BitMine’s proposal to dramatically expand its authorized share count has sparked a growing backlash among shareholders, even as the company doubles down on Ethereum as its core treasury asset.

While Tom Lee has framed the move as a long-term flexibility play rather than an immediate dilution event, a widening group of investors says the structure, timing, and incentives raise uncomfortable questions.

5 Reasons Tom Lee’s BitMine Strategy Isn’t Winning Fans

Tom Lee’s push to expand BitMine’s authorized share count was intended to reinforce the company’s long-term conviction in Ethereum.

Instead, it has exposed a growing rift amidst fears that the proposal weakens governance just as dilution risks are rising.

Critics are not rejecting the Ethereum thesis itself, but rather questioning whether the structure, timing, and incentives behind the plan truly protect shareholder value. Five core concerns now explain why Lee’s strategy is struggling to win fans.

1. Urgency Undermines the “Future Split” Narrative

One of the sharpest critiques centers on timing. Lee has pointed to future stock splits, potentially when Ethereum reaches extreme price levels, as justification for authorizing more shares today.

Investors argue this rationale conflicts with BitMine’s current reality. Specifically, the company already has roughly 426 million shares outstanding out of 500 million authorized, leaving little room to maneuver.

“Why authorize shares today for a theoretical split potentially years away?” one analyst asked, adding that shareholders would “happily vote yes on a split if/when the price justifies it.”

The urgency, critics argue, aligns more closely with BitMine’s need to continue issuing equity to buy ETH.

2. Scale Without Guardrails

The sheer size of the request, from 500 million to 50 billion authorized shares, has also alarmed investors.

Even to reach BitMine’s stated Alchemy of 5% ETH allocation target, the company would need to issue only a fraction of that amount.

“So why the request for 50 BILLION?” wrote analyst Tevis, calling it “massive overkill” that gives management “the biggest carte blanche in history.”

Critics argue that the proposal eliminates the need for future shareholder approvals, thereby removing an important governance checkpoint.

3. ETH Growth vs. Shareholder Value

Another fault line lies in executive incentives. Proposal 4 ties Tom Lee’s performance compensation to total ETH holdings rather than ETH per share.

While investors broadly support performance-based pay, some argue that the chosen metric encourages scale at any cost.

Tevis warned that a “Total ETH” KPI could reward growth even if dilution erodes per-share exposure. Meanwhile, an ETH-per-share target would add a critical safeguard.

4. Below-NAV Issuance Fears

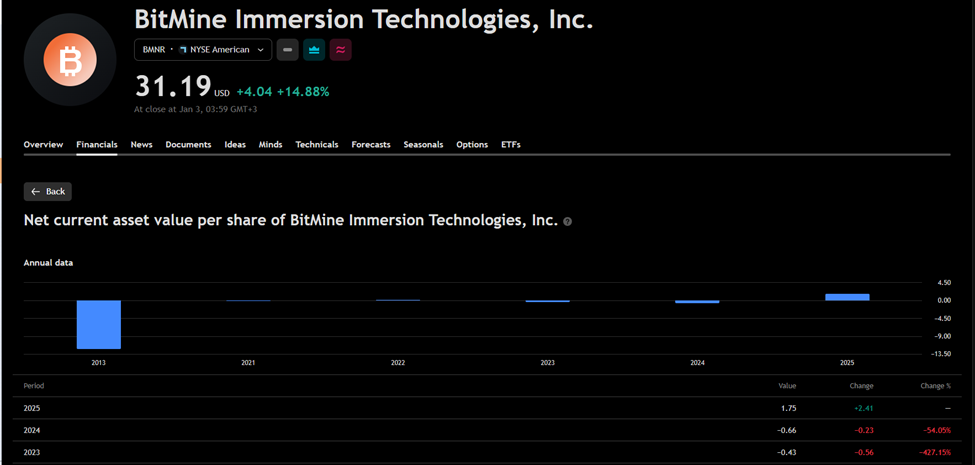

Dilution concerns have intensified as BitMine no longer trades at a clear premium to NAV. Tevis said he was “not concerned about dilution at all” when shares traded above NAV, but that calculus changes near parity.

BitMine net asset value (NAV). Source: TradingView

Broad authorization, critics argue, lowers the barrier to issuing shares below NAV, an outcome that would permanently reduce ETH backing per share.

“If BMNR issues new stock at a discount to NAV… the amount of ETH backing every single share permanently decreases,” Tevis wrote.

5. Equity vs. Spot ETH Questioned

The debate now cuts deeper, with some investors arguing it may be better to own ETH instead. Others echoed similar concerns, warning that the proposal “paves the way for shareholders to get shat on at short notice via ATM dilution.”

Despite the criticism, many dissenting shareholders stress they remain bullish on Ethereum and supportive of BitMine’s broader strategy.

What they want, they say, are clearer guardrails, before handing management a blank check tied to one of crypto’s most volatile assets.