Key Takeaways

Lighter does not run on general-purpose L2s; instead, it utilizes a custom ZK Rollup architecture optimized specifically for high frequency trading (HFT).

Replaces the capital inefficient AMM model with a central limit order book, delivering a Binance like experience in a decentralized environment.

Uses ZK SNARKs to cryptographically prove that every order matches the Price Time Priority rule, completely eliminating exchange manipulation.

For over a decade, the crypto market has been dominated by a paradox: We trade decentralized assets on centralized platforms (CEXs) that operate as “Black Boxes.” Users deposit funds, place orders, and blindly trust that the exchange will match them fairly. However, history from Mt. Gox to FTX has repeatedly proven that “Don’t trust, Verify” is the only true standard.

First generation DEXs (like Uniswap) solved the custody problem but failed on performance and slippage. Enter Lighter (Lighter.xyz). Backed by industry giants like a16z and Paradigm, Lighter promises to end the “Black Box” era by bringing Nasdaq level speed to Ethereum grade security.

What is Lighter?

Lighter is a Decentralized Perpetual Futures Exchange (PerpDEX) that utilizes a Central Limit Order Book (CLOB) model. Unlike typical DEXs running on general purpose Layer 2s (such as Arbitrum or Optimism) where financial transactions must compete for bandwidth with gaming or NFTs, Lighter is built on a distinct ZK Architecture. It functions as a Layer 2 “tailor made” for finance, capable of processing tens of thousands of transactions per second with near zero costs.

To grasp the essence of Lighter, one must look at the limitations of current infrastructure. General purpose Layer 2s like Arbitrum or Optimism operate like public highways where financial transactions must share bandwidth with everything from NFT minting to gaming. This creates latency and costs that are prohibitive for Market Makers who need to update quotes thousands of times per second.

However, to fully grasp Lighter’s significance, we must view it not merely as an exchange, but as an infrastructure evolution: an App specific Rollup.

Lighter opts for a Custom ZK Architecture, stripping away the overhead of a general purpose blockchain to dedicate 100% of its computational resources solely to order matching. Technically, it operates as a high performance Compute Engine atop Ethereum. It delivers the deep liquidity AMMs lack, backed by the mathematical certainty of ZK proofs.

What is Lighter? – Source: Lighter

In essence, Lighter bridges Web2 performance (off chain matching) with Web3 guarantees (on chain settlement), transforming transparency from an optional feature into an enforced technical primitive.

Lighter Core Architecture

To realize the vision of a high performance yet decentralized order book, the Lighter team engineered Lighter Core based on four immutable principles:

Self custody: Users always maintain control of their assets.

Verifiability: Operations must strictly adhere to a public set of rules.

Scalability: The system must scale seamlessly in both latency and throughput.

Secure Exit: Users must always maintain the ability to exit independently.

The Engineering Trade off: Why ZK Proofs?

In computer science, building a Verifiable Compute Engine always involves trade offs. Lighter Core rejected two common approaches in favor of the most challenging, yet optimal, path:

Vs. Blockchain Consensus (e.g., dYdX v4, Hyperliquid): These systems achieve verifiability through redundant execution across network nodes. While secure, consensus mechanisms create bottlenecks in latency and throughput. Furthermore, data must remain public for nodes to cross check, limiting privacy flexibility.

Vs. TEEs (Trusted Execution Environments – e.g., SGX): Some projects leverage secure hardware (TEEs) for speed. However, TEEs still require trusting the hardware vendor (e.g., Intel) and remain vulnerable to side channel attacks.

Lighter’s Choice: Succinct Proofs (ZK Proofs). Although historically costly and complex to develop, ZK allows for both vertical and horizontal scaling without compromising security. It decouples “execution” (fast, off chain) from “verification” (secure, on-chain).

