Bitcoin bulls have reason for optimism as the new year begins. Three key on-chain metrics are flashing pre-bullish signals simultaneously: the Coinbase Premium Gap is bouncing back as institutional inflow recovers, the Fear & Greed Index has jumped, and the long/short ratio remains above 1.0 despite recent deleveraging.

The largest cryptocurrency by market cap is trading around $91,700 at the time of publication. It recovered from lows near $87,000 seen in late December. However, sentiment remains fragile, and analysts urge caution amid lingering macroeconomic uncertainties.

Institutional Capital Returns to the Market

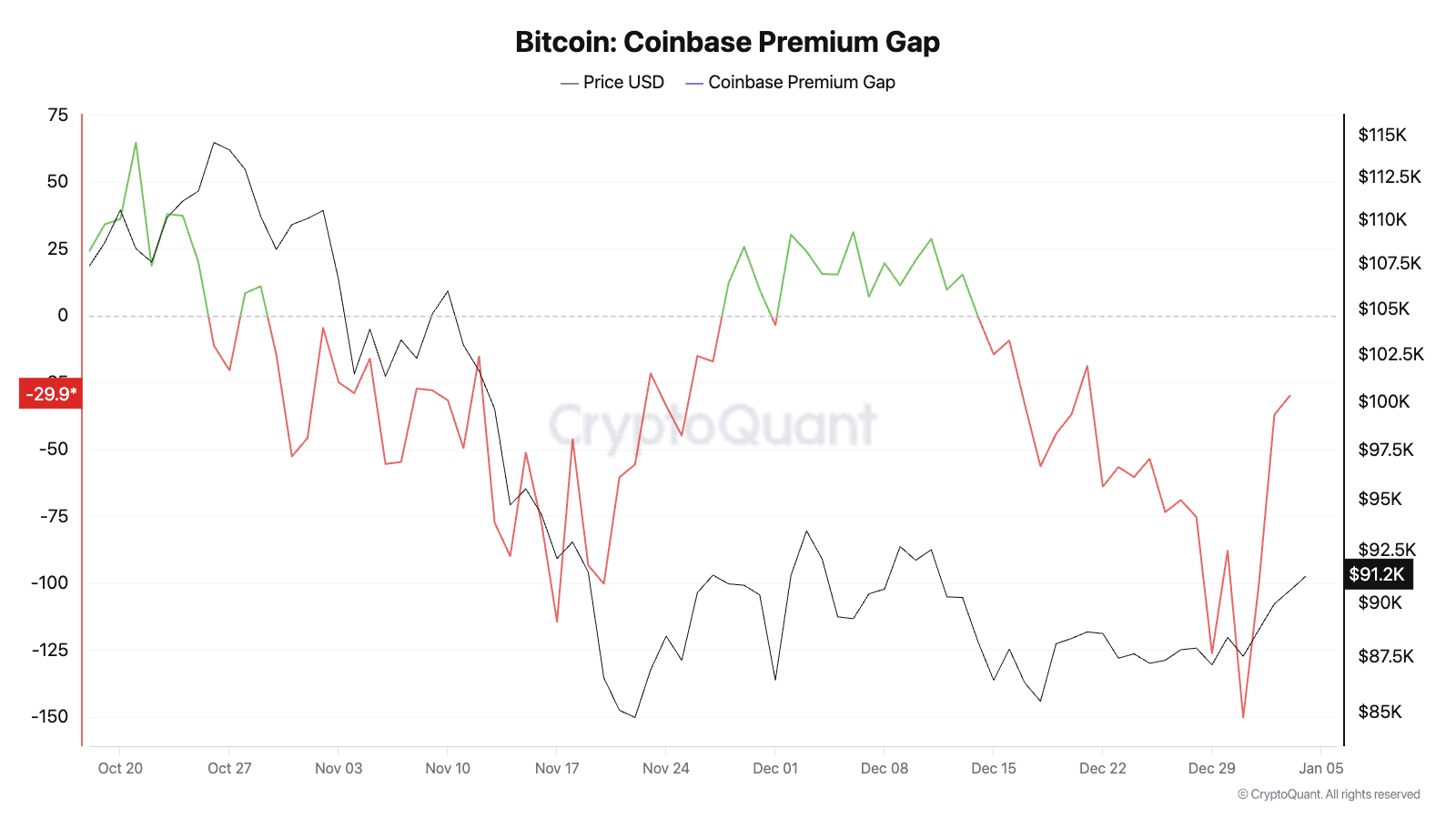

The Coinbase Premium Gap, which measures the price difference between Coinbase and Binance, has staged a notable recovery after plunging to -150 in late December. The metric is now approaching the zero line, suggesting that US-based investors—particularly institutions—are returning to the buy side after year-end selling pressure subsided.

Source: CryptoQuant

This shift is significant given Coinbase’s role as the primary gateway for regulated American capital. A sustained move into positive territory would confirm renewed dollar-denominated inflows, a key driver of previous Bitcoin rallies.

Sentiment Climbing Out of Extreme Fear

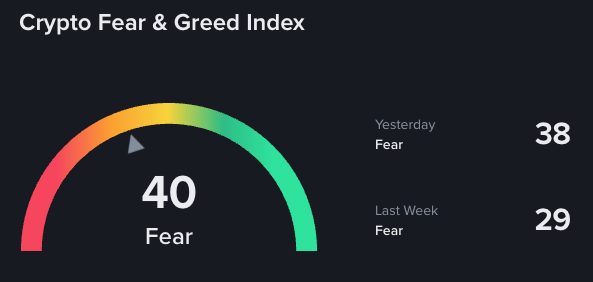

Market psychology is also improving. The Crypto Fear & Greed Index, which aggregates volatility, trading volume, social media sentiment, and market momentum to gauge investor emotions on a scale of 0 (extreme fear) to 100 (extreme greed), has risen from 29 last week to 40 today. This marks a clear move away from the “Extreme Fear” zone that typically signals capitulation.

While readings vary across platforms—Coinglass shows 26 while Binance reports 40—the directional trend is consistently upward.

Source: Binance Square

Traders Maintain Bullish Bets

Derivatives data support the cautiously optimistic outlook. The BTC long/short ratio has declined, but remains above 1.0. The ratio compares the volume of long (buy) positions to the volume of short (sell) positions in futures markets. When above the critical 1.0 threshold, it indicates that more traders are betting on price increases than on price decreases.

The gradual cooldown—rather than a sharp flush—indicates a healthier market structure with lower risk of cascading liquidations in either direction.

Reasons for Caution Remain

Despite the encouraging signals, several factors warrant restraint. The Fear & Greed Index, while improving, still sits firmly in “Fear” territory. This reflects broader uncertainty around Federal Reserve policy, with markets recalibrating expectations for rate cuts following hawkish December FOMC minutes.

Additionally, year-end tax-loss selling may have artificially depressed prices, meaning the current bounce could partly reflect technical repositioning rather than genuine conviction. Some analysts note that accurate confirmation of a trend reversal would require the Coinbase Premium to flip decisively positive and hold.

Outlook

The convergence of recovering institutional demand, improving sentiment, and sustained long positioning creates an optimistic backdrop for Bitcoin in early 2026. However, with fear still elevated and macro headwinds unresolved, traders appear to be cautiously accumulating rather than aggressively buying—a prudent stance given recent volatility.