KEY TAKEAWAYS

LIT’s price outlook depends more on adoption, liquidity, and post-airdrop selling.

A high TVL-to-market cap ratio suggests that the Lighter project is securing real capital.

LIT may stay volatile in 2026, with upside tied to DEX growth and downside risk from unlocks

Lighter (LIT) enters 2026 with increased visibility following the recent token launch.

Interest surged after the airdrop, which pulled in new holders and boosted short-term momentum.

However, early excitement seemed to have faded fast. That is why this Lighter price prediction focuses on what can actually move LIT.

First, it looks at adoption and on-chain activity. Next, it weighs supply changes, unlocks, and sell pressure from airdrop recipients.

Then, it tracks liquidity, sentiment, and the broader crypto cycle. Therefore, it is essential to examine this Lighter price prediction spanning 2026 to 2030 critically.

Lighter Price Prediction

In this segment, CCN reveals its prediction for the Lighter price next year. We also disclose our expectations for the cryptocurrency’s performance in the coming months, utilizing both fundamental and technical analysis.

| Minimum Lighter price prediction | Average Lighter price prediction | Maximum Lighter price prediction | |

|---|---|---|---|

| 2026 | $2.16 | $3.40 | $6.54 |

| 2027 | $1.08 | $1.93 | $2.47 |

| 2030 | $8.99 | $11.46 | $15.87 |

LIT Price Prediction 2026

In 2026, the LIT price might follow a similar playbook to Hyperliquid. As a result, there is a growing demand for cryptocurrencies.

Thus, the Lighter price prediction for the year could be around $6.54 at the maximum. At the minimum, the altcoin might trade at $2.16, while the average market value could be $3.40.

LIT Price Prediction 2027

2027 might not be as bullish for LIT. By that period, the crypto market could be in a complete bearish phase, possibly driving the Lighter price to $1.08.

If the market stabilizes a bit, the maximum Lighter price prediction could be $2.47

LIT Price Prediction 2030

Like many cryptos, the LIT price might experience exponential growth in 2023. From CCN’s project, the altcoin could swing between $8.99 and $15.87.

Lighter Price Analysis

LIT has just launched, so any price analysis at this stage should be treated as an early-stage observation rather than a performance evaluation.

In the immediate post-launch period, the price action is typically driven by initial liquidity conditions, listing excitement, and speculative positioning.

This means volatility may be high as early buyers and short-term traders test key psychological levels and search for a “fair” market range.

A helpful way to view LIT’s price is by observing how quickly liquidity deepens on major exchanges.

Additionally, if the volume wanes, the price may retrace due to thin order books. However, if the volume stays healthy and pullbacks are bought quickly, it can suggest stronger conviction.

The most practical approach is to focus on risk management, using smaller position sizing, wider stop logic, and waiting for more apparent confirmation, such as a stable consolidation range or higher lows forming over multiple sessions.

In short, it’s too early to judge performance, but early liquidity and volume behavior will shape near-term direction.

Short-term LIT Price Prediction

Since the Lighter LIT token just launched, it might be challenging to predict its price in the short term.

If buying pressure increases, Lighter’s price might rise in the $4 direction. However, if selling pressure intensifies, the market value may decline to $2.

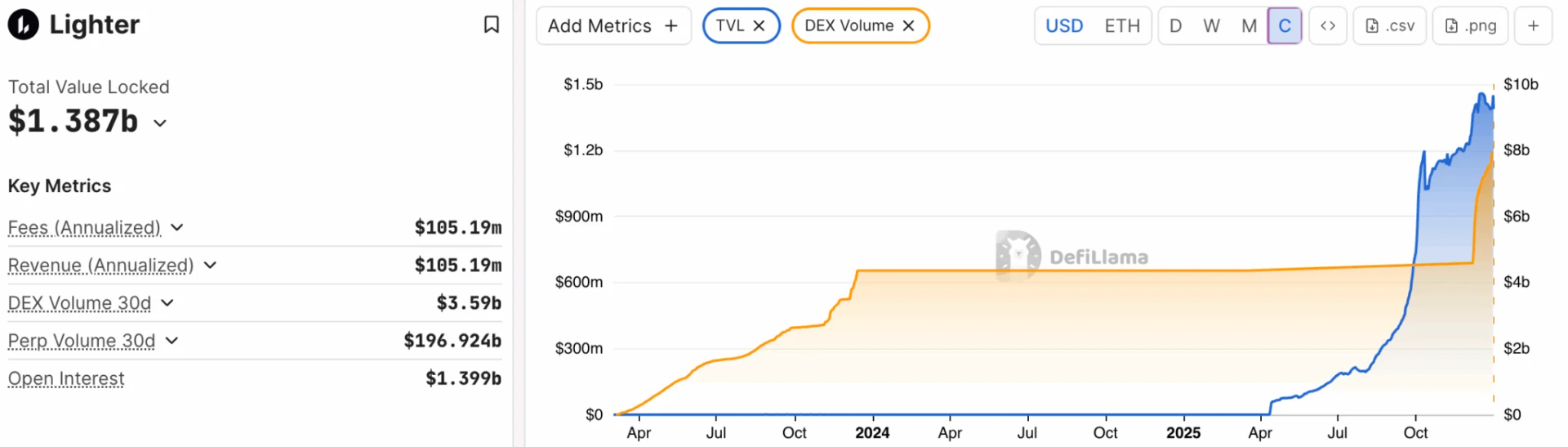

Lighter Market Cap to TVL Ratio

The TVL-to-market cap ratio is a commonly used metric for valuing DeFi projects.

It compares the value of assets locked in a protocol’s smart contracts (TVL) with the project’s token valuation (market cap), helping traders assess whether a token is priced above or below the activity and capital secured by the platform.

