Key Takeaways

Wrapped Ether (WETH) is a tokenized version of Ether (ETH) that complies with the ERC-20 standard.

Unlike native ETH, which was built before the ERC-20 standard, WETH can be easily used in decentralized finance (DeFi) protocols and smart contracts.

You can convert ETH into WETH (wrapping) and WETH back into ETH (unwrapping) at a 1:1 ratio. If done directly through the smart contract, this process works as a deposit (not a trade), meaning there is zero price slippage.

Avoid wrapping 100% of your ETH into WETH. Keep a small amount of native ETH in your wallet to pay for gas fees in the future.

Introduction

If you use Ethereum, most tokens you trade and invest with use the ERC-20 token standard. There are thousands of ERC-20 tokens, but USDT and USDC are among the most popular. The ERC-20 technical standard is one of the reasons tokens can be easily used within decentralized applications (DApps).

But this presents a problem for Ethereum's native cryptocurrency, ether (ETH). Because ETH was created before the ERC-20 standard, it doesn’t follow the same rules. This makes it technically incompatible with many smart contracts that are designed to handle only ERC-20 tokens.

Wrapped Ether (WETH) is the solution. It acts as a bridge, or a "wrapper," allowing native ETH to function as an ERC-20 token.

How Does WETH Maintain Its Price?

On the Ethereum Mainnet, WETH value is guaranteed by a custodian smart contract. When you "wrap" ETH, you are sending it to the smart contract that locks your ETH in a digital vault and mints the exact same amount of WETH to your address. The contract is programmed so that it can never mint WETH without receiving ETH, and it can never release ETH without burning WETH.

So, while there may be minor fluctuations in WETH/ETH markets (especially the ones that are not on the native chain), the custodian smart contract ensures 1 WETH is always mathematically equal to 1 ETH.

How to Wrap and Unwrap ETH

There are two main ways to convert your assets: manual wrapping (interacting with the smart contract) and trading (swapping via a pool). It’s useful to know the difference to save on fees.

1. Auto-wrapping via DApps

Most modern decentralized exchanges (like Uniswap V3 or V4) handle the wrapping process for you automatically.

When you try to swap ETH for another token, the protocol will often wrap your ETH into WETH in the background as part of the transaction. This is the case for most DeFi platforms; you no longer need to manually wrap ETH before using their products.

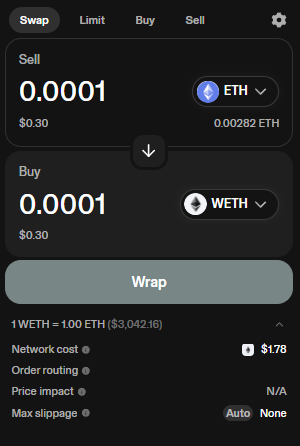

2. Manual wrapping (zero slippage)

If you need to hold WETH specifically (e.g., to make a bid on an NFT marketplace), you should use a wrapping interface.

Cost: You only pay the network gas fee. There is 0% protocol fee and 0% slippage.

How: Select ETH as the input and WETH as the output on a DEX interface (like Uniswap). The interface recognizes this is a wrap, not a trade.

3. Wallet swaps

Many wallets (like MetaMask) offer a built-in "Swap" button. While convenient, be aware that wallet swap features often charge a "Service Fee" (e.g., 0.875%) on top of the gas fee. It’s usually cheaper to wrap your ETH via a DEX interface instead of using a wallet's swap feature.

Can You Wrap ETH on Other Blockchains?

Yes, but it works differently than on Ethereum Mainnet.

Canonical WETH (Ethereum mainnet)

This is the "official" WETH handled by the smart contract described above. It’s the safest form of WETH as it’s directly backed by ETH locked on the Ethereum blockchain.

Bridged WETH (Layer 2s and sidechains)

When you see WETH on blockchains like Arbitrum, Optimism, Polygon, or BNB Chain, this is known as Bridged WETH.

How it works: Your native ETH is locked in a contract on Ethereum Mainnet, and a bridge protocol mints a "representation" of that ETH on the new chain.

The Risk: Bridged WETH introduces "Bridge Risk." If the bridge protocol is hacked, the WETH on the secondary chain may lose its backing and value. Always be aware of which bridge you are using.

The "Gas Lock" Mistake

A common mistake beginners make is wrapping all of their ETH into WETH.

Remember: You cannot use WETH to pay for gas fees on the Ethereum network.

If you have 1.0 ETH and you wrap exactly 1.0 ETH into WETH, you will have 0 ETH left in your wallet.

You will now be stuck. You cannot send, trade, or even unwrap your WETH because you have no native ETH to pay for the transaction fee required to unwrap it.

Always leave a small buffer (e.g., 0.01 ETH) in your wallet to cover future gas fees.

Closing Thoughts

Wrapped ether is a very useful tool in the DeFi ecosystem. It solves a "technical debt" issue from Ethereum's early days, allowing the native currency to interact seamlessly with the thousands of DApps built on the ERC-20 standard.

While the mechanism sounds complex, for the average user, it’s simply a translation layer. Just remember to distinguish between "Canonical" WETH on Ethereum and "Bridged" WETH on other chains, and never wrap your entire stack of ETH.