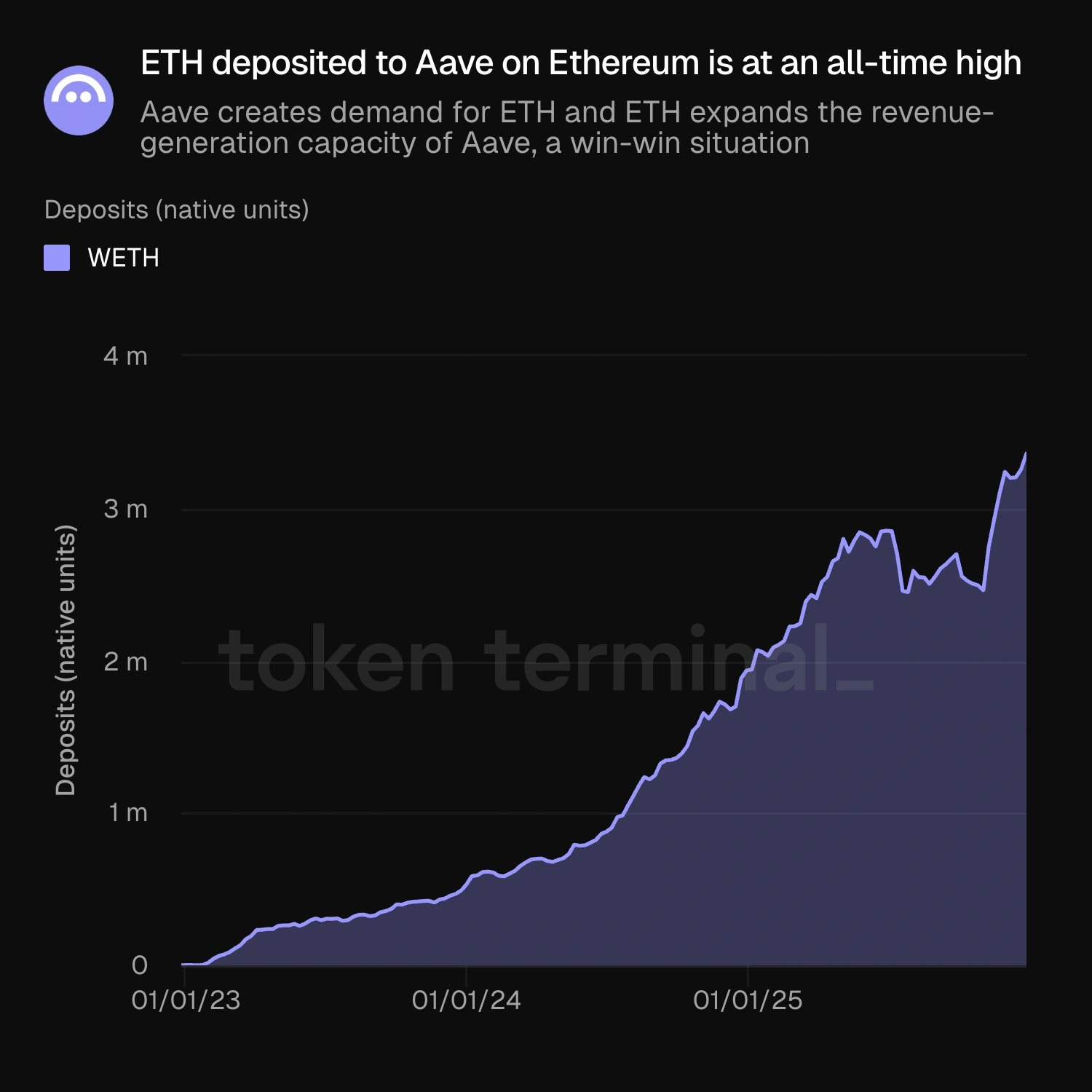

According to Token Terminal data, the amount of Ethereum deposited to Aave has reached an all-time high, crossing 3 million ETH and approaching 4 million ETH as of January 4, 2026.

The announcement comes just as DeFiLlama published its top 10 protocol list by total value locked (TVL), naming Aave as the number one in the report.

Aave has seen record highs in Ethereum deposits since 2025

To truly appreciate how far Aave has come in 2026, one needs to zoom out and return to 2024, which is around the time when TVL started to take off on Aave. The borrowed liquidity metric also paints a clearer picture of the utility the network has come to be associated with.

Between 2024 and 2025, the Aave protocol processed billions in debt, recording just over $3 billion in borrowed funds at the start of 2024, a figure that ballooned to over $30.5 billion when it reached an all-time high in September 2025.

In the same year, Aave saw its highest monthly revenue reach $14.4 million in January, with revenue crossing $13 million in September before ending the year at $7.57 million.

All that has positioned Aave as the top lending protocol. As of January 2026, its overall TVL has reached $35 billion, and most of it is parked in the Ethereum mainnet.

Going into 2026, Aave still leads the lending industry, and its relationship with ETH only solidifies that link. Token Terminal called the arrangement between both chains a win-win situation because, as Aave creates demand for ETH, ETH expands the revenue-generation capacity of Aave. This has spurred investor confidence in the Aave protocol and kept it ahead of other lending protocols.

Aside from the Aave platform, Compound Finance, Morpho, and Spark, the lending arm of MakerDAO, also reported high ETH deposits.

Vitalik Buterin is bullish on Aave’s role in Ethereum

According to an article from Ethereum’s founder, Vitalik Buterin, low-risk DeFi like Aave has the potential to become the “search” to Ethereum, which he likened to “Google.”

According to him, low-risk DeFi is a great solution because it has irreplaceable value and is good for sustainability due to its ability to generate significant transaction fees without becoming a parasite.

Buterin also mentioned how, unlike Google’s ad model, which is focused on data harvesting, low-risk DeFi is a great option because it does not unnecessarily subject the L1 to pressure for the sake of speed.

As far as he is concerned, this signals alignment and makes more sense as a revenue generator. He claimed it also makes it easier to defend Ethereum’s impact because its biggest use case would not be to facilitate “digital monkey” sales.

Buterin called low-risk DeFi a stepping stone that can ultimately help the Ethereum ecosystem get closer to its more advanced goals.

The smartest crypto minds already read our newsletter. Want in? Join them.