Ethereum is sending two very different signals at the same time - and that tension is becoming impossible to ignore.

On one side, market flow data shows persistent selling pressure. On the other, developer activity has exploded to record levels. Together, these signals suggest Ethereum is not weakening, but transitioning through a market-wide de-risking phase while its foundations continue to expand.

Key Takeaways:

Alphractal data shows Ethereum remains under dominant selling pressure, confirming a market-wide de-risking phase.

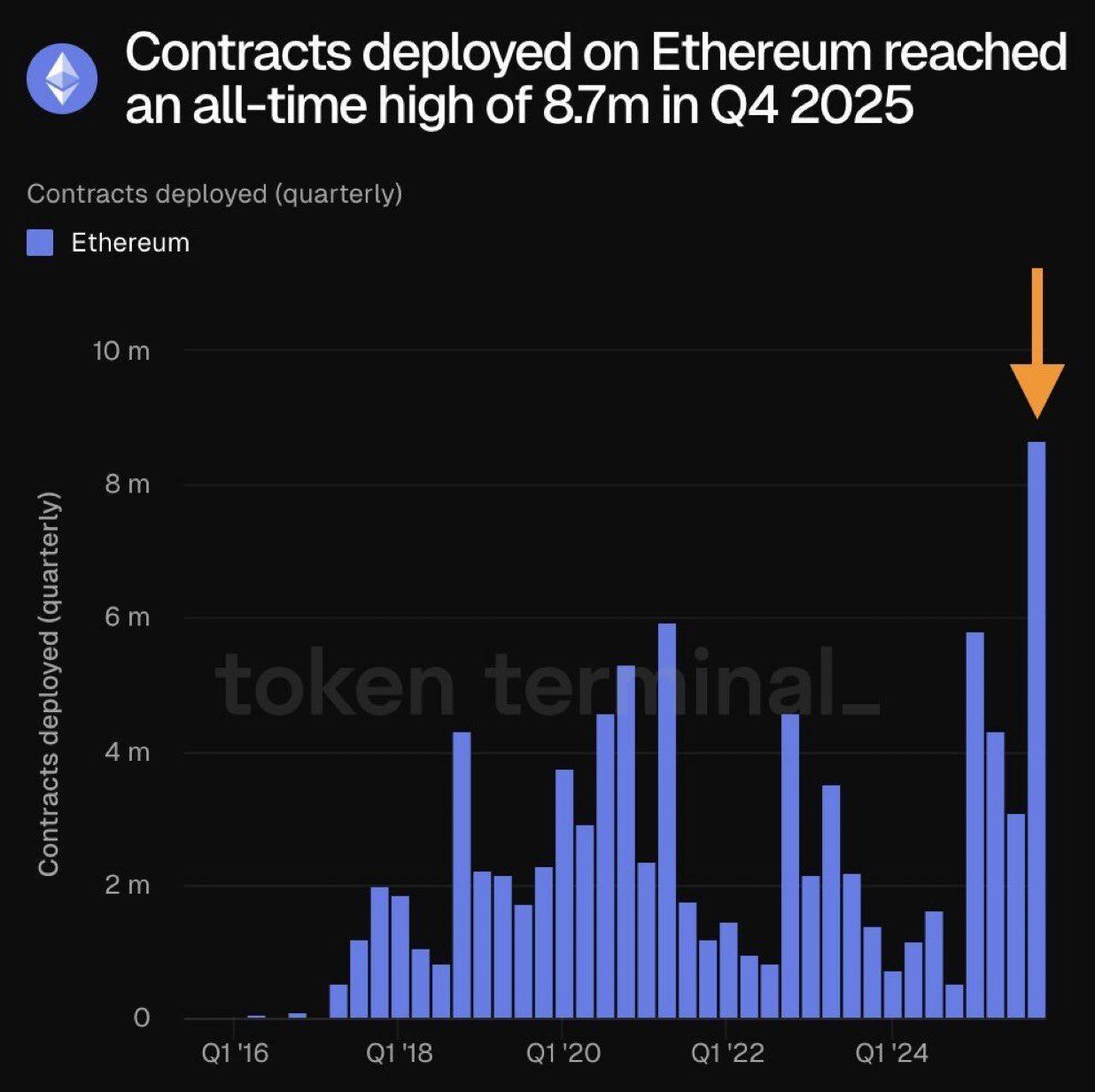

Leon Waidmann highlights a record 8.7 million smart contracts deployed in Q4 2025, signaling accelerating builder activity.

The divergence suggests Ethereum is consolidating structurally while its fundamentals continue to strengthen heading into 2026.

Market structure: selling pressure still in control

Data from Alphractal shows that Ethereum continues to follow the same structure seen across the broader crypto market. Buy/sell pressure delta remains skewed toward sellers, meaning rallies are repeatedly met with distribution rather than sustained demand.

This matters because it confirms Ethereum’s price behavior is not an isolated problem. The dominance of sell-side pressure indicates capital is reducing exposure across risk assets as a group, not rotating away from ETH specifically.

In practical terms, this creates capped upside, choppy price action, and failed breakouts – even when fundamentals improve. It also explains why bullish narratives struggle to translate into immediate price appreciation.

Ethereum shows the same structure.

Selling pressure is still dominant.

This confirms the behavior is market-wide. pic.twitter.com/HqY5sMMIml

— Alphractal (@Alphractal) January 3, 2026

Builders ignore price and keep shipping

While flows show caution, builders are acting very differently.

According to Leon Waidmann, Ethereum just recorded the most active developer quarter in its history. Roughly 8.7 million smart contracts were deployed in Q4 2025, making it the highest quarterly figure ever observed.

Waidmann’s key point is not raw volume, but intent. He argues that builders are no longer optimizing for speculation. Instead, they are shipping infrastructure, applications, stablecoin logic, and real-world asset frameworks designed to scale.

That divergence is critical. Historically, developer acceleration during periods of market hesitation has tended to precede major growth phases rather than coincide with tops.

Why these two signals coexist

At first glance, the contradiction looks confusing: why would developers accelerate while price stalls?

The answer lies in market regimes. Alphractal’s data suggests we are still in a distribution phase, where liquidity exits risk assets gradually. Waidmann’s observations show that builders are treating this phase as an opportunity to build rather than to speculate.

This combination typically appears late in de-risking cycles, not at the beginning of collapses. Selling pressure suppresses price, but infrastructure quietly expands underneath.

What this implies for 2026

As long as selling pressure remains dominant, upside across crypto – including Ethereum – is likely to remain limited. However, once that pressure fades, the assets with the strongest underlying activity tend to react first and hardest.

Ethereum’s position is unique in this context. It continues to function as the core execution and settlement layer while absorbing market-wide pressure without losing developer momentum.

In other words, price is reflecting the current market regime, while activity is positioning for the next one.