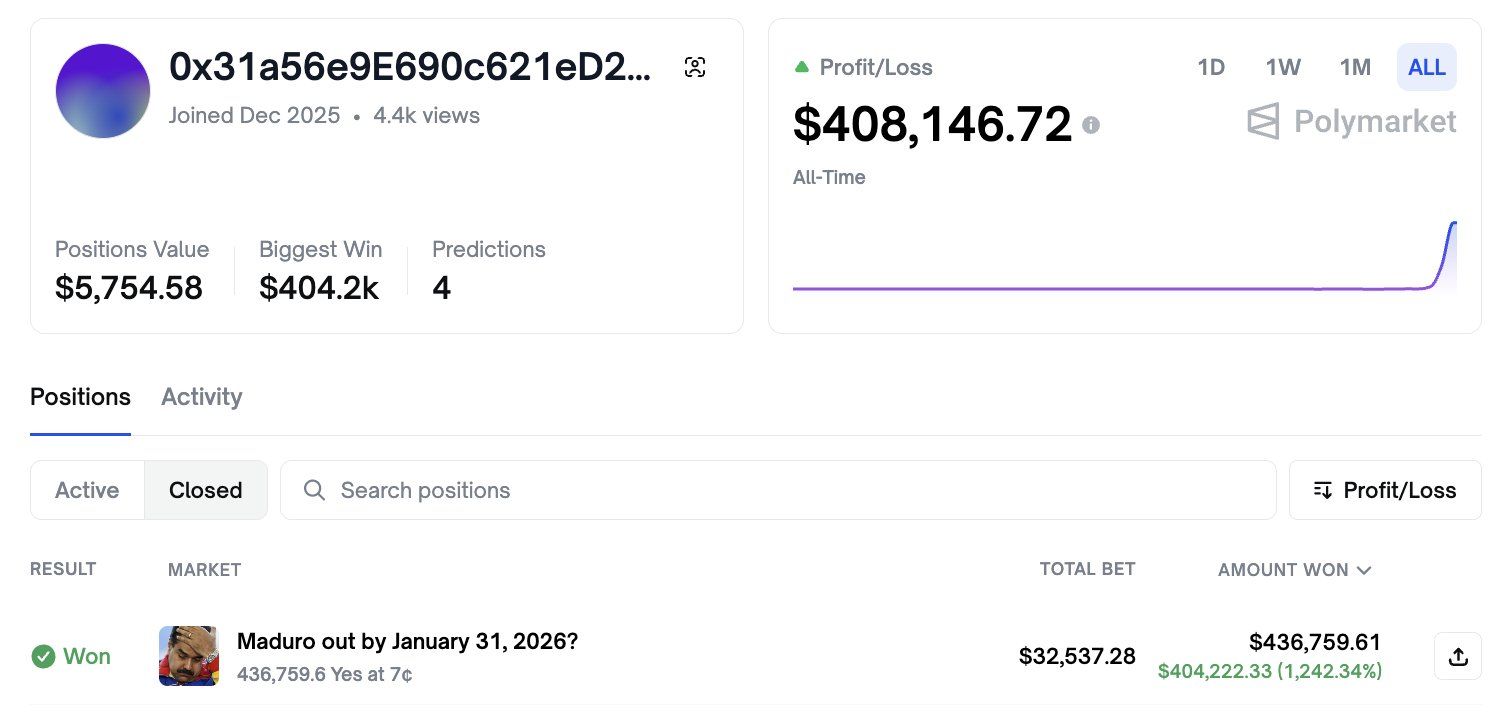

According to public transaction data highlighted by Joe Pompliano, a newly registered Polymarket account placed more than $30,000 on contracts predicting Maduro’s removal from power.

Within 24 hours, the United States announced Maduro had been taken into custody following a U.S. military operation, sending the market sharply higher and generating an estimated profit of roughly $400,000.

Other market participants flagged the activity as unusual, noting that the account appeared to concentrate exclusively on Venezuela-related outcomes, including U.S. military action and Maduro’s removal by late January, at a time when the contracts were trading at relatively low probabilities.

Prediction Markets And Information Asymmetry

Unlike traditional financial markets, prediction platforms such as Polymarket do not prohibit trading based on non-public information.

The model is built on the premise that markets aggregate information efficiently, regardless of source, a feature that critics argue creates ethical and regulatory blind spots when contracts are tied to national security events.

Polymarket has previously stated that it operates as an information market rather than a regulated securities exchange, and that traders are responsible for complying with applicable laws.

The platform has not publicly commented on the specific trades in question.

Also Read: Crypto's Biggest Critic Gone: SEC Commissioner Crenshaw Exits, Leaving All-Republican Panel

U.S. Announces Maduro’s Arrest Following Military Operation

The market movement coincided with a dramatic announcement from President Donald Trump, who confirmed that U.S. forces had carried out a military operation in Venezuela to detain Maduro.

In a press conference, Trump described Maduro as “the illegitimate dictator” and accused him of leading a criminal network responsible for large-scale drug trafficking into the United States.

“Maduro and his wife will soon face the full might of American justice and stand trial on American soil,” Trump said.

Detailing the operation, Trump said U.S. armed forces launched what he described as an “extraordinary military operation” in Caracas, involving air, land, and sea power.

He characterized the assault as a decisive action to bring Maduro into custody, calling it one of the most significant displays of American military force in decades.

Renewed Debate Over Regulation And Market Integrity

The apparent alignment between the timing of the Polymarket trades and the subsequent U.S. announcement has reignited debate over whether prediction markets should impose restrictions on trading tied to classified or highly sensitive geopolitical developments.

While the trades do not appear to violate Polymarket’s stated rules, critics argue that such episodes risk undermining public trust in prediction markets and could draw attention from regulators already examining the growing influence of crypto-based platforms on political and financial narratives.

Supporters of prediction markets counter that these platforms often surface information faster than traditional channels, reflecting real-time expectations rather than formal disclosures.

Read Next: Why Crypto's $49B Funding Surge Went To Exchanges, Not Builders In 2025