Maple (SYRUP token) is the premier marketplace for institutions seeking high-yield lending opportunities with transparency on how profits are generated.

As a pioneering DeFi protocol offering collateralized loans to KYC-verified investors on Ethereum and Base, Maple Finance delivers attractive yields through its Syrup platform—reaching up to 15% APY on USDC deposits.

By the end of 2024, Binance Wallet announced the launch of Maple Finance on Binance Alpha. The products introduced on this new feature, though not guaranteed to be listed on the exchange, are potential candidates showing good development and meeting the general market trends.

What is Maple Finance?

Maple Finance is a decentralized finance (DeFi) lending platform for institutions. The project aims to improve legacy capital markets by combining industry-standard compliance with transparent, seamless lending enabled by blockchain technology and smart contracts.

Maple focuses on institutional lending and borrowing and has launched the Syrup protocol to bring stable yields to DeFi projects.

To mitigate risks, Maple facilitates overcollateralized lending. If a borrower defaults, the collateral is liquidated to protect the lender's principal. All loans from Maple and Syrup pools are fully backed by select digital assets that have undergone a rigorous risk assessment.

Institutional borrowers must undergo stringent credit underwriting and comply with KYC or AML standards.

Maple Finance reported significant growth in 2024. The platform has 700 institutional lenders, achieving 1,500% growth compared to the previous year.

Half of Maple's existing lenders have tripled their positions. On November 15, the total value locked (TVL) on the platform exceeded $589 million, with over $5 billion in loans originated and more than $62.7 million in interest paid to liquidity providers.

Maple raised $5 million from investors like BlockTower Capital and Framework Ventures. In 2021, the project concluded a $1.4 million seed round led by Polychain Capital and an Initial DEX Offering (IDO) that raised $2.5 million.

Tokenomic

SYRUP is the governance token of the entire Maple ecosystem, including Syrup. SYRUP tokens can be converted into staked SYRUP (stSYRUP), allowing holders to participate in the ecosystem's growth and earn additional rewards.

SYRUP replaces the old MPL token, and MPL holders must convert their tokens at a 1:100 ratio. Stakers earn an annual percentage yield (APY) of approximately 9%.

Token name: Maple Finance

Symbol: SYRUP

Blockchain: Ethereum

Total supply: 1,154,930,098 SYRUP

Price movement and exchanges

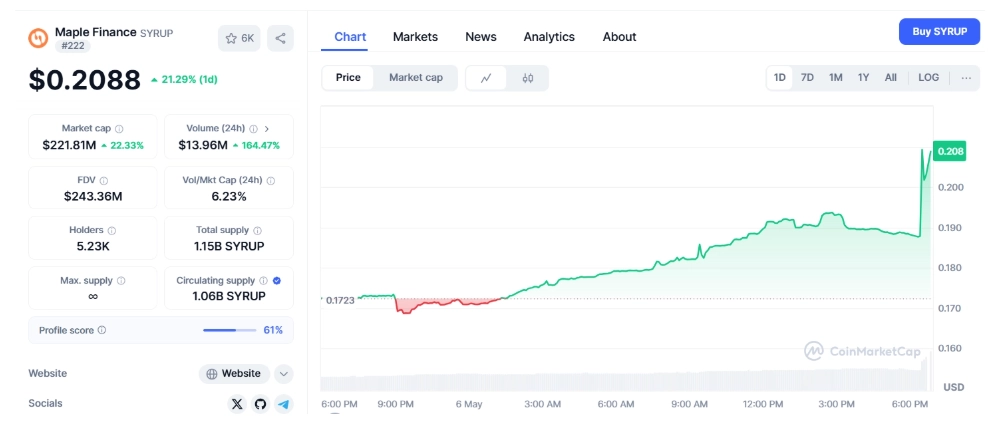

According to data from CoinMarketCap, Maple Finance’s SYRUP token surged from $0.18 to $0.20 immediately following its listing announcement on Binance Spot—marking a 24-hour gain of over 20%. Trading volume also spiked to $13.96 million, up 164.47% from the previous day, reflecting strong investor enthusiasm.

Currently, SYRUP is trading at $0.2088, with a market capitalization of $221 million, ranking #222 on CoinMarketCap. The “Binance effect,” combined with Maple Finance’s appeal—offering yields 5–10% higher than Aave—has helped drive the price upward.

Investors can also trade SYRUP on platforms such as Uniswap, Gate.io, and BitMart.

How Maple Finance works

Lenders (Liquidity providers)

Maple pools generate above-market yields for lenders by issuing secured, overcollateralized loans backed by liquid digital assets. Yield generation is enhanced through liquid staking with full transparency.

Lenders can choose pools to deposit capital based on factors such as historical performance and the underlying collateral. Strict borrower underwriting and detailed collateral analysis ensure robust risk management and capital protection. Continuous monitoring and advanced alert systems allow for swift margin calls and collateral liquidation to safeguard lenders.

Maple's Blue Chip Secured lending pool only accepts BTC and ETH as collateral, held in qualified custody. The Maple High Yield Secured pool generates higher yields by underwriting selected loans and reinvesting collateral into staking.

Borrowers

Borrowers are institutions seeking liquidity from Maple's institutional lending marketplace. All approved borrowers must complete KYC, AML checks, and a rigorous underwriting process. Collateral assets undergo an in-depth approval process.

Once the internal underwriting and collateral type approvals are met, tailored terms are set for the borrower, including eligible collateral assets and LTV thresholds. All collateral is held with qualified institutional custody solutions (e.g., Anchorage, BitGo, Zodia). Maple provides on-chain addresses for lenders to verify the collateral details for each outstanding loan.

When a loan is active, Maple's internal risk assessment and collateral management ensure no significant changes occur in the borrower's financial health or collateral liquidity. The Maple Direct team actively manages the loan book's health with margin calls and liquidation thresholds set conservatively above 100% to protect lenders.

Syrup Protocol

Syrup (Syrup.fi) is a permissionless yield protocol powered by Maple Finance for DeFi users. By depositing funds on the protocol, users can access yields from fixed-rate, overcollateralized term loans to institutions. No KYC is required for lenders using the DeFi Syrup protocol, and the collateral for underlying loans can be verified on-chain in real-time via the Syrup web app.

In addition to yields from deposits, users can earn Drips, the primary mechanism for distributing ownership within the Maple ecosystem. Drips are distributed by season. At the end of each season, Drips are converted to SYRUP.

Users can boost their base Drip earnings rate by depositing into Syrup through wallet integration partners or using syrupUSDC in the DeFi ecosystem.

Additional incentives and improvements allow depositors to increase their Drip rewards through capital commitments:

A 3-month commitment yields a 1.5x multiplier on the user's base rate.

A 6-month commitment yields a 3x multiplier on the user's base rate.

In just four months post-launch, Syrup has rapidly expanded to nearly $300 million in TVL with a 20% APY, providing direct access to Maple's institutional lending system within DeFi.