Put simply:

A TVL-to-market cap ratio above 1.0 suggests that the protocol is securing more value than the market assigns to its token, often interpreted as potential undervaluation.

On the other hand, if the ratio is below 1.0, it implies the market cap exceeds the capital locked, which can signal relative overvaluation, depending on revenue, growth, and token utility.

Where Lighter Stands Right Now

As of Dec. 31, 2025, Lighter’s:

Market cap: $662.93 million

TVL: $1.38 billion

That puts Lighter’s TVL-to-market cap ratio at 2.08.

In other words, Lighter is securing roughly twice as much capital as its market value suggests, indicating that the token may be priced conservatively relative to the liquidity and activity already present within the protocol.

What It Could Mean (And What It Doesn’t)

This reading does not guarantee an immediate price move. TVL can be sticky, speculative, or incentive-driven — and market cap can lag or lead depending on listings, liquidity, and narrative.

But a ratio this elevated typically indicates one thing: The protocol is attracting more locked capital than the market is currently rewarding.

If usage remains sustained and fee generation scales with TVL, that imbalance can become supportive for price over time.

However, when the TVL growth is primarily incentive-based or temporary, the metric can overstate fundamental strength.

Lighter Price Performance Comparisons

Here is a rundown of how Monad’s price compares to other cryptos in the same category.

| Current price | Three months ago | Price change | |

|---|---|---|---|

| Lighter (LIT) | $2.63 | Yet to launch | Nil |

| Hyperliquid (HYPE) | $25.92 | $49.50 | -47.23% |

| ASTER | $0.69 | $1.72 | -61.85% |

| ARKHAM | $0.18 | $0.54 | -66.39% |

Lighter Price History

| Period | MONAD price |

|---|---|

| Last week (Dec. 24, 2025) | In the pre-market stage |

| Launch price (Dec. 30, 2025) | $3.40 |

| All-time high (Dec. 30, 2025) | $4.04 |

| All-time low (Dec. 30, 2025) | $2.30 |

Lighter Supply and Distribution

| Supply and distribution | Figures |

|---|---|

| Maximum Supply | 1,000,000,000 |

| Total supply (as of Dec. 31, 2025) | 250,000,000 (25% of maximum supply) |

From the Lighter Whitepaper

Lighter is built like a high-performance exchange, according to the whitepaper, but with a key twist.

Notably, the system is designed so users can verify that trades and liquidations were executed correctly, rather than simply trusting the operator.

The protocol is composed of five core components:

Sequencer

Prover

Indexer

API Servers

Ethereum Smart Contracts

Each component plays a distinct role in keeping the platform fast, scalable, and verifiable.

What is Lighter?

Lighter is best described as an app-specific Layer 2/ rollup-like system for perpetuals, where: Trades are matched at very low latency by a specialized execution engine (“sequencer”) The correctness of trading operations is made publicly verifiable using succinct proofs (SNARKs) Ethereum smart contracts hold funds, so users keep a credible path to exit without relying on a custodian The official whitepaper position is that Lighter is the first exchange to offer verifiable order matching and liquidations while maintaining performance similar to traditional exchanges.

How LIT Works

As stated earlier, the Lighter DEX is a platform designed to operate as smoothly and quickly as a centralized exchange.

Instead of relying on a single company to hold funds and settle trades behind closed doors, Lighter designs the trading flow in a way that remains fast while also aiming to be transparent and accountable.

To begin, you connect your wallet and keep ownership of your identity and access. Then you deposit funds into Lighter’s trading environment, which makes trading faster because the system doesn’t have to wait for a full on-chain confirmation every time you place or cancel an order.

Because of this setup, placing trades feels instant. It also makes the interface feel familiar, since you can create limit orders, take liquidity, and trade with the same rhythm you would expect on a typical exchange.

Next, Lighter uses an order book to match buyers and sellers. That’s important because an order book gives more control than a simple swap system.

You can choose your exact price, wait for the market to come to you, or quickly accept the best available offer. This is why Lighter can appeal to active traders who want deeper tools, tighter spreads, and a more “pro” experience.

So, rather than asking you to trust the platform blindly, it uses cryptographic systems that help prove the internal accounting and trading actions are consistent.

This approach helps reduce the risk of manipulation, silent insolvency, or unfair trade practices because the system becomes more transparent and verifiable.

Is LIT a Good Investment?

We can’t tell you whether Lighter’s LIT token is a “good investment” for you, because that depends on your goals, risk tolerance, time horizon, and how much volatility you can handle.

Additionally, crypto tokens can fluctuate significantly in both directions, particularly immediately after their launch.

Instead of a yes or no answer, we will help you evaluate LIT like an investor would, so you can make a decision with clear eyes.

Currently, LIT is relatively new and heavily headline-driven. Lighter’s token was launched on Dec. 30, 2025, and reports indicate a 25% airdrop to users, with a supply split of 50% for the ecosystem and 50% for the team/investors.

This matters because new tokens often experience “airdrop selling”, which can cause sudden drops even when the project is strong.

On the bullish side, the strongest argument for LIT is that the underlying exchange is showing serious traction.

Recent reports indicate that Lighter achieved approximately $200 billion in 30-day trading volume, surpassing major competitors in perpetual DEX volume rankings.

Therefore, if LIT continues to attract more demand and activity, and the Lighter DEX rises, the price could be higher in 2026.

Will LIT Go Up or Down?

Since the LIT token is relatively new, it is still in the stage of price discovery. Thus, it may be too early to determine whether the Lighter price will increase or decrease.

So, the first few days of 2026 will indicate whether the LIT price will rise or fall. It may also depend on developments surrounding the project, market sentiment, and broader conditions within the crypto ecosystem.

Should I Invest in LIT?

We are not investment advisors. So, we can’t tell you what to invest in. Please, do your own research.