Workflow

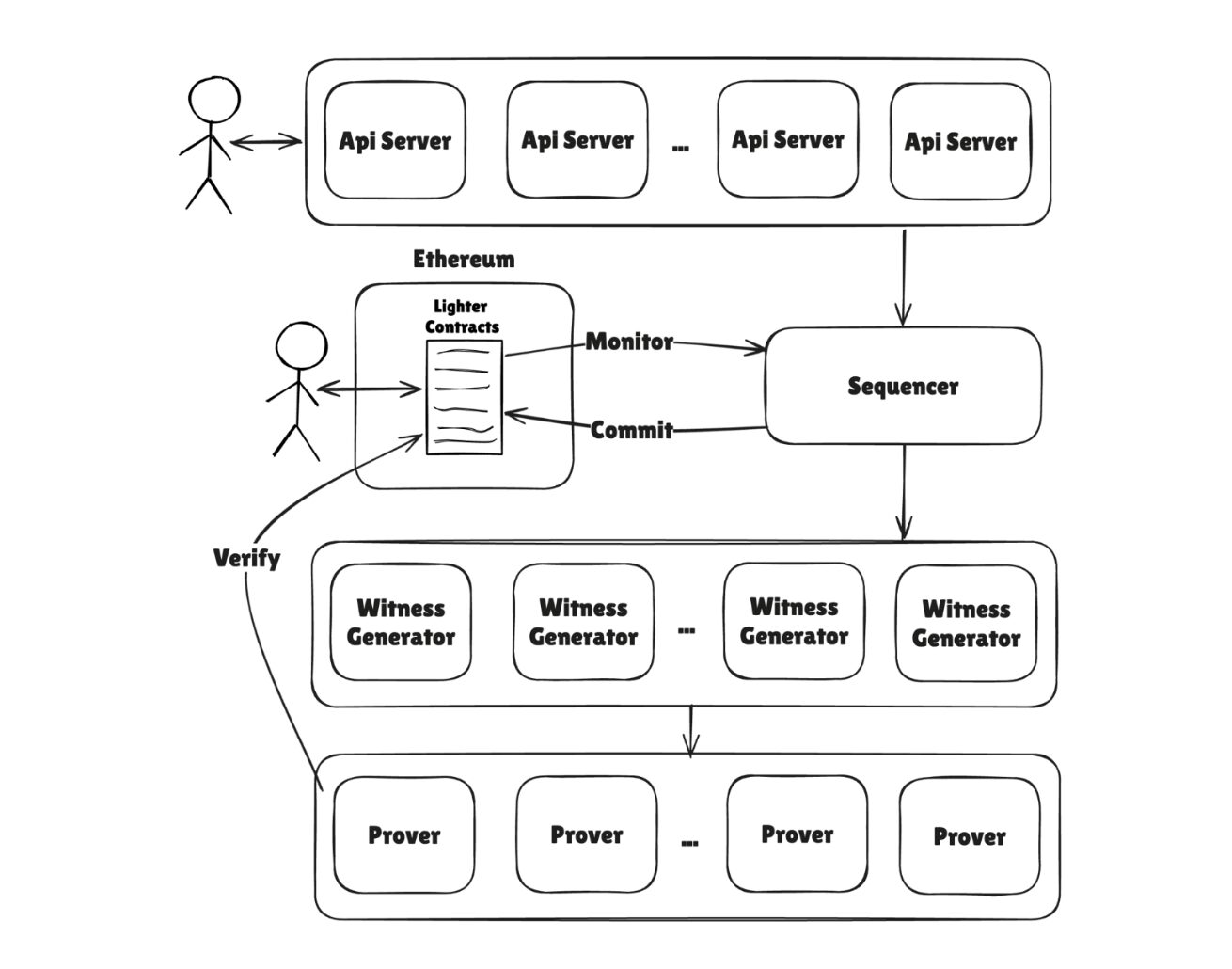

Lighter Core is not just a smart contract; it is an orchestrated assembly of components:

Sequencer & Soft Finality: The heart of the system is the Sequencer, responsible for ordering transactions on a “First in, First out” (FIFO) basis. It provides immediate “Soft Finality” to users via APIs, delivering a seamless, CEX like experience.

Witness Generators & Prover: This is where the magic happens. Data from the Sequencer is fed to Witness Generators, which transform it into circuit friendly inputs. Subsequently, the Lighter Prover built from scratch specifically for exchange workloads generates hundreds of thousands of execution proofs in parallel.

Multi layer Aggregation: To minimize gas costs on Ethereum, Lighter utilizes a Multi layer Aggregation Engine. This compresses thousands of individual proofs into a single Batch Proof for final verification on Ethereum.

