Ethereum is showing renewed signs of strength as it begins to stabilize after months of choppy price action. While recent technical improvements suggest momentum is turning in favor of the bulls, key resistance levels remain overhead, which means the recovery seems promising, but not yet fully confirmed.

Market Structure Remains Unconvincing Despite The Bounce

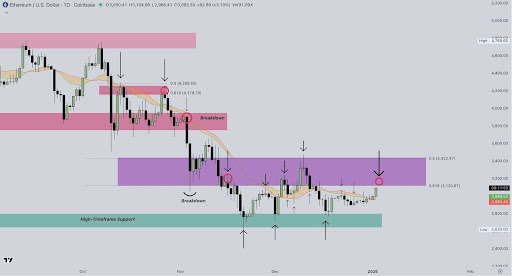

In a recent market update, crypto analyst Luca expressed a cautious outlook regarding Ethereum’s current market structure. While the price has managed a technical feat by breaking above the 1D Bull Market Support Band, a zone that has historically served as a reliable reversal point over the past several months, Luca remains unconvinced of a broader trend shift.

The primary hurdle for a definitive bullish reversal lies at the 0.618 Fibonacci Point of Interest (POI), currently positioned at $3,120. Luca emphasizes that Ethereum must durably reclaim this level to shift the lower-timeframe sentiment. Until this specific price target is secured as support, the risk of the current move being a fake-out remains high.

Drawing parallels to the current state of Bitcoin, Luca suggests that the most prudent approach for investors is to remain defensive, as the market has yet to confirm a breakout above the Fibonacci resistance. This cautious stance is intended to guard against emotional trading during a period of high uncertainty and potential volatility.

To manage this risk, Luca is maintaining a cash reserve to hedge spot holdings in case a rejection occurs. A failure to hold current levels would likely trigger a deeper pullback toward the previous high-timeframe resistance range near $2,700 before a more sustainable and durable reversal to the upside unfolds.

Ethereum Opens 2026 With A Key Trend Shift

According to StockTrader_max, Ethereum has started 2026 on a clearly positive technical footing. ETH has printed its first daily close above the 50-day moving average since October 9, a period that coincided with the liquidation-driven shock that rippled through the broader crypto market. This close marks a meaningful shift in trend behavior after months of trading below key short-term averages.

From a bullish perspective, reclaiming the 50-day MA is exactly the kind of confirmation sought for following an extended corrective phase. It signals improving momentum and suggests that buyers are beginning to regain control, potentially laying the groundwork for a more sustained recovery rather than a short-lived bounce.

Looking ahead, StockTrader_max highlighted the 200-day moving average around $3,550 as the next major upside objective. As capital starts to rotate back into Ethereum and risk appetite improves, the analyst expects price action to gravitate toward this level in the coming sessions.