Lighter Core Architecture – Source: Lighter

Escape Hatch

This feature defines true ownership. In a worst case scenario, such as the Sequencer being compromised or attempting to censor your withdrawal, Lighter Core triggers the Escape Hatch mode.

The protocol allows users to submit a Priority Request directly on Ethereum. If the Sequencer fails to process this request within a predefined timeframe, the Smart Contract freezes the entire exchange. In this state, users can leverage the compressed Data Blobs previously published on Ethereum to reconstruct their account state and withdraw full asset value directly on chain, independent of the Lighter team or off chain coordination.

Order Book Tree & Verifiable Matching Logic

If Lighter Core is the “engine,” then the Order Book Tree is its most sophisticated “transmission.” To understand how Lighter operates smoothly while other ZK DEXs struggle with latency, we must dissect its data structure.

The Bottleneck

In traditional computer science, to match orders based on “Price Time Priority,” Matching Engines (like Binance’s) typically use Linked Lists. But in the Zero Knowledge world, Linked Lists are a disaster. Why?

To prove an order is in the correct position within a linked list, the ZK Circuit must compute the Hash of the entire list. The complexity is linear: O(N).

The Consequence, the deeper the order book, the higher the computational cost and the slower the speed. This is why early DEXs defaulted to AMMs instead of Order Books.

Lighter’s Innovation

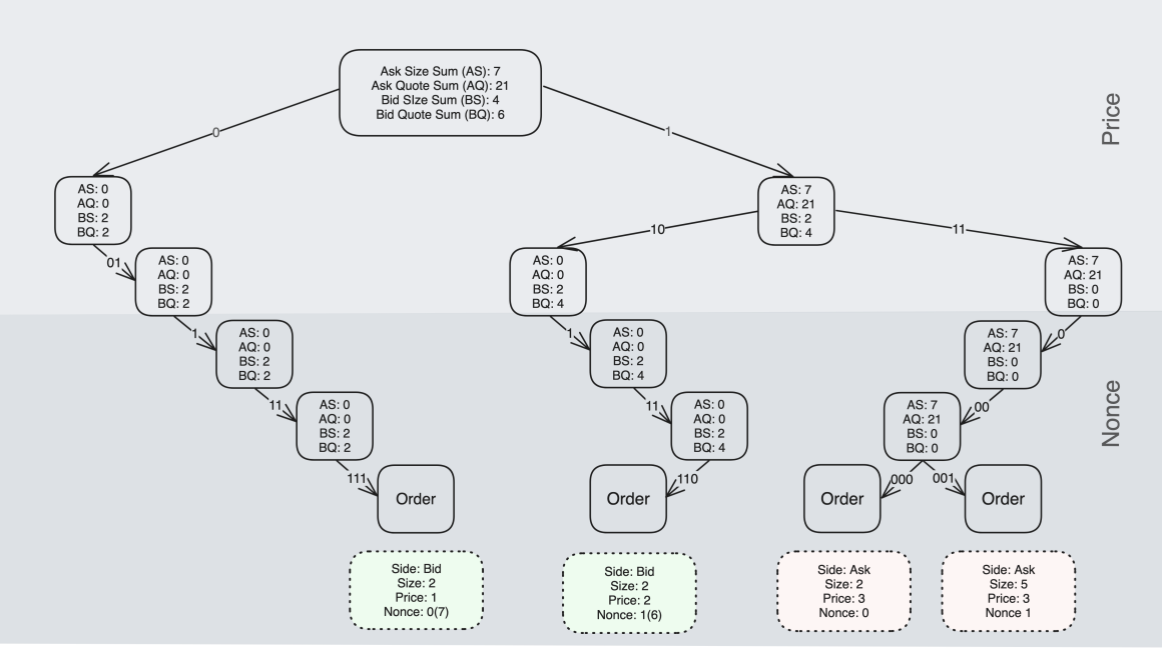

The Lighter team didn’t force a square peg into a round hole. They engineered the Order Book Tree, a hybrid structure combining a Merkle Tree and a Prefix Tree.

The genius lies in how they Encode Priority. Instead of using Timestamps which are susceptible to manipulation or desynchronization in decentralized networks, Lighter uses a Nonce. The Index of an order in the tree is hard coded.

An order with a better price and a lower Nonce (arrived earlier) automatically falls into the priority position within the tree without requiring any expensive sorting algorithms.

Thanks to this structure, every operation, insert, Cancel, or Match reduces complexity to O(Log N). Whether the order book has 10 orders or 10 million, the processing speed and ZK proof generation cost remain virtually constant. This is the key to unlocking High Frequency Trading (HFT) on chain.

Sample Order Book Tree internal node construction – Source: Lighter

Sample Order Book Tree internal node construction

Smart Nodes & Stateless Prover

Another fascinating detail found is the use of “Smart Internal Nodes.Standard Merkle Trees only store Hashes. And lighter Trees store Aggregate Data like AskSizeSum or BidQuoteSum directly within the branch nodes.

By operating in a Stateless mode, the Prover bypasses the need to store massive amounts of order data, relying instead on ‘Path Witnesses’ to verify execution against the State Root.

This is where the architecture shines. It transforms market integrity from a CEO’s promise into a hard mathematical constraint. If a Sequencer tries to jump the queue or extract MEV, the underlying hash calculation fails, causing Ethereum to reject the proof immediately. In essence, the code enforces what regulators cannot.

Custom Circuits & Multi Layer Aggregation

If the Order Book Tree serves as the structural skeleton, the ZK Engine is the operational core enabling the system to achieve optimal cost efficiency. An analysis of Lighter’s architecture reveals a divergent approach from the industry trend: instead of utilizing general purpose zkEVMs, the project has opted to build an App specific ZK infrastructure.

Custom Arithmetic Circuits

A significant challenge for current Layer 2 scaling solutions is the “technical debt” incurred from attempting to simulate the entire Ethereum Virtual Machine (EVM). This often necessitates redundant opcodes that are unnecessary for specific financial tasks.

Lighter addresses this by engineering Custom Arithmetic Circuits from scratch.

These circuits are exclusively designed for exchange logic: order matching, balance updates, and liquidations.

Technical data indicates that by eliminating the EVM overhead, the Lighter Prover operates at significantly higher speeds and consumes considerably fewer resources than zkEVM competitors when processing the same volume of transactions. This is a prerequisite for achieving the Low Latency required for High Frequency Trading (HFT).

Multi Layer Aggregation

Lighter’s ability to offer zero trading fees for Retail Users does not stem from short-term subsidy strategies, but from the structural advantage of Multi Layer Aggregation.

The verification process operates as a data compression assembly line:

Batching: The Prover generates parallel execution proofs for thousands of small transactions.

Aggregation: The system collects hundreds of thousands of sub-proofs and compresses them into a single Batch Proof.

Final Verification: The Smart Contract on Ethereum only needs to verify this single final proof.

The economic consequence is that the Marginal Cost to verify an additional transaction on the network approaches zero. This creates a sustainable competitive advantage regarding operational costs.

Cryptographic Alignment

Regarding security, Lighter’s architecture establishes a rigid link between Off chain and On-chain data via Public Inputs (Commitments).

When the Prover generates a proof, the system mandates a commitment to a public input containing: the new State Root Hash, a summary of the Data Blob.

By enforcing a strict check between the Proof and the Commitment, the system cryptographically binds the public Blob data to the execution logic. This guarantees that the information users rely on for the Escape Hatch is identical to the verified input, effectively neutralizing any risk of Data Availability attacks.

The Ecosystem Play

Complex infrastructure projects like Lighter require substantial R&D resources. Therefore, analyzing the partner roster and cash flow model is a critical metric for assessing the project’s long term viability.

Strategic Backing

Lighter’s capital structure features participation from Tier 1 venture capital firms, including a16z (Andreessen Horowitz), Paradigm, Founders Fund, alongside angel investors from Robinhood and Coinbase.

The “Robin Hood” Business Model

Lighter implements a clear fee segmentation strategy:

Retail Traders: Benefit from a Zero Fees policy aimed at attracting liquidity and expanding the user base.

Institutions & HFTs: Serve as the primary revenue source. This group is willing to pay fees in exchange for ultra low latency, deep liquidity, and crucially, fairness, ensuring their orders are not front run by the exchange.

Tokenomics

According to the official allocation data, the total supply of Lighter is capped at 1,000,000,000 LIT (1 Billion tokens). The distribution architecture establishes a precise 50/50 equilibrium between internal stakeholders and the external community.